Why choose us as your mortgage broker?

We want to represent the very best of what it means to be a mortgage broker: delivering a high level of service and tailoring home loan solutions that make a difference to the lives of our clients.We get tough loans approved

Our expertise is in helping customers who have unusual circumstances, even those that have been knocked back by a bank in the past. Where other brokers have failed, we regularly get an approval from a reputable lender.Get the right home loan for your needs

We take a holistic approach when assessing your financial situation and long-term goals to ensure that you get a home loan that’s right for you.Get incredible interest rates

Because of the relationships we have with our panel of lenders, we’re able to negotiate a sharp interest rate based on the strength of your application.Fast approval, easy process

We can help you navigate the often complex pre-approval and application process, helping you to achieve your dream of owning a home much easier and in much less time.Our customers love us

We have hundreds of love letters and positive customer reviews on our website, Facebook , Google and Product Review.Our outstanding achievements

We’re the winner of multiple industry and consumer awards including best customer service and brokerage of the year.You can trust us

In a crowded market, it’s hard to know who you can trust. As experts, we regularly provide commentary to Sydney Morning Herald, The Age, news.com.au, The Adviser and Australian Broker.We aren’t owned by a bank

Our expert mortgage brokers will provide you with down-to-earth home loan advice and as a credit licence holder we’re required by Australian law to give you a loan that’s suitable for you needs.We provide the best post-settlement service

Our post-settlement team is there to assist and guide you throughout the lifetime of your home loan. Not only do we answer all your post-settlement queries, but we also help you make changes, additions, and amendments to your loan type.Access to more lenders

We deal with the major banks as well as a number of building societies, credit unions and specialised lenders that offer discounted rates and have flexible credit policies that other brokers have never heard of.Australia-wide services

We can help you qualify for a home loan to buy property anywhere in Australia.Free upfront valuations and credit reports

We can give you a pretty good indication of how much the bank will allow you to borrow and how to overcome the barriers to home loan approval.We’re members of the FBAA and AFCA

The Finance Brokers Association of Australia (FBAA) upholds professional standards in the mortgage broking industry while our membership with the Australian Financial Complaints Authority (AFCA) protects you as a consumer.We act in your best interests

You can rest easy knowing that we are legally required to act in your best interests under Best Interests Duty; whereas a lender has no legal obligation to do so.

We Are ISO 27001 Certified

With our ISO 27001 certification, you can be confident that your data is secure, your privacy is respected and we are dedicated to providing trustworthy and reliable service. We are committed to protecting your information and ensuring an excellent customer experience.

We are loan approval experts

We specialise in helping people with complex financial situations and those who do not meet standard lending policies. Our company mission is to help people who are being let down by the Australian banking system. We know which lenders can help and which ones can not. Unlike most mortgage brokers who are just salesmen, we are experts in the lending guidelines used by the major banks and other lenders. We deal with a wide variety of lenders and know their policies back to front, as well as the hidden catches and potential problems you might face. We have an extensive in-house credit assessment process which we complete before applying with any bank or lender. Most of our mortgage brokers have worked in the credit department of a lender approving and declining loan applications, so we can talk their language and build a case to get your loan approved! Some of our specialities include non-resident mortgages, low doc loans, fixed rate loans and unusual employment loans.Our Sales Process

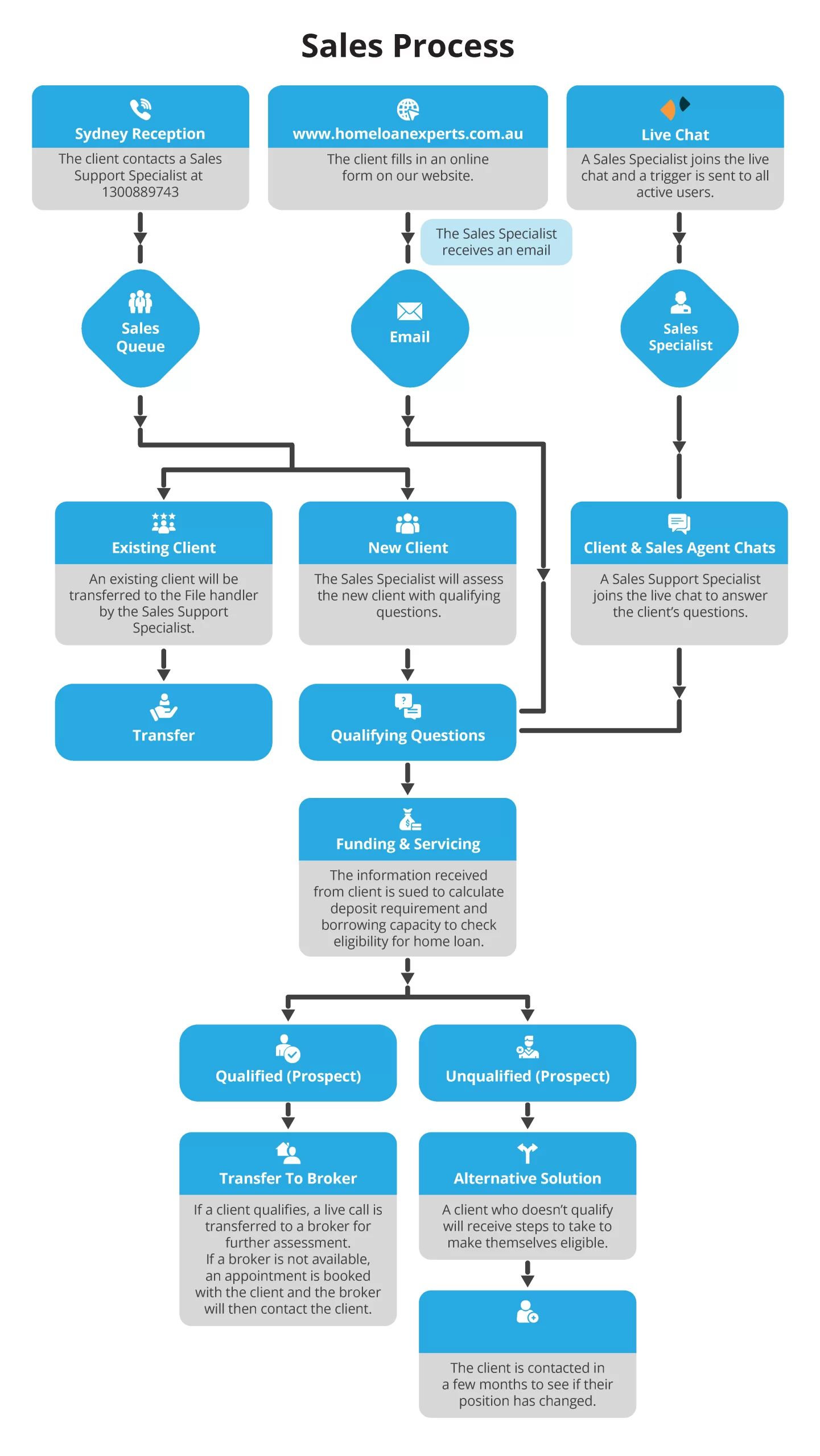

Our sales team has a proven process for helping our clients find out whether we are the ideal fit for them. The sales process starts when a client contacts us through one of our three channels:- Phone call

- Website form submission

- Live chat

Infographic:

Our services are completely free in most cases

Our services are completely free for most home and investment loans. We will only charge a brokerage fee for certain types of short term loans, small loans, some types of commercial or trust finance and if you refinance, or in any way exit, your home loan within the first two years.! We get paid by the lender for doing the work that would otherwise be done by a bank manager, so you pay the same rate as if you went to the lender directly.! However, unlike a bank, we can help you choose from a wide variety of lenders and get the best option for your needs from our panel of over 30 lenders.!Australia-wide services

Are you out in the bush? Interstate? Overseas? To us, it doesn’t matter! We can deal with anyone who is buying or refinancing a property in Australia. Our business is streamlined to enable us to efficiently deal with your application by mail, phone, fax or email. We commonly deal with applicants from all states of Australia, in particular NSW, VIC, QLD and the ACT. We also assist foreign nationals, Australian expats and temporary residents to buy owner occupied or investment properties in Australia.Home loans from 50+ lenders

Our outstanding reputation and achievements

We have built a reputation on being well-organised, well-trained and having expertise that is second-to-none. Our authority in the mortgage broking industry is reflected by our various industry and consumer awards as well as our coverage in the media. Our achievements include:- Home Loan Experts managing director Otto Dargan is a two-time The Adviser‘s Australia’s Brightest Broker award (2011-12).

- Our company was named a New South Wales finalist for the 2012 Telstra Australian Business Awards.

- Finalist in the ‘Brokerage of the Year – Under 5 Staff’ category of the Australian Mortgage Awards for 2010, 2011 and 2012; and in the ‘(>6 Staff) – Independent’ for 2013 and 2014.

- Named one of The Adviser‘s ‘Top 25 Brokerages’ for both 2013 and 2014.

- Featured Sydney Morning Herald, The Australian, and The Daily Telegraph

- Regularly featured in Mortgage Professional Australia, The Adviser, Australian Broker and other industry publications.