What is the loyalty tax?

Lenders in Australia usually offer lower rates to attract new borrowers, leaving existing customers with less competitive terms. The mortgage loyalty tax is particularly concerning as it often goes unnoticed by borrowers who may not review their loan terms regularly.

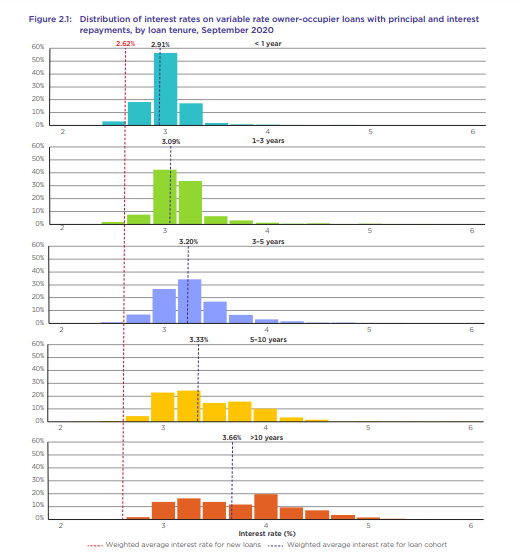

According to the Australian Competition and Consumer Commission (ACCC)’s Home Loan Price Inquiry – Final Report, the average difference in interest rates paid by new and existing variable rate customers as of September 2020 was:

- 0.29% for borrowers with home loans less than 1 years old.

- 0.47% for borrowers with home loans between one and three years old.

- 0.58% for borrowers with home loans three and five years old.

- 0.71% for borrowers with home loans five and 10 years old.

- 1.04% for borrowers with home loans greater than 10 years old.

As you can see, the difference increases the longer you stay with a lender.

Why Loyalty Tax Matters

You might be missing significant potential savings because you have not reviewed your loan in over three years.

For example, if you have a home loan of $250,000 and switch to a home loan with an interest rate 58 basis points (0.58%) lower than your existing loan, you could save over $1,100 in interest in the first year. Over the remaining term of the loan, you would save over $33,000 in interest.

Similarly, for larger home loans, the savings are even more substantial. For instance, if you have a home loan of $500,000 and switch to a home loan with an interest rate 58 basis points lower than your existing loan, you could save over $2,200 in interest in the first year and over $66,000 in interest over the remaining term of the loan.

How do I avoid paying the loyalty tax?

The only way to avoid paying the loyalty tax is by shopping around and negotiating with your lender.

Existing home loan customers have three options before them, namely:

- Requesting a lower rate

- Refinancing

- Consulting a mortgage broker.

Requesting a lower rate

While not all customers will be eligible for a discount, customers willing to ask for a better rate often get these discretionary discounts.

The discounts offered are influenced by the Loan-to-Value Ratio (LVR) and the customer’s strong credit history. Generally, the lower the LVR, the greater the discounts available.

When you make a pricing request the banks will look at your loan amount, repayment history (mortgage conduct), and the loan to value ratio (LVR) and their computer system will generate a discount for you in that range.

If you’re unhappy with the discount rate, you can usually escalate the matter with the bank negotiating for a more significant discount. Their pricing department will then do a manual assessment and get back to you with a final discount rate.

They often match the rates offered by a competitor but not always.

If they can’t or won’t match the rates available to you through other lenders, then refinancing is your best option.

Refinancing

By refinancing to a new loan or a new lender, customers can take advantage of larger discounts which are usually not available for existing loans. The initial cost of refinancing is minimal compared to the thousands of dollars that you may potentially save on interest and other fees over the life of the loan period.

The primary roadblock seems to be that customers do not have the inclination to spend time and effort to make the switch.

Refinancing isn’t as complicated as it used to be plus you have already been through the process when you first bought the property. This time there is no contract of sale to go through, no solicitors and real estate agents to talk to, just your bank or your mortgage broker.

Consulting A Mortgage Broker

At Home Loan Experts, our mortgage brokers stay informed and updated about current market trends and interest rate changes. We have insights on which lenders on our panel offer better deals for new customers versus existing ones. After securing a loan, we will continue to monitor it and alert our customers if better options are available.

One of our customers Dave had a home loan fixed at 3.83% p.a. which was expiring in a week’s time. Dave wanted to switch to a variable rate and get the best rate for himself. First, we applied for a price reduction (pricing request) and the bank came back with a discounted variable rate of 2.94% p.a.

However, after looking at the rate offered by another bank who was willing to refinance Dave’s home loan at 2.69% p.a., we escalated the pricing request and asked them to match the offer.

After a manual review by their pricing department, they agreed to match the offer “as an exception for retention purposes”.

Say Goodbye To Mortgage Loyalty Tax

Stop paying more to stay loyal! Discover better home loan options and save thousands .

Explore Your Options