Find Better Home Loan Rates

Latest home loan interest rates

Starting from

%*

p.a.

Comparison rate

%*

p.a.

Disclaimer: Your actual rate may vary according to your preferred lender and mortgage situation/needs. Talk to our experts for a personalised quote.

Discuss Rate With An ExpertApplying for Refinancing: The Process

A general rule of thumb is that homeowners should consider refinancing every three to four years to ensure that they’re getting the best deal possible.

It’s no secret that banks often offer better interest rates to new customers than existing ones. Moreover, with banks offering refinance cash backs and waived application fees, it is a worthwhile exercise to consider refinancing.

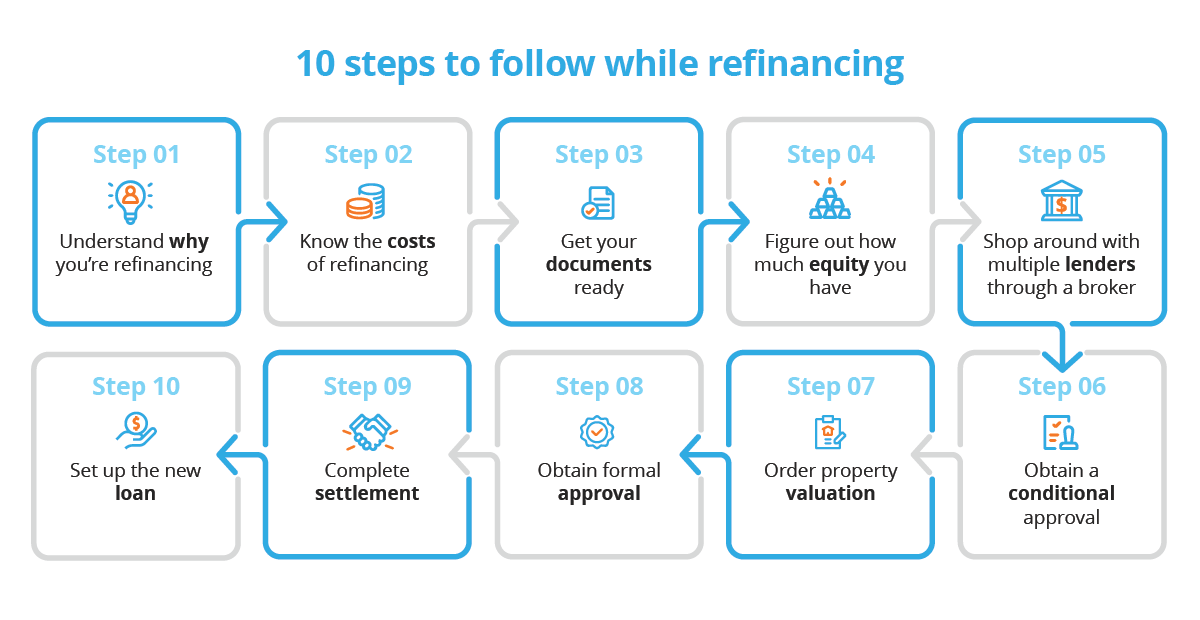

Luckily, the refinance home loan process is a lot more straightforward than what it used to be. Here’s what the refinancing process will look like for most borrowers.

- Understand Your Motivation: Define why you want to refinance, whether for a better rate, lower payments, or accessing equity. This guides your decision-making process.

- Know the Costs: Consider fees like discharge fees, application fees, and valuation fees. Compare costs versus potential savings to ensure refinancing is financially viable.

- Assess Your Equity Calculate your equity by subtracting your mortgage balance from your property value. Aim for at least 20% equity to avoid additional fees.

- Prepare Your Documents: Gather necessary documents like home loan statements, income proofs and identification.

- Consult with a Broker: Engage with a mortgage broker to explore lender options and understand refinance cashback offers. At Home Loan Experts, our mortgage experts have the credit expertise to properly assess your situation and recommend some products that are more competitive than your current mortgage.

- Obtain conditional approval:Once you’ve chosen a lender, your broker will work with you to submit a conditional approval by submitting the paperwork required.

- Prepare for Appraisal: Your lender will provide you with a document known as the ‘Closing Disclosure’, which outlines all the pertinent details of your mortgage. It’s crucial to carefully review each term and condition before signing any loan documents.

- Obtain Approval: Calculate your equity by subtracting your mortgage balance from your property value. Aim for at least 20% equity to avoid additional fees.

- Complete Settlement: If switching lenders, your broker will handle the discharge process with your current lender. Ensure all necessary forms are filled out and any discharge fees are accounted for.

- Set Up Your New Loan: Congratulations on refinancing your home loan! You’ll soon receive a welcome letter with your interest rate and repayment terms. Ensure repayment details are accurate and any desired features like offset or redraw are set up.

Refinancing FAQs

What is refinancing?

Why should I refinance my home loan?

How much can I save by refinancing?

How much equity is needed to refinance?

What are the costs involved in refinancing?

What are some things to know before I refinance?

Still need answers? We're here to help!

Ask an expertOur team of mortgage experts will assist you within 24 hours.