Why Refinance Your Home Loan?

If you’re like many homeowners, your mortgage repayments are your largest expense.

Your current home loan might not be as competitive as it once was, especially if the rates are too high or it lacks features that reduce interest charges. Refinancing can get you a new, more competitive deal – and that can save you big money.

You can use what you save to build a retirement nest egg or an emergency fund, or even pay down debts.

When you decide to refinance, crunch the numbers on how much you save by refinancing, not where interest rates are right now.

Will Refinance Save Me Money?

The short answer is yes. Let’s find out how much money you can save by refinancing your home loan under different scenarios:

Lower Interest Rate

When you refinance to a lower interest rate, your repayments will be lower and you also pay less interest over the life of the loan.

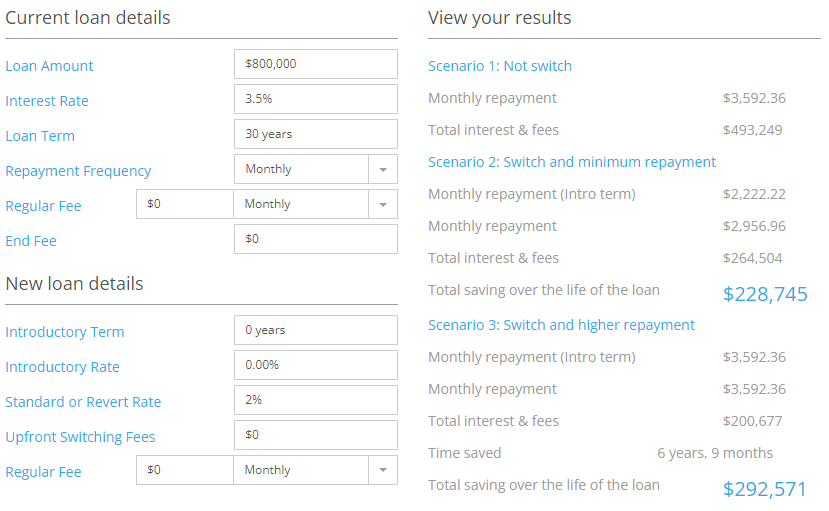

For example, for a current loan of $800,000 at a 3.5% interest rate, the monthly repayment is $3,592. However, if you refinance to a lower rate of 2%, the repayment drops to $2,957 and you save over $228,000 in interest over the life of the loan.

You can use our refinance calculator to find out how much you will save if you refinance.

Broker Tip: Remember to take note of any break fees, establishment fees, etc, when you refinance to a new lender. These costs must be calculated to determine if the refinancing deal is worth it.

Use An Offset

You can refinance to use an offset account.An offset account is a transaction or savings account linked to your home loan. The advantage of using an offset account is that it reduces the outstanding balance on your home loan for purposes of calculating the amount of interest in your repayments. With an offset account, you pay less interest over the life of your loan. A 100% offset account will subtract the entire balance of the account from the amount owing on your home loan when calculating your repayment.

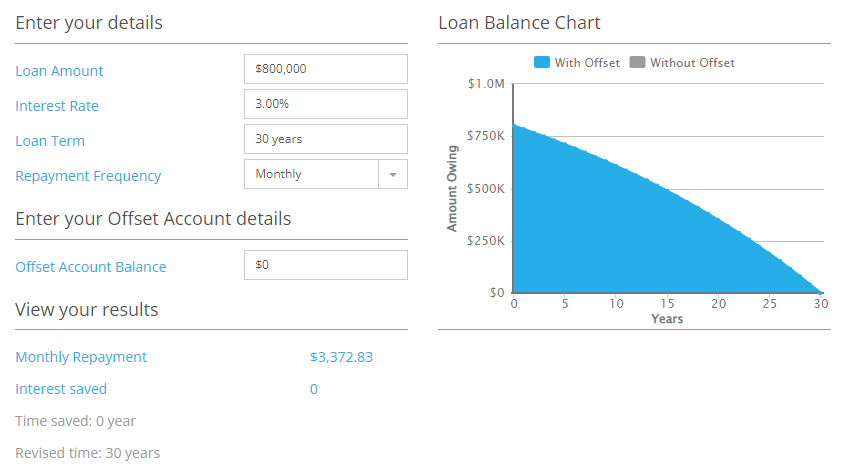

Without an offset account, your monthly repayment for an $800,000 loan at a 3% interest rate is $3,372.83.

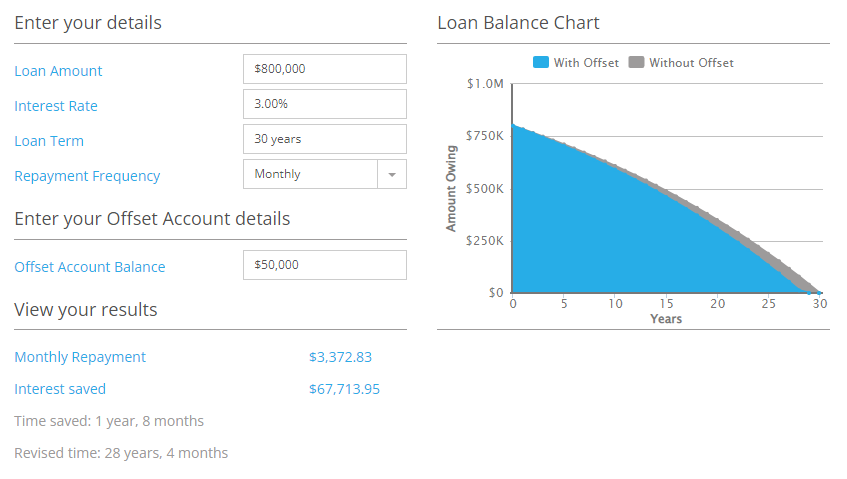

Now, if you were to put $20,000 in a 100% offset account:

You save over $67,000 in interest and pay off your home loan almost two years faster.

With an offset, even when your monthly repayment amount remains the same, putting more money in your offset equates to massive interest savings and you pay off your home loan faster.

You can use our offset calculator to determine how much interest you save by using an offset account.

Switch From Fixed To Variable Or Vice Versa

If you are currently on a fixed rate that will expire within the next six months to a year, start your search for a lender that offers a great variable rate. Once the fixed-rate term ends, you will revert to a variable interest rate.

Compare your current revert rate and see if it’s competitive. If not, be prepared to make a switch, especially since repayments fluctuate with a variable rate.

On the other hand, if you anticipate that interest rates will rise over the next months, then you might want to refinance to a lower fixed interest rate and have the assurance of fixed monthly repayments.

Do not change your home loan if you’re closer to ending the fixed period, as break fees are applicable.

Split Mortgage

A split mortgage is a feature that lets you divide your home loan into fixed and variable interest rates – you get the best of both worlds.

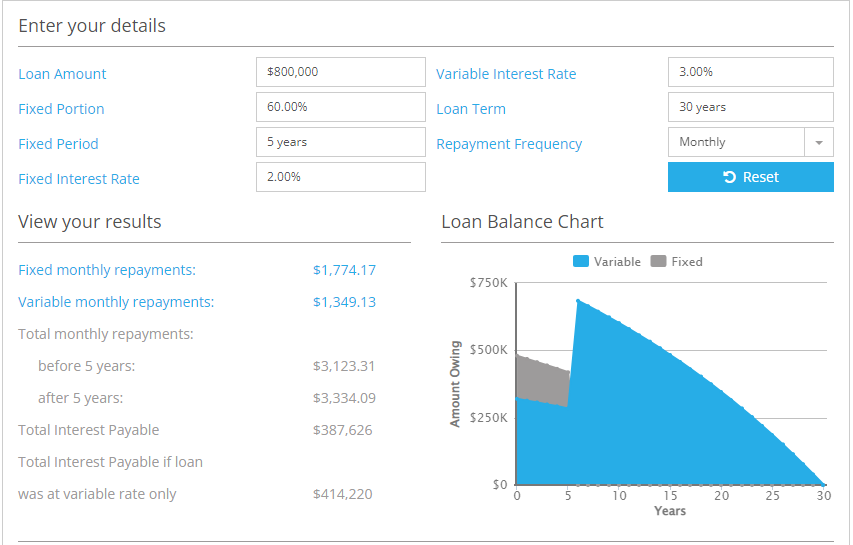

For example, if you have a home loan of $800,000 and choose to split it 60/40, 60% of it will be charged a fixed interest while the remaining 40% will have a variable rate.

If you have extra money, then you can use it to pay your variable loan.

Using the split mortgage calculator, we can determine that, in this example, a split mortgage could save more than $26,500 in interest, compared to if you had only a variable interest rate.

This option is not available with all lenders. Be sure to check with us to see which lenders provide split loan mortgages and how much you will save from it.

Make Additional Repayments

If you suddenly come across an increase in your earnings, then you can use it to make additional repayments on your home loan.

When interest rates are low, you can make extra repayments and save thousands of dollars in interest and pay off your home loan faster.

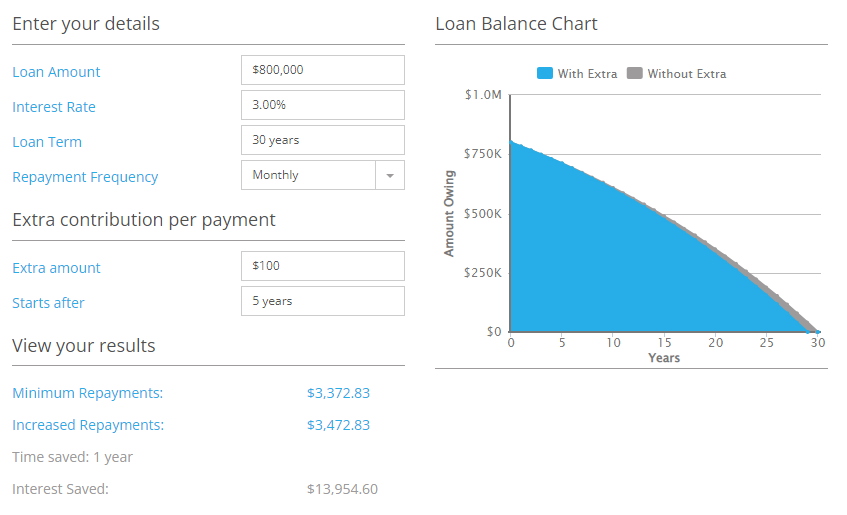

Using the extra repayment calculator, if you pay $100 each month, then you save almost $14,000 in interest and pay off your home loan a year earlier.

Most fixed home loans either do not allow additional repayments or they place a cap on how much you can repay each month. If the option is available, using it will save you money in the long run.

Debt Consolidation

If you have several debts to repay, then rolling them all over into your home loan is one use for refinancing.

When you consolidate your debts, you roll over all your loans into the home loan account and pay one interest rate for all the debt. You will lower your repayments, as mortgage rates are usually lower than personal loans or credit cards.

An example:

You have a home loan of $550,000.

| Details | Amount |

|---|---|

| Home Loan | $500,000 |

| Monthly repayments | $2,245 (3.5%) |

| Personal loan | $10,000 |

| Personal loan monthly repayment | $193 (6%) |

| Credit card | $5,000 |

| Credit card repayment | $150 |

| Total debt size | $515,000 |

| Total monthly repayments | $2,588 |

Now, you refinance to consolidate your debts to a lower home loan rate of 2.5%.

| Details | Amount |

|---|---|

| New loan amount | $515,000 |

| Monthly repayments | $2,035 |

This saves $553 each month while keeping debts under control Caution: Debt consolidation means that the repayment term stretches for over 30 years, which costs more over time.

- Try to make extra repayments so you can pay off debt faster

- Cancel credit cards that are relatively small

- Do not fall into more debt in the future

Is It Worth It To Refinance?

Yes, it is worth it to refinance if you can lower your interest rate to save money in the long term.

While refinancing can cost money at first, your long-term savings usually outweigh the cost of refinancing.

You have to make sure you achieve your financial goal of saving money through refinancing.

However, there are situations where it’s not worth it to refinance.

When is refinance not worth it?

- If you have to pay a huge break fee that does not cover the break-even cost of refinancing.

- If you plan to move or sell your property soon. Avoid refinancing if you don’t plan to stay in your home for longer than the break-even period.

- If you have an existing equity loan that requires you to get your lender’s permission to refinance.

- If you only have a few years left on your home loan. Even if you refinance to a shorter term, the interest rates could be too high.

- If the new interest rate is not competitive enough. You end up paying more interest over the life of the loan.

At Home Loan Experts, we take care of the legwork, so refinancing is straightforward and easy for you. We will refinance your home loan to a competitive rate so you save more throughout the life of the loan. Call us today on 1300 889 743 or enquire online today.