Table of Contents

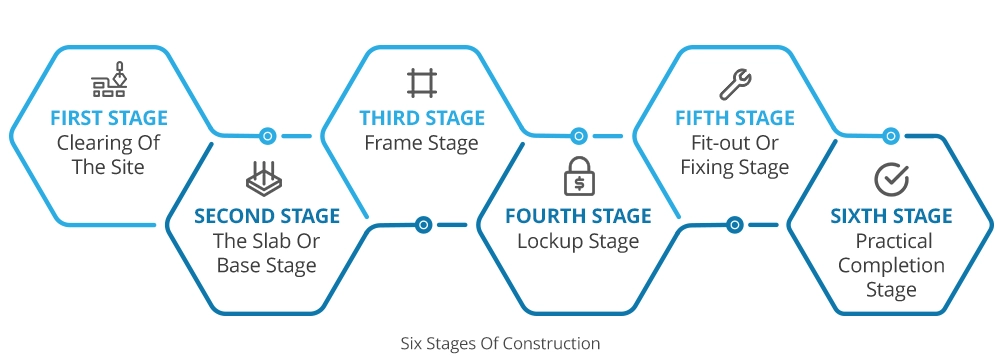

Building a house in Australia happens in several distinct stages. From the initial groundwork to the final touches, each stage of construction brings you closer to your dream home. Understanding what goes on in each stage helps you build your home with confidence.

What Are The Stages Of Construction?

There are typically six stages of construction:

- First Stage: Clearing The Site

- Second Stage: The Slab Or Base Stage

- Third Stage: Frame Stage

- Fourth Stage: Lockup Stage

- Fifth Stage: Fit-Out Or Fixing Stage

- Sixth Stage: Practical Completion Stage

Stage 1: Clearing The Site

The first stage involves preparing the land for construction. This includes clearing vegetation, trees, rocks, and any existing structures or debris. The process starts with removing undergrowth and progresses to larger vegetation, such as trees and stumps, which are cut down and their roots removed to prevent future issues like cracking in foundations. Weak points in the land are filled with clay or other materials to create a stable surface for construction.

- Timeline: Smaller residential lots: a few days to 2 weeks or up to 1-2 months for larger or complex blocks

Stage 2: The Slab Or Base Stage

Once the site is cleared, the foundation is laid. This includes excavation, levelling, and installing underground connections for plumbing, stormwater systems, and electrical conduits. A concrete slab is poured to form the base of the house. This slab provides thermal mass, helping regulate indoor temperatures by trapping or radiating heat. Temporary fencing is often installed around the property at this point.

- Timeline: 1-3 weeks, depending on site conditions and weather.

Stage 3: Frame Stage

During this stage, the skeleton of the house begins to take shape. Timber or steel frames are erected to support walls, floors, ceilings, and roof trusses. The external and internal walls are marked out based on final drawings, and rough-ins of plumbing and electrical systems are installed within the frame. A building certifier inspects the frame to ensure it meets safety standards before proceeding further.

- Timeline: 2-4 weeks

Stage 4: Lock-Up Stage

Your home is now sealed from the elements. During this phase, windows, external doors, roofing, and cladding are installed. Electrical and plumbing rough-ins are completed within wall cavities before plastering begins. This stage ensures that internal work can proceed without risk of weather damage or theft of materials.

- Timeline: 2-4 weeks

Stage 5: Fit-out Or Fixing Stage

This is where the house begins to feel like a home. Interior finishes are completed, including plastering, tiling, cabinetry, skirting boards, electrical fixtures, and bathroom installations. Waterproofing is also applied in wet areas.This stage transforms the structure into a livable home.

- Timeline: 4-8 weeks

Step 6: Practical Completion Stage

This final stage involves adding finishing touches to make the house ready for occupancy. Painting is completed inside and out; shelving for storage spaces like walk-in wardrobes is installed; air-conditioning units are fitted; door furniture is added; flooring is finalised; and appliances such as ovens are installed after settlement to avoid theft risks.

A Practical Completion Inspection (PCI) is conducted with the builder to identify any defects that need rectification before handover. During the PCI, the homeowner and the builder inspect all the rooms, fittings and fixtures. Any minor defects or incomplete items (like touch-up paint required) are noted by the builder so they can address them before you sign off on the final build.

Once you sign the completion documents, the final payment is made, and you receive the keys to your newly built home.

A building surveyor will issue an Occupancy Permit (or a Certificate of Final Inspection) once the final inspection is passed and all documentation is in place. This essentially certifies that the house is safe and compliant, allowing you to move in.

- Timeline: 2-4 weeks

Simplify the mortgage maze with the 360° Home Loan Assessor

Get results on:

- Your maximum borrowing power

- The hidden costs of buying a home

- Interest-rate options based on your situation

How Long Will It Take To Build A House In Australia?

It will take 6 to 12 months to build a house in Australia.

Here’s a 6-month breakdown of what happens at each stage of construction.

| Stages of Construction | Description | Typical Duration |

|---|---|---|

Site Preparation/Clearing | Site is cleared of vegetation and prepared for building | 1-3 weeks |

Slab/Base Stage | Excavation, underground services and concrete slab are completed | 1-3 weeks |

Frame Stage | Structural frame, roof trusses and wall layout are erected | 2-4 weeks |

Lock-Up Stage | Windows, doors, roof, cladding and external sealing to make the home weatherproof | 2-4 weeks |

Fixing/Fit-Out Stage | Plastering, cabinetry, internal doors, tiling, fittings and some flooring | 4-8 weeks |

Practical Completion | Final touches, painting appliances, PCI inspection, and occupancy permit is issued | 2-4 weeks |

Getting Approved For A Construction Loan in Australia

A full construction loan guide with common mistakes and how they can be avoided.

How Much Do I Pay At Each Stage?

The amount paid at each progress payment stage is based on a percentage of the total costs of completion.

As a general rule, the amount you pay at the different stages of construction is as follows:

- The deposit: 5%

- The slab or base stage: 15%

- Frame stage: 20%

- Lockup stage: 20%

- Fit-out or fixing stage: 30%

- Practical completion stage: 10%

It’s a little different in the Northern Territory:

- The deposit: No more than 5%

- The slab or base stage: 10%

- Frame stage: 20%

- Enclosed stage: 25%

- Fixing stage: 30%

- Practical completion stage: 7%

- Final completion: 3%

Planning to build your first home? We’re here to help.

Call us on 1300 889 743 or enquire online today.

Talk To Our ExpertsFAQs

Do I need to have surplus funds on standby?

Yes, it's important to have surplus funds on standby. Lenders won’t release the first drawdown until certain conditions are met, like council-approved plans, insurance, and stage-specific building specifications.

Meanwhile, your builder will usually request a 5% deposit upfront. While you might be able to negotiate with the lender to release funds early, it’s safer and more practical to have extra funds ready, to be sure construction can progress without delays.

Do I Need To Plan For Extra Work After Construction?

Can I Get A Construction Loan?

What Happens After My Construction Loan Is Approved?

When Do I Make Each Progress Payment?

Still need answers? We're here to help!

Ask an expertOur team of mortgage experts will assist you within 24 hours.