We Have More Calculators To Help You!

Loan Repayment Calculator

How much will your home loan repayments be?

Stamp duty calculator

How much stamp duty do I need to pay?

LMI Calculator

Find out how much LMI you might need to pay

How To Use The Home Loan Deposit Calculator

You have to complete all the required fields and select the right option to complete the calculation. The mortgage deposit calculator will provide you results for:- A breakdown of the estimated costs (stamp duty, Lenders Mortgage Insurance (LMI) fees, mortgage registration fees, etc)

- A breakdown of the available funds (first home buyers grant, initial deposit)

- The Loan-to-Value ratio or LVR

- The total deposit you need to buy a home

- The surplus or deficit amount based on your input

Who Can Use The Deposit Calculator?

- First home buyers

- Second home buyers

- Property investors

The size of your home loan deposit has a significant impact on your mortgage terms and overall financial situation. Our 360° Home Loan Assessor explains how a larger deposit can result in a lower loan-to-value ratio, reduced monthly repayments, and potentially avoiding lenders mortgage insurance.

Disclaimer: Over the next few days, you’ll receive additional guides to help you on your homebuying journey. Occasionally, you’ll receive carefully curated home-buying tips, offers & schemes, and news articles. You can unsubscribe any time you want. View our Privacy Policy

What Is A Home Loan Deposit?

A home loan deposit is an initial contribution you make towards the purchase price of the property you’re buying. The contribution you make means you own a portion of the property. So a larger deposit means you own more of the property. Most lenders require a house deposit of at least 20% of the property value (excluding transaction costs). If your deposit is less than 20%, you will have to pay Lenders Mortgage Insurance (LMI). The minimum deposit required by most lenders is at least 5% of the property value.| Property value | 20% deposit | 5% deposit |

|---|---|---|

| $600,000 | $120,000 | $30,000 |

| $700,000 | $140,000 | $35,000 |

| $800,000 | $160,000 | $40,000 |

| $900,000 | $180,000 | $45,000 |

| $1,000,000 | $200,000 | $50,000 |

Why Do You Need A Deposit For A Home Loan?

It helps lenders determine the size of your loan (also called the Loan-to-Value ratio or LVR) and whether you can comfortably repay your home loan.Using the calculator, you can find out if the deposit you saved will be enough to buy a property. Let’s take a look at a few examples.

Is 20% Really Enough For A House Deposit?

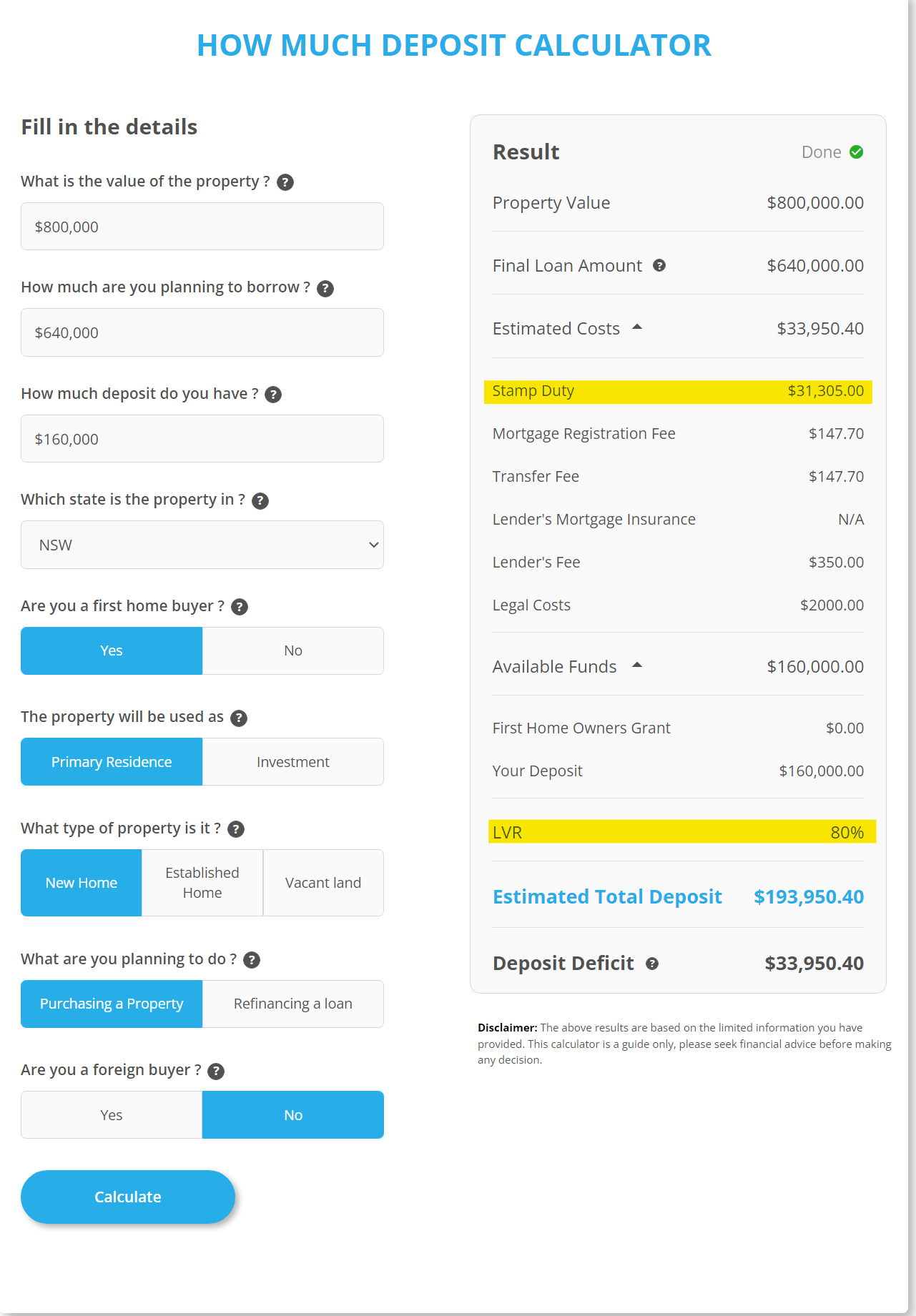

Jim is a first home buyer who is looking to purchase an $800,000 property in NSW. He’s saved $160,000 and is planning to borrow $640,000. Jim’s LVR is at 80%, so he does not need to pay LMI.

Remember, you also need to account for other upfront costs when you are buying a home. Even with a $160,000 deposit, he still has a deficit of $33,950 to pay. Looking at the calculator results, we see that Jim has to pay a stamp duty of over $30,000.

Jim’s LVR is at 80%, so he does not need to pay LMI.

Remember, you also need to account for other upfront costs when you are buying a home. Even with a $160,000 deposit, he still has a deficit of $33,950 to pay. Looking at the calculator results, we see that Jim has to pay a stamp duty of over $30,000.

Can I Buy A House With $50,000 Deposit?

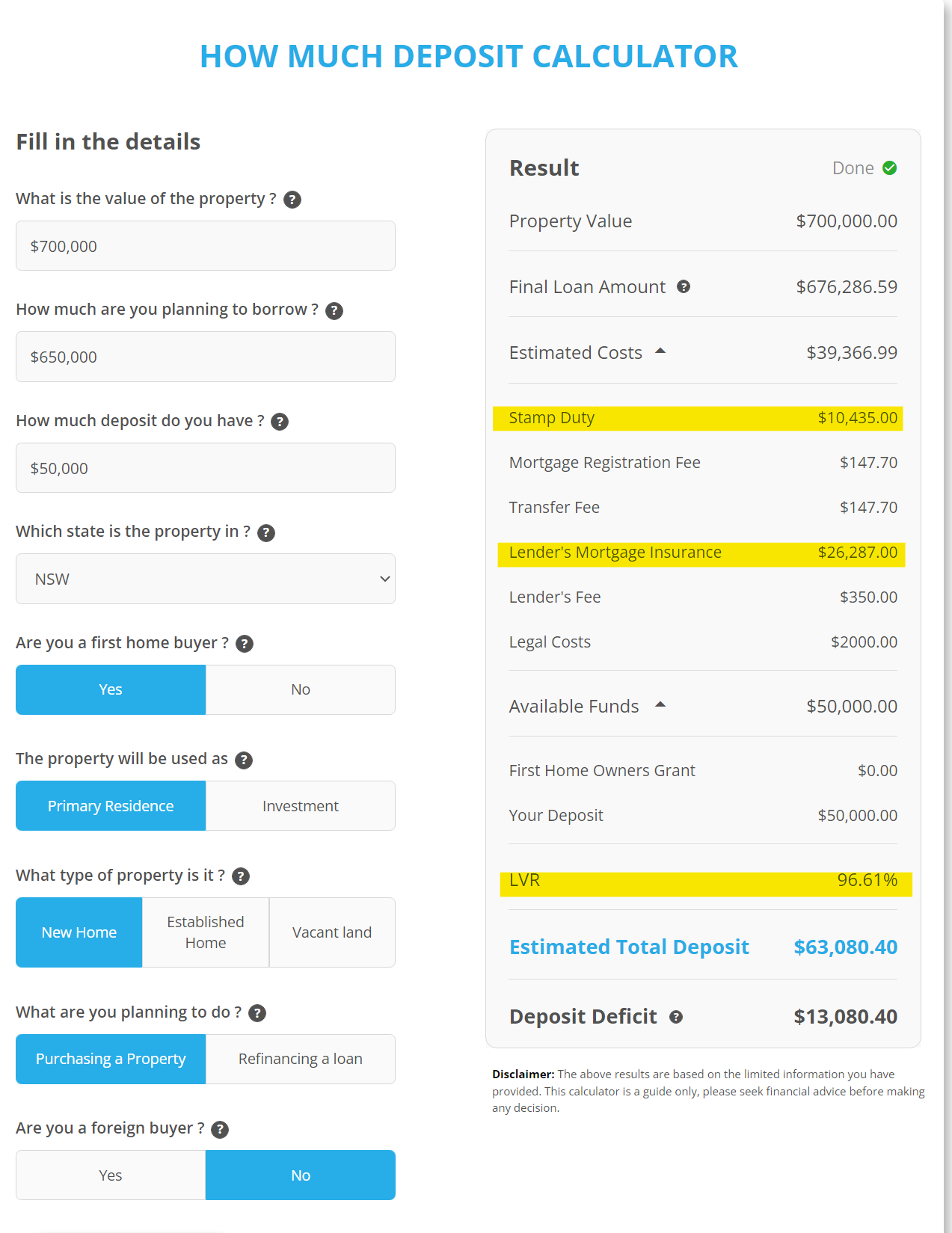

Henry is looking to buy $700,000 in NSW. He has saved $50,000 and is looking to borrow $650,000. Looking at Henry’s calculation, he might only need about $13,000 more; however, he also has to pay for LMI and stamp duty. The calculator’s result is based on the LMI being capitalised on top of the loan amount for the home.

The calculator gives results for stamp duty and other upfront costs associated with buying a home.

Looking at Henry’s calculation, he might only need about $13,000 more; however, he also has to pay for LMI and stamp duty. The calculator’s result is based on the LMI being capitalised on top of the loan amount for the home.

The calculator gives results for stamp duty and other upfront costs associated with buying a home.

What If I Don’t Have Enough Deposit For A Home Loan?

If your deposit is not quite enough, here is what you can do:- Apply for a guarantor home loan

- Be ready to pay LMI. You can use our LMI calculator to find out how much it costs.

- Apply for government grants and schemes available that help you buy with a lower deposit

- Use our savings calculator to find out if you can reach your deposit goal

- Apply with lenders who offer low-deposit home loans.