On 6 May 2015, the Reserve Bank of Australia (RBA) cut the official cash rate by 25 basis points to a new historical low of 2.00%. This came as a welcome surprise to borrowers as the cash rate was cut from 2.50% to 2.25% just four months earlier in February.

With property prices continuing to rise nationally, the latest rate cut is good news for not only first home buyers but for investors as well.

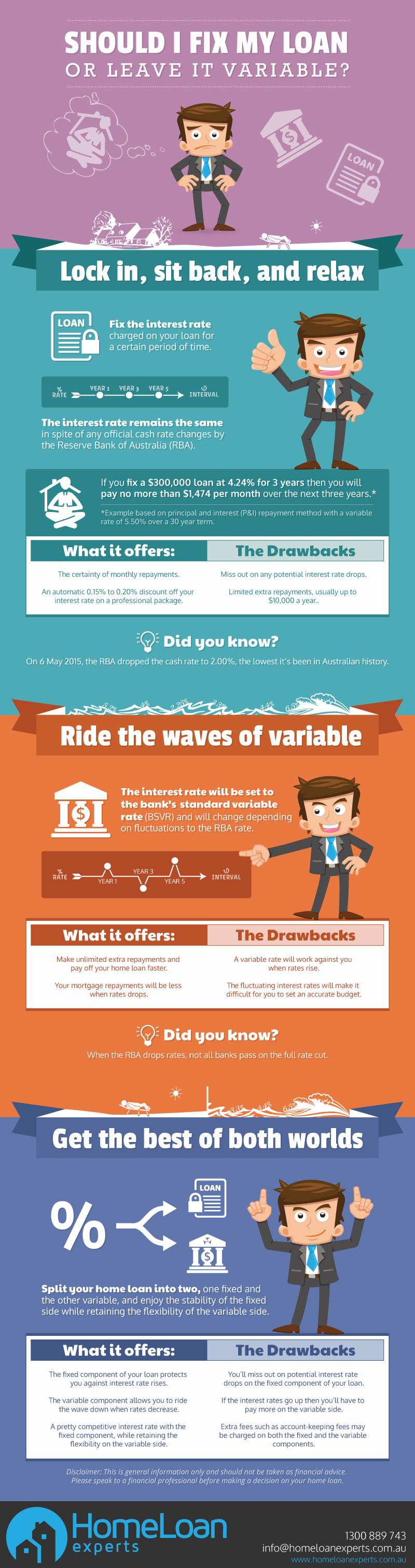

So if you’re thinking about getting a home loan, one of the biggest decisions you’ll need to make is whether you want to play it safe by locking in your interest rate or take a risk in the hopes rates will drop even further. There are pros and cons to each option no matter which way rates go.

Lock in, sit back and relax

With a fixed rate loan, you can fix your interest rate for a certain period, usually for 1, 3 or 5 year terms.

The interest rate on your loan will remain the same no matter which way the RBA go with the official cash rate.

When the fixed rate term ends your interest rate reverts back to a variable rate.

You’ll have the certainty of knowing just how much your repayments will be over the fixed period and you’ll even get an automatic 0.15% to 0.20% discount if you’re applying for a professional package.

Sounds awesome, right?

Here’s something to think about:

- You’ll miss out on any potential interest rate drops.

- The extra repayments your lender will allow you to make can be limited to $10,000 a year (this varies from lender to lender). The reason for this is that lenders would much rather you make the minimum repayments so you’ll have to pay the maximum amount of interest on your mortgage.

- You can’t get a 100% offset account to save on interest.

You should remember that fixing your loan means you’ll be committing to a particular lender for the fixed rate period so it’s important that you think over your choice carefully before making a decision.

Avoid fixing your loan if you plan on:

- Making extra repayments above the maximum extra repayment limit set by your bank.

- Refinancing your loan.

- Selling your property.

Ride the waves of a variable rate

With a variable rate loan, the interest rate charged on your outstanding balance will vary according to the RBA cash rate.

For instance, if you take out a $300,000 loan with a variable rate of 4.50% for a 30-year term, your repayments will be $1,520 per month.

If interest rates increase by 2.00% in the next five years, your monthly repayments will then increase by more than $300 a month to $1,847.

Despite this, variable rate home loans are very flexible mainly because they allow you to make unlimited extra repayments.

On top of that, you have the option of getting an offset account which allows you to “offset” or cancel out part of the interest you pay on your mortgage. You can also save on interest when rates drop.

In spite of the benefits of a variable rate home loan, you should keep in mind that:

- A variable rate will work against you when rates rise.

- Fluctuating interest rates will make it difficult for you to set an accurate budget which is pretty important when you’re paying off a mortgage.

Get the best of both worlds

Did you know that you can enjoy both the assurance of fixed repayments and the flexibility of making unlimited repayments side by side?

By applying for a split loan you can fix one part of your loan while leaving the other part variable. This doesn’t have to be a 50/50 split either.

You can decide what percentage you want to fix and what percentage you want to leave variable.

Splitting your home loan can be an effective way for you to manage the risk of interest rate fluctuations because the fixed component protects you against interest rate rises while the variable component allows you to take advantage of decreasing rates.

You’ll also be able to:

- Get a competitive interest rate with your fixed component.

- Make unlimited repayments and save on interest with an offset account on the variable side.

Splitting your mortgage sounds like the safest bet because you’re playing the field, however, there’s a couple of things you need to take into account:

- You’ll miss out on potential interest rate drops on the fixed component of your loan.

- If the interest rates go up then you’ll have to pay more on the variable side.

- Extra fees such as account-keeping costs may be charged on both the fixed and the variable splits.

Not sure what to do?

Our mortgage brokers take a comprehensive approach when assessing your situation and have strong relationships with more than 40 different lenders. They can advise you on which home loan type will work best for you.

Call us on 1300 889 743 or complete our free assessment form to see how we can help you.

Disclaimer: This is general information only and should not be taken as financial advice. Please speak to a financial professional before making a decision on your home loan.