How To Refinance A Home Loan?

A general rule of thumb is that homeowners should consider refinancing every three to four years to ensure that they’re getting the best deal possible. It’s no secret that banks often offer better interest rates to new customers than existing ones. Moreover, with banks offering refinance cash backs and waived application fees, it is a worthwhile exercise to consider refinancing. Luckily, the refinance home loan process is a lot more straightforward than what it used to be. Here’s what the refinancing process will look like for most borrowers.

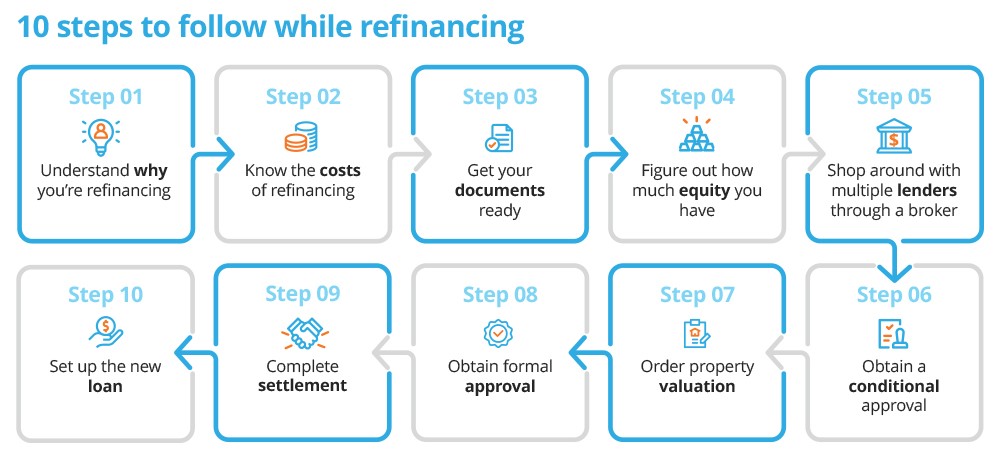

Step 1: Understand Why You’re Refinancing

First things first, you should have a clear understanding as to why you’re refinancing; be it to access a better interest rate or to reduce your monthly repayments, or to access some equity from your property. Knowing this upfront will make it easier for you to identify the outcome you desire and the home loan product that’s suitable for you.Step 2: Know The Costs Of Refinancing

There are a number of fees you need to consider when refinancing such as mortgage discharge fees, loan application fees, valuation fees, mortgage registration fees, ongoing lender fees etc. The refinancing fees vary depending on the lender you apply with, and the product you qualify for. However, banks are always competing against each other to attract good borrowers with lower interest rates, refinance cash backs, waived loan applications and set up fees.Step 3: Figure Out How Much Equity You Have

Your equity is the difference between your property value and the mortgage balance owing on the property. You can use our Home Equity Calculator to calculate your equity. Generally, to refinance you’ll need minimum equity of 5%; however, ideally you’ll want at least 20% equity so as to avoid Lenders Mortgage Insurance fees.Step 4: Get Your Documents Ready

When refinancing, you’ll be required to provide your:- Last 6 months home loan statements which show the total amount owing to the bank.

- Recent council rates notice and building insurance on your home.

- Last three months’ unsecured debt statements such as credit card statements, personal loan and car loan statements etc.

- You’ll also need to provide your 2 most recent payslips, bank statements and IDs.

Step 5: Shop Around With Multiple Lenders Through A Broker

You can shop around and compare home loans yourself. But as mortgage brokers, we have access to a broad range of lenders – 40 lenders in our case – as such we can help you find a good deal and a good rate based on your situation.Step 6: Obtain A Conditional Approval

Once you’ve lodged your application, you can expect to obtain a conditional approval between a day and seven business days based on that particular lender’s turnaround time.Step 7: Order Property Valuation

Fortunately, for properties in metro areas and prime locations, a lot of lenders will accept a computer valuation of the property. As for properties with no recent data or for very high loan to value (LVR) loans, lenders may insist on a full valuation of the property. This usually takes around three to five business days.Step 8: Obtain Formal Approval

The lenders will send you the Loan Offer documents, mortgage discharge forms, Titles Office – Mortgage Discharge etc. for you to sign. For the mortgage discharge, you’ll need to download the latest mortgage discharge form from your existing lender’s website and submit.Step 9: Complete Settlement

From here on out, much of the work is handled by your new bank or lender. They will contact your existing lender and pay out the balance, and remove the outgoing financial institution’s (OFI) name from the mortgage.Step 10: Set Up The New Loan

Finally, once the settlement is complete, some lenders also send a Welcome Pack, which will outline your new loan details, and internet banking setup. This is where you’ll want to ensure that any loan features that you require such as offset accounts, redraw etc. are set up at this time.No Serviceability Required

We know a major lender that offers dollar-for-dollar refinancing, with no serviceability required if you have a clear payment history in the last 12 months. Dollar-for-dollar refinancing means your new loan will be for the same amount as your existing loan but with new terms – such as a better interest rate. To be eligible:- The new interest rate must be lower than the existing loan

- The LVR must be below 80%

- The new loan must be in the same name(s) as the existing one

- There must be no change in the borrower’s primary income source since the loan was established.

- The lender will assess each application on a case-by-case basis.

Refinance Calculator

Taking into account the costs and fees associated with switching home loans and lenders, this calculator works out how much you’ll actually save by refinancing.

It all comes down to what you’re trying to achieve so call us on 1300 889 743 or complete our free assessment form and we can talk you through your options.

Frequently Asked Questions About Refinancing

- A better interest rate that reduces the size of your mortgage

- Lower monthly repayments.

- Consolidation of debt into one manageable monthly repayment

- Competitive interest rates by refinancing to a major lender and addressing past credit issues.

- Access to equity for renovation, investment, travel, or savings.

- Refinancing options for your business loan.

Honeymoon rates: One type of promotion is called the “honeymoon rate”, a special rate that lenders offer only for the first few years of your mortgage (usually 1 to 3 years). After this period, these discounted interest rates revert to the Standard Variable Rate, which may not be the most competitive rate on the market anymore. Speak to a mortgage broker or lender and confirm that your new rates are in effect for the life of the loan and will not increase afterwards.

Rebates and cashbacks: Another type of promotion can be in the form of a refinance rebate or cashback. Although you shouldn’t refinance purely for a cashback, these rewards can be tempting and lenders offer them on a regular basis.

These rebates vary depending on whether you’re a first home buyer or an existing customer.

Apart from cashbacks, there can also be fee waivers such as discounted LMI and application fees, as well as the refund of the first annual fee on a professional package.

Your lender may offer you a better deal: It costs lenders a lot less to retain an existing customer than to find a new one. It’s one of the reasons why most of the major banks and lenders have large retention teams, some of which are the same size or even bigger than their sales teams!

If you try to switch mortgages it’s likely that you’ll get a call from someone in this team offering really competitive deals to try and make you stay, such as a heavily discounted interest rate or fee waivers.

In spite of this, a mortgage broker can usually get you an even better deal because they have access to special promotions not offered to the general public.

The reason is that they have very strong relationships with a number of Australian lenders due to the sheer amount of loans they write.

Read more about this on our when should I refinance my home loan page dedicated to answering all of your curiosity and helping you make an informed decision.- Borrowing costs: When you refinance, your new lender may charge a range of upfront fees.

- Loan application fee: Charged when you apply for a new home loan.

- Exit fees: These may apply when you pay out a loan early, usually in the first 3 to 5 years of your term. It could be a percentage of the remaining loan balance or it may be a set charge.

- Valuation fee: Your lender may charge a fee to have your property valued by a professional property valuer.

- Settlement fee: Your lender may charge a fee to pay out your current mortgage.

- Discharge fee: Although exit fees were abolished in 2011, a discharge fee of around $150 to $300 is usually charged by a lender in order to release you from the mortgage.

- Break costs: You may incur break costs from the lender who financed your current mortgage. These fees apply when you refinance within the fixed period of your home loan. For example, say you’re on a 5-year fixed mortgage and you decide to refinance after 3 years. There is no hard and fast rule with these costs but they can be as much as $10,000. Standard application fees which vary between lenders including home loan set-up and settlement.

- Government fees to register and transfer the property: If you increase your loan as part of your refinance, you may be charged stamp duty depending on your state. Your state’s Land Titles Office will also charge a mortgage registration fee to register your mortgage on to the title record for the property.

- Ongoing fees depending on the mortgage you choose: These charges could include monthly account keeping fees, annual fees or fees for redrawing.

- Lenders Mortgage Insurance (LMI): One off fee only applicable if you have more than 80% of the purchase price owing on your home loan refinance.

Some of these fees can be negotiated by you or your mortgage broker. For example, fees may be waived, there may be a promotion happening, or you may be entitled to a rebate.

Mortgage brokers tend to have better relationships with lenders and can therefore negotiate harder on your behalf. Check our page on refinance costs for more information.To be eligible to refinance you must meet certain criteria:

- Ideally, you should have less than 80% owing on your home loan.

- You can refinance on a variable rate: You can actually refinance every 6 months but keep in mind though that you’ll add an enquiry to your credit file every time you refinance. Despite this, it sometimes makes sense to refinance within the first few months depending on the amount of equity you have to use. For example, you may have only settled your loan in the last 3 months but recently found an investment opportunity and want to access your equity to invest. Your current lender may not allow you to do this but another lender may be able to consider your case. We may be able to help you do this depending on your equity position.

- You shouldn’t refinance on a fixed interest rate: Despite the break costs and early exit fees, it sometimes makes sense financially to refinance within the fixed period, especially if you recoup these costs within 2 years of refinancing. You should speak to a mortgage broker about your situation if you’re considering this (this can be tricky).

- You can refinance to a low doc mortgage: If you’re self-employed and can’t provide the necessary income evidence to qualify for a standard home loan, you can still borrow up to 85% of the value of your property. You may not be able to provide the tax returns to prove your income, especially if you’re nearing the end of the financial year. However, you may be able to approach your accountant and ask for a letter declaring your projected income for the end of the financial year and get a low doc loan. Cash out restrictions and other conditions apply so speak to a mortgage broker if you’re in this situation.

- You can refinance from a low doc to a full doc: Some people had a low doc mortgage but they’ve now got sufficient financial evidence that they can provide so they get a sharper interest rate with another lender.

- You can refinance out of a bad credit loan: You can refinance from a specialist lender to a major lender if you owe 80% or less of your property’s value and all of your defaults have been paid and are no longer showing on your credit file. See here for specific conditions and exceptions to standard policy.

- You may pay LMI twice: That means you’ll be paying LMI when borrowing more than 80% of the purchase price of your property and paying this cost again if you refinance 3 or 4 years later and you still owe more than 80% on your property.

- Unsatisfactory service from the new lender: This could be any number of issues including below par customer service, dissatisfaction with the initial loan process or post-settlement process, having no Internet banking features or, conversely, no branch access.

- Adding enquiries to your credit file: Making too many applications with too many lenders can negatively impact your credit score. Any more than 4 enquiries in a 12 month period can limit the number of lenders you’re eligible to refinance with.

If your mortgage is coming to the end of its fixed rate term, it’s a good time to shop around for a better interest rate or perhaps a more flexible product.

- Even if you’re on a variable rate, most people consider refinancing after about 3-4 years.

- If you want to purchase an investment property, your current lender may be reluctant in releasing equity to you due to strict lending requirements. By refinancing with another lender you may be able to get your loan approved.

Some people want branch access because dealing with issues and asking questions over the phone or online is difficult. Despite the advances in online technology, some people still prefer to see someone in person.

If you’ve been unable to meet your debt and mortgage repayments recently, you may have added black marks to your credit file.

If you apply with a major bank and get declined, you’ll add yet another blemish to your credit history so a specialist lender may be a better option for you.

Reasons Why Borrowers Refinance

Refinancing To Get A Better Interest Rate

With so many lenders and mortgage products on the market, lenders compete heavily regarding interest rates. There are many different types of promotions offered by different lenders throughout the year, so you’ll have to shop around to discover what’s being offered. If you are using a mortgage broker, it’s good to ask about the current promotions on the market. Brokers receive lenders’ updates and stay updated with the latest offers.Refinancing For Rebates And Cashbacks

If you’re struggling to keep up with your debts, debt consolidation can save you time and money. In basic terms, it works by taking all of your debts and rolling them into your mortgage, therefore, making it easier to manage your finances.- You pay the debts back at the rate of the home loan, not at the rate that comes with each debt. A credit card debt, for instance, can have an interest rate as high as 17%.

- You can consolidate up to about five different debt facilities.

- You won’t get hit with the fees associated with credit cards and personal loans.

- You actually pay back a smaller portion for these smaller debts because you’re paying a lump sum on a monthly basis.

- Instead of trying to manage your payments to several different lenders and credit providers, you can combine all of these into one easy, monthly payment.

Depending on your situation, you can:

- Borrow up to 90% of the property value: You must have a clean credit history and all of your repayments need to have been paid on time.

- Borrow up to 80% of the property value: You can have missed payments recorded on your file but you need to show that you’ve been making your payments on time for the last 6 months.

- Borrow up to 75% of the property value: Your borrowing power will be limited if you have serious credit impairment.

Refinancing To Consolidate Debt

If you’re struggling to keep up with your debts, debt consolidation can save you time and money. In basic terms, it works by taking all of your debts and rolling them into your mortgage, therefore, making it easier to manage your finances. The benefits are that:- You pay the debts back at the rate of the home loan, not at the rate that comes with each debt. A credit card debt, for instance, can have an interest rate as high as 17%.

- You can consolidate up to about five different debt facilities.

- You won’t get hit with the fees associated with credit cards and personal loans.

- You actually pay back a smaller portion for these smaller debts because you’re paying a lump sum on a monthly basis.

- Instead of trying to manage your payments to several different lenders and credit providers, you can combine all of these into one easy, monthly payment.

- Borrow up to 90% of the property value: You must have a clean credit history and all of your repayments need to have been paid on time.

- Borrow up to 80% of the property value: You can have missed payments recorded on your file but you need to show that you’ve been making your payments on time for the last 6 months.

- Borrow up to 75% of the property value: Your borrowing power will be limited if you have serious credit impairment.

Example Of Refinancing To Consolidate Debt

The situation: Justin owns a property worth $550,000 and a mortgage of $350,000 at a 5.00% interest rate. His monthly repayments are $1,878. He has two credit cards with roughly $10,000 owing in total, with minimum repayments of $200. He also has a personal loan of $20,000, which he used to go on an overseas holiday. At an interest rate of 15%, his monthly repayments are $475. On top of that, Justin’s wife has a car loan with about $30,000 owning and paying $594 in monthly repayments. The combined monthly repayments that Justin and his wife are paying add up to $3,174. They’re living on a tight budget, and they’re worried that any slight change in their situation, like his or his wife becoming ill or losing their job, could see them default on their mortgage. The solution: Justin has been paying his variable rate home loan for the past four years and finds out that some lenders allow you to consolidate your debt to reduce debt payments and roll them into one easy-to-manage monthly repayment. After speaking to a mortgage broker, he can refinance with a lender that will roll all of his existing debts into the new home loan. The results: Even though he got a home loan at the same rate of 5.00%, his total debt repayments are $2,200 per month, saving more than $1,000 per month. Justin and his wife are now getting back on their feet, managing their finances and have even been able to put some money away in case they need it in the future.Refinancing To Access Equity

Your home will likely be the most valuable asset you will ever own. Refinancing to access your equity will allow you to use the funds to invest in property and build your wealth. Home equity is the difference between the market value of your property and the balance remaining on your home loan. For example, if your home is worth $1,000,000 and you have $600,000 remaining on the loan, your home equity equals $400,000.What you should know:

- Most banks and lenders will allow you to borrow up to 80% minus the debt owing on home loan.

For example, if your property was valued at $600,000 and you had $200,000 owing on the mortgage, you could use up $280,000 in equity.

- Accessing over 90% in equity is possible with a few lenders but LMI will apply.

Luckily, the cost of mortgage insurance can be added or ‘capitalised’ on top of the loan, saving you from having to pay a hefty upfront fee.

- Release equity in your property comes down to the valuation of your lender. Sometimes their valuation can come in less than what you were expecting, hampering your investment plans. It may even prevent you from using the equity altogether.

Luckily, we can refinance your loan with another lender that will give you a more favourable valuation.

- All lenders have cash out restrictions when it comes to equity loans because they see these types of loans as more risky than a standard home loan.

- Although it’s not recommended that you refinance within the fixed period due to the break costs involved, if you’re in need of the equity due to an emergency or a special circumstance, speak to a mortgage broker about it.

Example Of Refinancing To Access Equity

The situation: Maria purchased her property five years ago and owes $350,000 on her home loan, repayable over the remaining 25 years of her loan term. Her interest rate is 5.04% with her current lender, and her monthly repayments are $2,054. She wants to access the equity in her property to complete some non-structural home renovations, purchase a new car for the family and take them on their first family holiday overseas. The solution: In the past five years, her property value has increased to $600,000, according to her lender’s valuation. Maria decides to refinance $480,000 of her mortgage (80%) and switch to a 3-year fixed rate of 4.24%, a rate reduction of 0.80%. This brings her new repayments to a slightly higher $2,359 per month, just over $300 monthly. The results: Maria now has access to $130,000 in equity with only a slight increase to her monthly repayments, a much better option than using a high-interest rate personal loan or credit card.Refinancing To Renovate Property

The type of loan you require will depend on what kind of renovations you plan on undertaking:

- Construction loan: This is suitable if you’re looking to knock down and rebuild your property or complete some other major construction such as adding an extra room.

- Line of credit: It’s like having a giant credit card on your mortgage. The benefit is that you can pay it whenever you want and it’s easy to manage. However, it’s essential that you’re good at managing your finances and financial commitments, otherwise there is a real risk of defaulting on your loan.

Refinancing Out Of A Mortgage Obtained With Bad Credit

If you currently have a mortgage with a specialist lender due to having adverse credit in the past, you can refinance to a standard bank loan and enjoy a lower interest rate as long as you meet certain criteria:

- You must owe 80% or less of your property’s value (90% is considered on a case by case basis).

- All defaults must be paid and must no longer appear on your credit file. Keep in mind that a mortgage default can remain on your credit file for up to 5 years.

- You must provide full income evidence (low doc loans may be available in some cases).

- You must show that you’ve been making your debt repayments on time for the last 6 months.

If you have a bank default on your home loan, you’ll have to refinance with another lender.

Worse still, if you’ve been black marked by LMI provider Genworth, you’ll be limited in accessing 80% of the property value in equity with most lenders.

If you’re in this situation, please fill in our online assessment form and we may be able to find a lender that uses a different LMI provider or has its own Delegated Underwriting Authority.

Example Of Refinancing To Pay Out A Part IX Agreement

The situation: Nick owns a property valued at $450,000 and owes $285,000 at an interest rate of 5.00%. His monthly repayments are $1,529. Nick is also paying down a Part 9 debt agreement with $35,000 left to pay. He’s currently paying $972 per month. His home loan and Part IX agreement combined bring his monthly repayments to $2,501. The solution: Under a Part 9 agreement, you can’t legally borrow money to pay down the debt agreement, but a specialist lender will allow refinancing to pay out the debt. In Nick’s case, he could refinance to a specialist lender and pay out his $35,000 debt agreement, bringing his new loan to $320,000. The results: His new home loan rate is around 2% higher at 7%, but his new monthly repayments are $2,128, a saving of almost $400 per month.Refinancing Due To Mortgage In Arrears

Major life events such as injury, illness, job loss or the death of a love one can prevent you from meeting your financial commitments. Refinancing is a solution that can actually save people from losing their homes if their mortgage is in arrears.

Usually, you’ll refinance to a specialist lender (sometimes referred to as a non-conforming lender) for 1 to 2 years.

Some specialist lenders do not look at your credit history at all and assess your mortgage application based on its merits. The disadvantage is that you may get a higher interest rate to offset the high risk you present to the lender.

Later, (after you’ve fixed your credit issues by paying off your debts) you can switch to a major bank or lender. You’ll be able to do this as long as you can prove that you have a full time job with a steady income and you’re now making your mortgage repayments on time.

Refinancing To Switch Mortgage Packages

A basic home loan package is best suited to people who want to get a lower interest rate and pay off the loan as quickly as possible.

With no extra mortgage features, such as a 100% offset account, redraw facility or a credit card, this package is suited to investors who want to avoid annual and account keeping fees and maximise their returns. Some borrowers get a basic package purely for the simplicity.

After a while though, they usually save up enough to reap the rewards of having an offset on a professional package. This is especially true if you plan to purchase multiple properties over the next few years.

Let’s say that you want to use the equity you’ve accrued in your home rather than come up with a deposit yourself. You don’t mind paying the Lenders Mortgage Insurance (LMI) because the insurance can be covered by the lender and you get negative gearing benefits.

You also want the mortgage to be part variable and part fixed. The basic package you’ve had for the past few years won’t allow you to do this but a professional package will.

On top of that, the professional package comes with discounts on home and contents insurance and other bank products.

Refinancing To Get Potential Tax Benefits

Refinancing your home loan may offer potential tax benefits. For example, if you refinance to access equity in your home and use those funds to invest in property, shares or other wealth-building opportunities, you may be able to take advantage of negative gearing and depreciation benefits.

Let’s say you renovated your property for $50,000, you may be able to claim depreciation on these costs over the life of the loan. To explain, that’s claiming the $50,000 you spent as a principal cost and then claiming depreciation thereafter.

Please note that it is recommended that you speak to a tax professional to find out exactly how many deductions you will be allowed.

Check out our ultimate guide on refinancing your investment loan for more essential tips.

Refinancing To Access Additional Features Or Add-Ons

In some cases, you may want to refinance to add more feature to your loan. These are worth the cost of refinancing in case your loan period is very long.

These additional features can include:

- Flexible repayments:This allows you to make extra repayments at zero additional cost so you can pay the loan off quicker.

- Repayment holiday: This facility lets you take a break from making repayments if you change jobs or apply for extended leave from work such as taking maternity leave. Certain lenders may also let you make reduced payments instead.

- Offset account: An offset account allows you to have a savings account or a transaction account linked to your loan account. The benefit of this facility is that your interest is calculated after subtracting the amount in your offset account from your remaining loan balance which reduces your monthly interest fees.

- Redraw facility: A redraw facility will give you the option of withdrawing any additional repayments that you have already made. This is especially helpful in circumstances when you need money for emergencies situations.

- Flexible rate options: A mix of fixed and variable loans, this feature lets you divide your total rate into fixed and variable parts according to your needs. You may even be allowed to make interest-only repayments for a certain period of time depending on the lender.

- Loan portability: If you’re moving from one home to another then this feature will allow you to take your loan with you whenever you move without needing to arrange a new loan.

Refinance Your Home Loan Today

If you’ve been paying off your mortgage for about 4 or 5 years now, review your loan and wider financial situation. Your home loan may have been right for you a few years ago but your circumstances change over time. Our mortgage brokers have considerable knowledge on a wide range of home loan products from over 40 lenders. They also have the credit expertise to properly assess your situation and recommend a number of products that are more competitive than your current mortgage. For our customers, our post-settlement (customer care team) will stay in touch with you to ensure you’ve got everything set up. If you’re applying through the bank, then you want to talk with your bank’s customer care team to do the same.Call us today on 1300 889 743 or complete our free assessment form to discover what amazing home loan packages may be available to you.