What Is Loan-To-Value Ratio (LVR)?

The Loan-to-Value Ratio (LVR) is a financial term that compares the amount of the loan with the value of the property being purchased, expressed as a percentage.

Put simply, the LVR of your loan is the percentage of the property value you’re borrowing.

Lenders use LVR to assess risk, with lower LVRs generally indicating reduced risk for lenders.

When the LVR exceeds 80%, lenders typically require borrowers to pay for Lenders Mortgage Insurance (LMI). This insurance protects the lender in case the borrower defaults on their loan. If a borrower cannot repay their mortgage and the property is sold for less than what is owed, LMI covers the shortfall.

LVR Sweet Spots

Whether your LVR is, say, 89.99% or 90.10% can have a large impact on your rate. Senior Mortgage Broker Vivienne Than explains, “Each bank has its own sweet spots for LVR that optimises interest rates. They could be every 5- to 10-point increase in LVR, like 80% to 85%, or 89.99% to 90.10% or 89% to 89.10%. For example, for one prominent lender, if you are looking at a $500K home loan with a standard variable rate, the interest rate is 6.74% at 89.1% LVR but 6.59% at 89%. I would ask my client to pay one-tenth of a point more in deposit to reduce their rate from 6.74% to 6.59%.”

Besides lowering your interest rate, the LMI you pay can also be lowered.

For example, if you were to buy a $1 million property in NSW, the LMI for 90.10% LVR is $32,408. However, if you lower your LVR to just 88.99%, you pay $22,725, saving you nearly $10,000 in LMI fees.

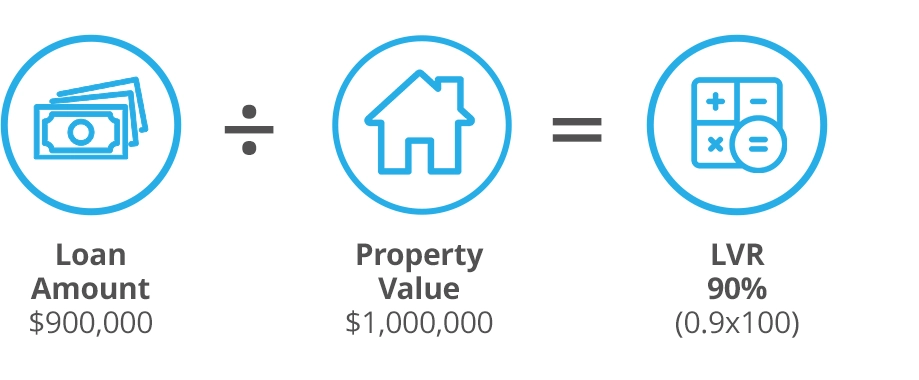

How Is LVR Calculated?

Your LVR is calculated by dividing the loan amount (the amount you’re borrowing) by the property value and then multiplying the result by 100 to express it as a percentage.

Mathematically, LVR = (Loan Amount ÷ Property Value) × 100

This formula expresses the loan amount as a percentage of the property’s value.

For example, if you borrow $900,000 against a $1 million property, your LVR is 90%.

LVR = (900,000 ÷ 1,000,000) × 100

Your LVR matters! Get help on what it means for your mortgage. Let’s explore your options.

Talk To An ExpertHow Does LVR Affect Home Loan Approval

The LVR influences various aspects of your home loan, including the interest rates you’re offered, potential additional costs like Lenders Mortgage Insurance (LMI), and your chances of securing loan approval.

- Interest rates: Many lenders implement tiered pricing based on LVR brackets. For instance, an LVR below 60% may qualify for the lowest interest rates, while an LVR between 60% and 80% might incur slightly higher rates. Those with an LVR above 80% could face higher rates.

- Lenders Mortgage Insurance (LMI): If your LVR exceeds 80%, lenders typically require you to pay for Lenders Mortgage Insurance (LMI) as well. This insurance protects the lender in case you default on your loan, but it is an additional cost borne by the borrower.

- Loan Approval: LVR plays a crucial role in loan approval processes. Many lenders have maximum acceptable LVRs. A high LVR can reduce your borrowing power or even lead to loan rejection.

What Is The Ideal LVR For A Home Loan?

An ideal LVR for a home loan is 80% or lower, as this range allows borrowers to access lower interest rates. Most lenders will accept an LVR from 60% to 80%. Higher LVRs, above 80%, are acceptable, but these might come with higher interest rates. Having a low LVR means low risk for lenders.

High LVR Or Low LVR: Which Is Better?

When comparing a high-LVR to a low-LVR home loan, a low LVR is a better option for several reasons:

Low LVR

- An LVR of 80% or less indicates that the borrower has more equity in the property, which reduces the lender’s risk. This could mean more favourable terms, including lower interest rates and fewer fees.

- If you’re borrowing more than 80% LVR, you might be required to pay Lenders Mortgage Insurance, which adds costs to the loan. By maintaining a low LVR, you avoid this expense.

- A lower LVR typically leads to lower interest rates.

- A low LVR means you start with a larger stake in your property.

High LVR

- Loans with high LVRs are considered higher risk by lenders, leading to higher interest rates and loan repayments.

- High-LVR loans often incur additional fees, such as LMI, which can increase the overall cost of borrowing.

- Most lenders will ask to see genuine savings if LVR is above 80%.

Why Is High LVR Risky?

A high LVR is a loss to the lender if the borrower defaults, as the property value might not recover the loan amount.

A high LVR is risky to borrowers for the following reasons:

- Lenders will require the borrower to pay Lenders Mortgage Insurance (LMI), a premium designed to protect the lender, not the borrower, if the mortgage cannot be repaid on time.

- Lenders have stricter lending policies when the loan is in LMI territory.

- Borrowers will be charged a higher interest rate to offset the increased risk. This means that, in addition to a larger mortgage, the borrower pays more in interest.

- Certain loan features and facilities, such as offset accounts, split loans, and redraw facilities, may not be available to borrowers.

- A larger loan reduces home equity. If the property value declines, the borrower may face negative equity, where the amount owed exceeds the home’s market value.

4 Ways To Lower Your LVR

If you want to avoid a high LVR loan, here are four ways to decrease your LVR:

- Save for a higher deposit so your LVR is not in LMI territory. Ideally, you want to keep your LVR below 80%.

- If a family member is willing to guarantee your loan with their property, you can avoid LMI and borrow up to 100% or more of the property value.

- Check out government schemes and programs that waive LMI for first-home buyers.

- See if you qualify for waived LMI. Certain professions, such as doctors, lawyers and accountants, could qualify for waived LMI.

Learn More About LVR (FAQs)

Does LVR Affect Interest Rate?

Yes, the LVR affects the interest rate on your home loan. Lower interest rates are usually given to borrowers with lower LVRs, as they pose a lower risk to the lender.

How Does A Bank Value My Property When Calculating LVR?

How Is LVR Calculated When Refinancing

What Is A Good LVR For Investment Property?

Still need answers? We're here to help!

Ask an expertOur team of mortgage experts will assist you within 24 hours.