Disclaimer: The results from this Negative Gearing Calculator are for illustrative purposes only and should not be considered financial advice. The calculations are based on the information provided and do not account for future tax law changes, interest rate fluctuations, or individual financial circumstances.

Turn Your Investment Plan into Action!

Get the right guidance with mortgage experts.

Talk To Our ExpertsHow Does Negative Gearing Work?

Negative gearing occurs when the expenses of an investment property, including loan interest, maintenance, and management costs, exceed its rental income, resulting in a financial loss. This loss can be deducted from your taxable income, reducing your overall tax liability.

To learn more about negative gearing, refer to our What is negative gearing? page.

How Is Negative Gearing Calculated?

To calculate the gearing of your taxable income, you need to determine the total rental income your investment property earned over a year, then subtract all the relevant expenses associated with the property.

If the results show a loss, meaning the expenses are more than the income, you are negatively geared.

Net Rental Loss=Rental Income−Rental Expenses−Interest on Loan

If the result is negative, then your property is negatively geared.

To calculate the tax benefit, you apply your marginal tax rate to the loss:

Tax Benefit= Net Rental Loss × Income Tax Rate

- Find out the total rental income you earn from your investment property in a tax year.

- Sum up all expenses associated with the property, like:

- Property management fees

- Bank fees

- Loan repayments

- Council rates and land tax

- Repairs and maintenance costs

- Advertising for tenants

- Depreciation costs

If the result is a loss (expenses exceed income), this is considered negative gearing.

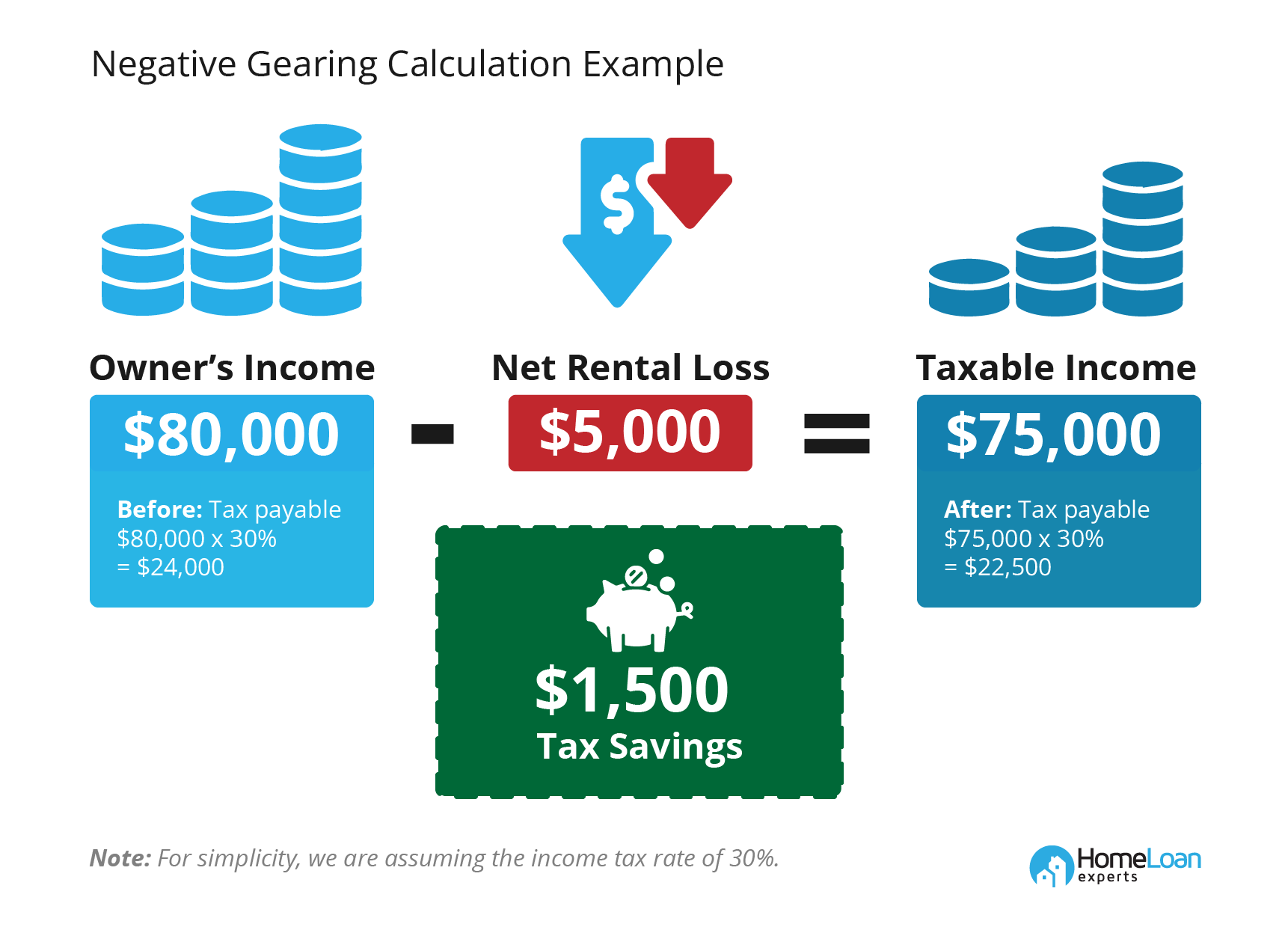

Here’s an example calculation:

- Rental income = $20,000

- Property expenses = $25,000

- Net Rental Loss = $20,000 (Rental Income) – $25,000 (Total Expenses) = $5000

You can subtract the $5000 net rental loss from your taxable income.

Example Of Negative Gearing

Why Should I Use A Negative Gearing Calculator?

You should use a negative gearing calculator to:

- Estimate tax deductions: Calculate how much of your rental loss can be offset against your taxable income to reduce your tax liability.

- Assess leverage: Understand how borrowing to invest affects your finances and potential long-term returns.

- Evaluate potential capital appreciation: Determine if the property’s value is likely to grow over time, making up for short-term losses.

- Plan your investment strategy: Gain insights into whether negative gearing aligns with your financial goals and long-term wealth-building plans.

Is Negative Gearing Right For Your Investment Strategy?

Negative gearing might be the right strategy for your investment if:

- You have a high taxable income and want to reduce your tax liability.

- You can keep your Debt-To-Income (DTI) under 6-7 to maintain your future borrowing power.

- You plan to hold your property for at least 10 years to benefit from property value appreciation.

- You can afford short-term losses while waiting for long-term capital growth.

- You have a stable financial position with a steady income and reserve; these are essential to cover ongoing property expenses.

Using negative gearing as an investment strategy is not without its risks:

- Poor cashflow: Negative gearing could lead to a lack of cashflow.

- Market volatility: Negative gearing as a strategy relies heavily on the property’s potential growth to offset the initial losses. The property market is volatile.

- Tax benefits mainly affect high-income earners: The tax benefits of negative gearing primarily benefit people with higher incomes. If your income isn’t high enough, it may not be for you.