Use the investment property calculator to accurately predict the weekly cashflow position of your next investment property.

How to use this calculator

Simply enter the details of the investment property you want to purchase and your income, and our calculator will work out the rest for you.

- Step 1: Enter the details of the purchase, including the property price and your deposit.

- Step 2: Enter your income and the expected rental income.

- Step 3: Enter the costs associated with the property (our calculator will estimate some of them for you).

Please speak to our mortgage brokers today by calling 1300 889 743 or by filling in our free online assessment form to find out how we can help you with an investment loan.

What Is Investment Property Cashflow?

You should see each investment property that you own as a separate mini-business.

You have income, and you have expenses associated with the property, and you either make a loss or a profit each week.

If your interest, repairs, maintenance, council rates, water rates, insurance and property management fees are more than your rental income, the property has negative cashflow.

That means you must put in a sum each week to cover the shortfall.

Most properties have a negative weekly cashflow when they are purchased, but over time the rent increases and the property becomes positively geared.

Some properties have a positive cashflow from the moment that they are purchased.

If you purchsed one of them, then well done.

These types of properties often are in mining towns, remote locations or blocks of units.

Negative gearing can be a good strategy if you have a high taxable income.

Investors in the top two tax brackets tend to benefit the most from negatively geared properties, as long as the properties have a high growth rate.

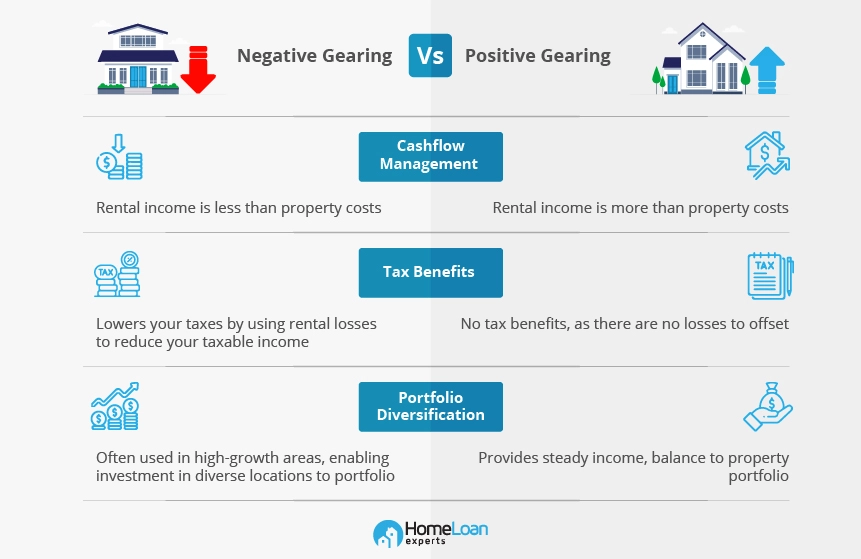

Negative Gearing vs Positive Gearing

However, this can vary depending on your overall situation, so check out the negative gearing vs positive gearing page to compare the pros and cons of each investment strategy.

Also, read about managing cash flow while negative gearing.

Calculating Your Income

The cash flow calculator needs to know your taxable income so that it can work out the benefits you may receive from depreciation and negative gearing.

For your rental income, if you’re not sure how much rent you’ll receive from your property, use 4% of the value for a house or 5% for a unit or townhouse.

This will give you an estimate of your annual rental income, which you can then divide by 52 to find out your weekly rental income.

Calculating Property Expenses

Our investment property cashflow calculator will automatically estimate many of the expenses associated with your property.

Expenses That The Investment Property Calculator Will Consider

- Council rates

- Water rates

- Building insurance

- Property management fees

- Maintenance

- Home loan repayments

Expenses That The Investment Property Calculator Won’t Consider

- Gardening

- Landlords insurance

- Contents insurance

- Renovations

- Bank fees, such as an annual package fee

- Changes in interest rates

- Purchasing costs such as legal fees, Lenders Mortgage Insurance (LMI) and stamp duty

You may qualify for an LMI discount, so complete our free online assessment form to find out more.

Calculating Negative Gearing Benefits

When you have negative gearing, you can claim the loss as a deduction when you lodge your tax return.

The government is effectively subsidising your investment property.

For example, let’s say that your annual income was $100,000 and your property made a loss of $10,000 in a year.

Your taxable income would be $90,000, and if the tax rate at the time was 30%, you’d be able to reduce $3,000 from your taxable income as a result of negative gearing.

That’s an oversimplification. Our calculator can work it out exactly using up-to-date tax rates.

Investors also need to decide between P&I vs interest-only loans when optimising for tax deductions.

How Does Depreciation Work?

When a property is built, the building will degrade over time until the house eventually needs to be rebuilt.

This decline in value of the building can be deducted for tax purposes.

Depreciation isn’t an actual expense that you need to pay but an accounting entry.

Effectively, you save tax without actually having any cost affecting your weekly cashflow.

Depreciation is a complicated subject, so please talk to your accountant for more information.

Frequently Asked Questions

In Australia, you will typically need a deposit of at least 20% of the purchase price of an investment property. However, some lenders may be willing to accept a lower deposit, especially if you have a good credit score and a strong income.

The 2% rule is a guideline for determining how much rent a property should generate in relation to its purchase price in Australia. According to this rule, the monthly rent should be at least 2% of the purchase price. For example, if you buy a property for $500,000, the monthly rent should be at least $10,000.

The 1% rule is a more conservative guideline than the 2% rule. According to this rule, the monthly rent should be at least 1% of the purchase price. For example, if you buy a property for $500,000, the monthly rent should be at least $5,000.

To calculate the investment value of a property, you can use the following formula: Investment value = Net operating income/capitalisation rate Net operating income is the amount of money a property generates after paying all of its expenses, including mortgage payments, property taxes, insurance, and repairs and maintenance. Capitalisation rate (cap rate) is a measure of how much return an investor can expect to receive on their investment. It is calculated by dividing the net operating income by the property value. A property’s investment value will vary depending on the specific property and the market conditions. However, a general rule of thumb is that the investment value should be at least 7%.

To calculate depreciation on an investment property in Australia, you can use the following formula: Depreciation = cost of property * depreciation rate * number of years Cost of property is the original purchase price of the property. Depreciation rate is the percentage of the property’s value that can be depreciated each year. The depreciation rate for residential property in Australia is typically 2.5%. Number of years is the number of years the property is expected to be depreciated. The maximum depreciation period for residential property in Australia is 40 years.

Capital gains tax is calculated on the difference between the sale price of a property and its purchase price. The amount of capital gains tax you pay will depend on your income tax bracket and the length of time you owned the property.

- If you sell a property within 12 months of purchase, you will have to pay short-term capital gains tax. Short-term capital gains tax are taxed at your marginal tax rate.

- If you sell a property after 12 months of ownership, you will have to pay long-term capital gains tax. Long-term capital gains tax is taxed at a lower rate than your marginal tax rate. The exact rate depends on your income tax bracket.

Apply For An Investment Loan

Once you’ve experimented with the property investment calculator, we can help you qualify for an investment loan to buy a new property.

Speak to our mortgage brokers by calling 1300 889 743 or fill in our free assessment form to find out if you can qualify for a professional discount on your interest rate.