Why Refinance With Home Loan Experts?

-

Access To Better Rates

Benefit from our knowledge of over 50 lenders; find rates and rebates tailored to your needs

-

Time-Saving Expertise

Save time and effort as we streamline your search. We will narrow lender options, ensuring smoother approvals.

-

Pre-Assessment Of Application

Avoid unsuccessful enquiries on your credit file. Our pre-assessment before lodging your application improves your chances of approval.

-

Empowering Product Insights

Gain insights into product options and features. We’ll educate you on the pros and cons of each, empowering you to make informed decisions.

-

Post-Settlement Support

Benefit from our ongoing support post-settlement. We’ll monitor your rate and negotiate with lenders for better deals when available

Ready to access better rates and streamline your search? Let our expertise guide you to tailored solutions from over 50 lenders. Start saving time and effort today!

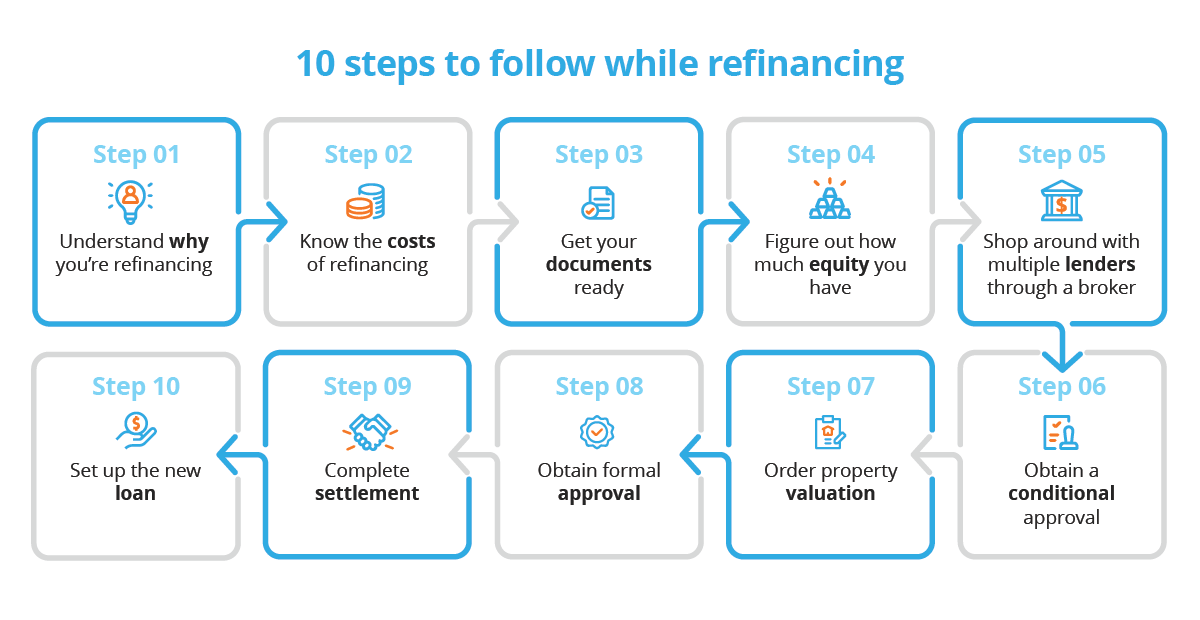

Applying for Refinancing: The Process

A general rule of thumb is that homeowners should consider refinancing every three to four years to ensure that they’re getting the best deal possible. It’s no secret that banks often offer better interest rates to new customers than existing ones. Moreover, with banks offering refinance cash backs and waived application fees, it is a worthwhile exercise to consider refinancing. Luckily, the refinance home loan process is a lot more straightforward than what it used to be. Here’s what the refinancing process will look like for most borrowers.

- Understand Your Motivation: Define why you want to refinance, whether for a better rate, lower payments, or accessing equity. This guides your decision-making process.

- Know the Costs: Consider fees like discharge fees, application fees, and valuation fees. Compare costs versus potential savings to ensure refinancing is financially viable.

- Assess Your Equity Calculate your equity by subtracting your mortgage balance from your property value. Aim for at least 20% equity to avoid additional fees.

- Prepare Your Documents: Gather necessary documents like home loan statements, income proofs and identification.

- Consult with a Broker: Engage with a mortgage broker to explore lender options and understand refinance cashback offers. At Home Loan Experts, our mortgage experts have the credit expertise to properly assess your situation and recommend some products that are more competitive than your current mortgage.

- Obtain conditional approval:Once you’ve chosen a lender, your broker will work with you to submit a conditional approval by submitting the paperwork required.

- Prepare for Appraisal: Your lender will provide you with a document known as the ‘Closing Disclosure’, which outlines all the pertinent details of your mortgage. It’s crucial to carefully review each term and condition before signing any loan documents.

- Obtain Approval: Calculate your equity by subtracting your mortgage balance from your property value. Aim for at least 20% equity to avoid additional fees.

- Complete Settlement: If switching lenders, your broker will handle the discharge process with your current lender. Ensure all necessary forms are filled out and any discharge fees are accounted for.

- Set Up Your New Loan: Congratulations on refinancing your home loan! You’ll soon receive a welcome letter with your interest rate and repayment terms. Ensure repayment details are accurate and any desired features like offset or redraw are set up.

At Home Loan Experts, we are your broker for life and will be with you even after settlement. If you wish to speak to us, call us on 1300 889 743 or complete our free online assessment form.

Refinancing FAQs

Refinancing is when you get a new loan to repay your old home loan. You can do this with your current bank or a different one. It’s smart to look at your current home loan before refinancing if you want a lower interest rate. This is especially true now because some banks offer cashback and waive application fees if you refinance.

There are many reasons you should consider refinancing your home loan:

- Get a cheaper interest rate and lower your monthly repayments.

- Access equity to buy an investment property, renovate, build and more.

- Bring your high-interest debts like credit cards, personal loans and car loans into a debt consolidation home loan.

- Save your home if your home loan is in arrears.

- Refinance from a specialist lender to a major lender after you’re past your bad-credit issues.

- Take advantage of tax benefits.

- Refinance to a home loan product that helps you repay your home loan faster.

- Refinance to grow your business.

Find out more by reading our page on the benefits of refinancing.

The amount you can save by refinancing depends on various factors, such as your current interest rate, the new interest rate you qualify for, the remaining term of your loan, and any associated fees.

You can use our home loan refinance calculator to find out how much you can save by refinancing.

Generally, you need at least 20% total equity in your home to refinance the loan. Lenders typically let you borrow a maximum of 80% of your property’s value on a standard mortgage so most homeowners begin with enough total equity to refinance. Some lenders will let you borrow up to 95% of your property value if you pay Lenders Mortgage Insurance (LMI) or if you have a particularly impressive credit score. If you have less than 20% total equity in your home, you may still be able to refinance but you may have to pay LMI again.

Are you eligible to refinance?

- You owe less than 80% of the property value: Ideally, you should owe less than 80% on your mortgage; otherwise, you may have to pay thousands in Lenders Mortgage Insurance (LMI).

- You are on variable rate:Variable-rate loans offer more flexibility when refinancing, allowing you to avoid exit fees associated with fixed-rate loans.

- You can refinance out of a bad credit loan:You can refinance a bad-credit home loan to a major lender if your Loan-To-Value Ratio is 80% or less and there is no longer a default on your credit file.

- You can refinance from a low-doc to a full-doc:If you had a low-doc mortgage but now have sufficient income evidence, you may qualify for a standard home loan at a better interest rate.

Refinancing costs vary, but they range between $900 and $3,500. The costs can include discharge fees, break fees, application fees, valuation fees and title search fees.

Learn more about the costs of refinancing.

Here are some things you should consider before refinance:

- Be clear on why you want to refinance. It may not always be to get a lower rate, but to get a more flexible loan or even to access equity for a renovation.

- Consider your future plans and think about your long-term financial goals. Think about how refinancing fits into your overall financial strategy.

- Evaluate your current financial status, including income, expenses and credit score, to determine your eligibility and the potential impact on your finances.

- Research various lenders and loan options to find the best fit for your needs. Consider factors such as interest rates, fees and repayment terms. This is when the services of a trusted mortgage broker like Home Loan Experts will be helpful.

- Determine the total cost of refinancing, including fees and closing costs, and compare it with the potential savings over time to ensure it’s financially beneficial.

Testimonials

Smooth And Very Positive Refinance Process

This is our second refinance with Rojan Paudel and his team (Subi and Shalu). Always been a smooth, efficient process and a very positive experience for me and my husband. What could be a daunting refinance decision was always made easy by Rojan and his team. Quick responsive team. Always grateful for the positive experience.

Outstanding Service, They Are Truly Experts In Their Field!

This is the second time we have used Home Loan Experts, first to buy our house and then to refinance. I have only the best things to say about them. They provide a truly outstanding service, especially for people who don’t fit the typical ‘borrower’ profile for mainstream banks. I will only use their service if we need to refinance again, very highly recommend.

Quick And Easy Refinance

Was able to facilitate my refinancing to a new lender at a better rate. Hunted down a favourable valuation and was able to leverage that. Even approached my existing bank to see if they could do better. Smooth process and happy to have them push the whole process through with no hiccups.

4.8 out of 1600+ reviews

4.6 out of 420+ reviews

4.7 out of 720+ reviews