Property investment comes with plenty of strategies but few are as talked about (or debated) as negative gearing. Love it or hate it, this approach has shaped Australia’s real-estate market for decades. So, how does it turn a loss into a long-term win?

What Is Negative Gearing?

Negative gearing is a popular Australian property investment strategy where the costs of owning an investment property exceed the rental income, creating a loss. This loss can be deducted from your taxable income, helping you save on taxes.

Imagine you invest in a $300,000 apartment in a growing neighbourhood with new developments. To attract tenants, you set the rent at $300 a week. Your mortgage repayments and property management costs total $400 a week, leaving you $100 out of pocket each week. This loss can offset your taxable income, potentially reducing your tax bill. Curious about your investment’s potential? Use our negative gearing calculator to see how your strategy could pay off.

The goal is to hold the property until its value grows, allowing you to sell for a profit (capital gain). Often called “capital growth properties”, negatively geared investments can be a powerful way to grow your wealth, though you must cover short-term losses and you’re counting on market growth.

How Does Negative Gearing Work?

To calculate negative gearing, follow these steps.

1. Calculate Rental Income: Determine the total rental income the property generates over the financial year. This includes all rent payments received from tenants.

2. Add Up Expenses: Calculate all expenses associated with owning and maintaining the property. Common expenses include home loan repayments, including interest, property management fees, maintenance costs, insurance and council rates.

3. Determine Net Income or Loss: Subtract the total expenses from the rental income. If the expenses exceed the income, the result is a negative figure, indicating a loss.

Example: Let’s suppose your rental income is $25,000 and expenses total $35,000,

$25,000 – $35,000 = -$10,000.

This $10,000 is your net loss.

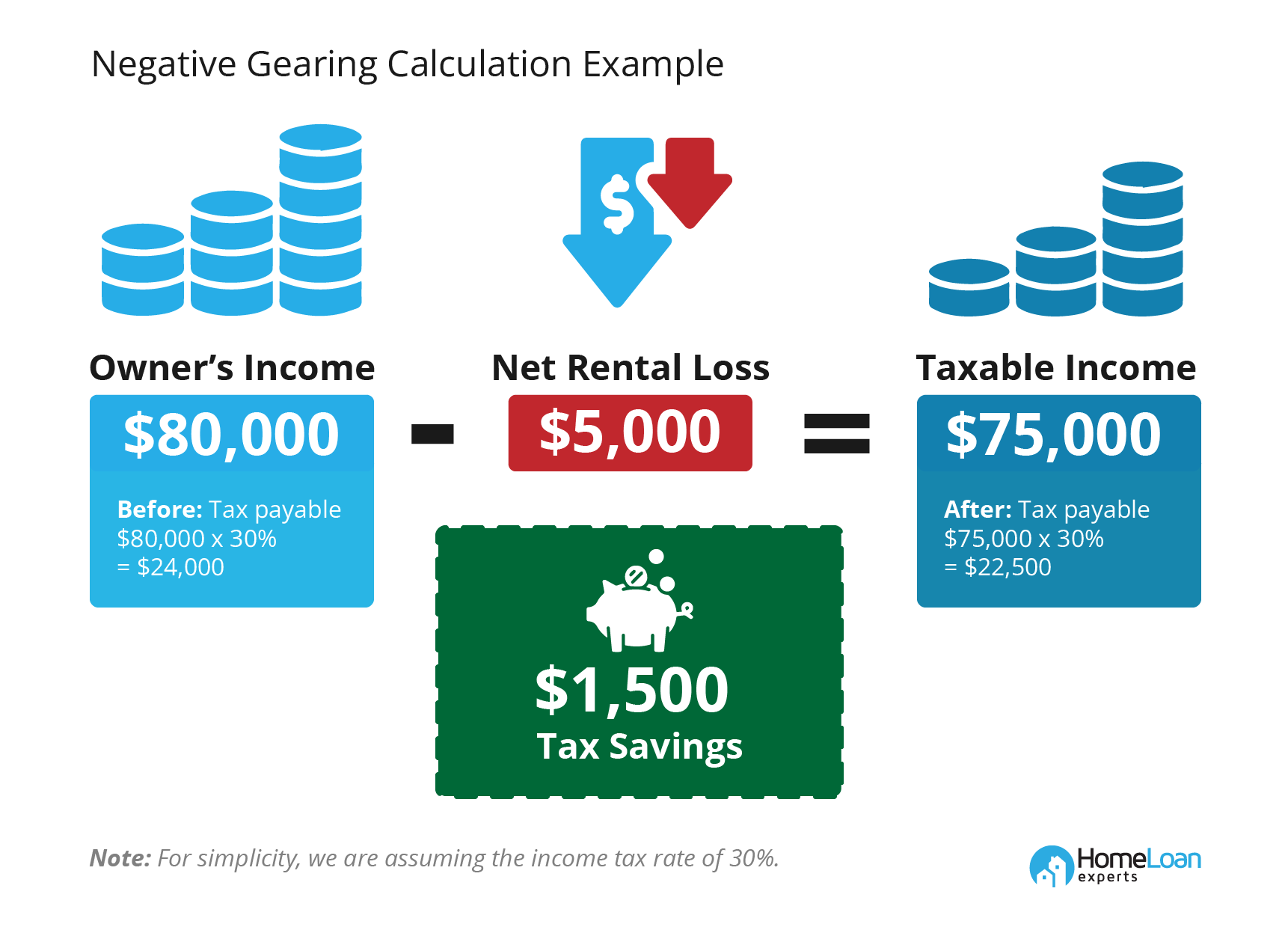

4. Deduct from Taxable Income: Deduct the net loss from your total taxable income, such as your salary or business income. This leads to a lower tax bill.

Example: If you earn $100,000 on your job and have a $10,000 loss from your property, your taxable income reduces to $90,000. This means you pay tax on $90,000 instead of $100,000, resulting in tax savings. Assuming a marginal tax rate of 30%, the $10,000 loss reduces your tax liability by $3,000.

Negative Gearing Vs Positive Gearing

When building a property portfolio, how your rental income stacks up against your expenses determines whether your investment is negatively or positively geared. Each situation offers distinct tax implications, cashflow effects, and long-term financial outcomes. Here’s a breakdown to help you compare the two.

Negative gearing: pros and cons

Benefits

- Claim losses on tax: You can claim most losses, including depreciation, when tax time rolls around, in effect reducing your taxable income. Independent financial advice is always essential.

- Capital growth: You’ll need a bit of luck, but as long as you’ve invested in real estate in a location with strong fundamentals for future growth (blue-chip), you have a chance to see a good return on investment if you decide to sell at the end of a property cycle (typically 7 to 10 years). These gains should far outweigh any losses you’ve been hit with.

Drawbacks

- Tighter cash flow and reduced borrowing power: Negative gearing can strain your cash flow, especially if your income isn’t stable or rising over time to cover rental shortfalls or property costs. Since rent increases aren’t always feasible, any change in your financial situation could pressure you to sell before capital growth is realised. This limited cash flow also affects your borrowing capacity, making it harder to secure finance for future property investments.

- You’ll get taxed: Any capital gains will be taxed. Read more about capital gains tax and the cons of capital loss. Luckily, you’ll only pay tax on 50% of your capital gains.

Positive gearing: pros and cons

Benefits

- Cold hard cash: You have more money in your pocket, which you can save for a deposit to invest in more properties or simply pay off your investment loan sooner. It also provides a financial buffer, should your personal situation change for any reason.

- Increases your borrowing power: Most lenders will accept only up to 80% of your rental income when assessing your ability to service a home loan; however, at least one of our lenders will accept up to 100%.

- New and old investors: People new to investing or those nearing retirement may not want to be burdened by too much debt, so a cashflow-positive strategy tends to make more sense.

- The (other) great equaliser: Cashflow-positive properties can help keep your property portfolio in check by covering any losses you incur on negatively geared properties you own.

Drawbacks

- You’ll get taxed: The Australian Taxation Office (ATO) will take a slice of your rental income.

- Slow capital growth: Since most positively geared investment properties are in rural or regional towns, any capital gain benefits will have to wait, since growth rates tend to be slower than in metro/city areas. This can also hamper any plans you had to access equity in order to fund future property investment.

- Low yields are your enemy: Generally speaking, the higher the rental yield, the more cashflow positive is the property. In a high-growth environment, yields are low, so this can have a negative effect on your positive-cashflow strategy.

- Fluctuating growth: You’re relying on good economic factors, including low interest rates, low vacancy rates and even strong employment figures to keep the rent flowing in, leaving you with some surplus gains after costs. For example, towns that are relying on particular industries like mining may be high yielding one day and go bust the next.

- Unexpected costs: Mortgage repayments and rates are one thing but freak maintenance and repair costs can really throw out your cash flow. Unfortunately, you can’t plan for the unexpected.

Which Strategy Is Right For You?

Choosing between negative and positive gearing comes down to your financial goals, income stability, and risk tolerance.

- Looking for long-term growth and tax benefits? Negative gearing might suit you.

- Prefer immediate income and lower financial risk? Positive gearing could be the better fit.

Ultimately, the best strategy is one that aligns with your overall investment plan. Speak with a qualified mortgage broker or financial adviser to weigh your options and make informed decisions.

Take the Next Step in Your Property Investment Plan

Make your property investment count with expert guidance from Home Loan Experts. We find competitive rates and tailored loan solutions. Secure your ideal loan today!

Learn MoreFrequently Asked Questions

How Does Negative Gearing Affect Housing Affordability?

Increased investment in the Australian property market, driven by negative gearing, has been linked to rising house prices. This makes homes less affordable for first-time buyers and low-income earners. Studies suggest negative gearing is a great factor influencing investment decisions and property speculation in Australia.

The impact on rents within the Australian context is more complex. Some argue it increases rental supply, thereby keeping rents down. Others contend that abolishing negative gearing could lead to rent increases, similar to the situation in Perth and Sydney in the 1980s following its brief removal in Australia.

To address housing affordability in Australia, some experts advocate for reforming negative gearing, rather than complete abolition. Potential reforms include:

- Limiting the number or type of properties eligible for negative gearing deductions.

- Increasing capital gains tax on investment properties.

- Allowing first-home buyers in Australia to claim tax deductions for mortgage interest.

- Increasing government investment in public and affordable housing initiatives.

How Does Negative Gearing Affect Tax Returns?

Still need answers? We're here to help!

Ask an expertOur team of mortgage experts will assist you within 24 hours.