Sydney property prices to soar?!

Could a house in Sydney be worth $48.5 million by 2064? Please think of the children!

Sydney has long been the biggest culprit of bloated property prices, but trying to predict what the market will do in the next 12 months, let alone the next 10, 20 or even 50 years is a little bit “he said, she said” when you think about it.

If our utter obsession with property were to continue, savvy investors could be retiring by the age of 40 on the back of a decent portfolio and first home buyers may cease to exist altogether.

For those trying to break into the market, don’t go off whimpering in the corner with a bottle of bourbon just yet. Keep in mind there are ways to get a home loan without having to go hungry trying to save enough for a deposit.

At least there’s always room for rent

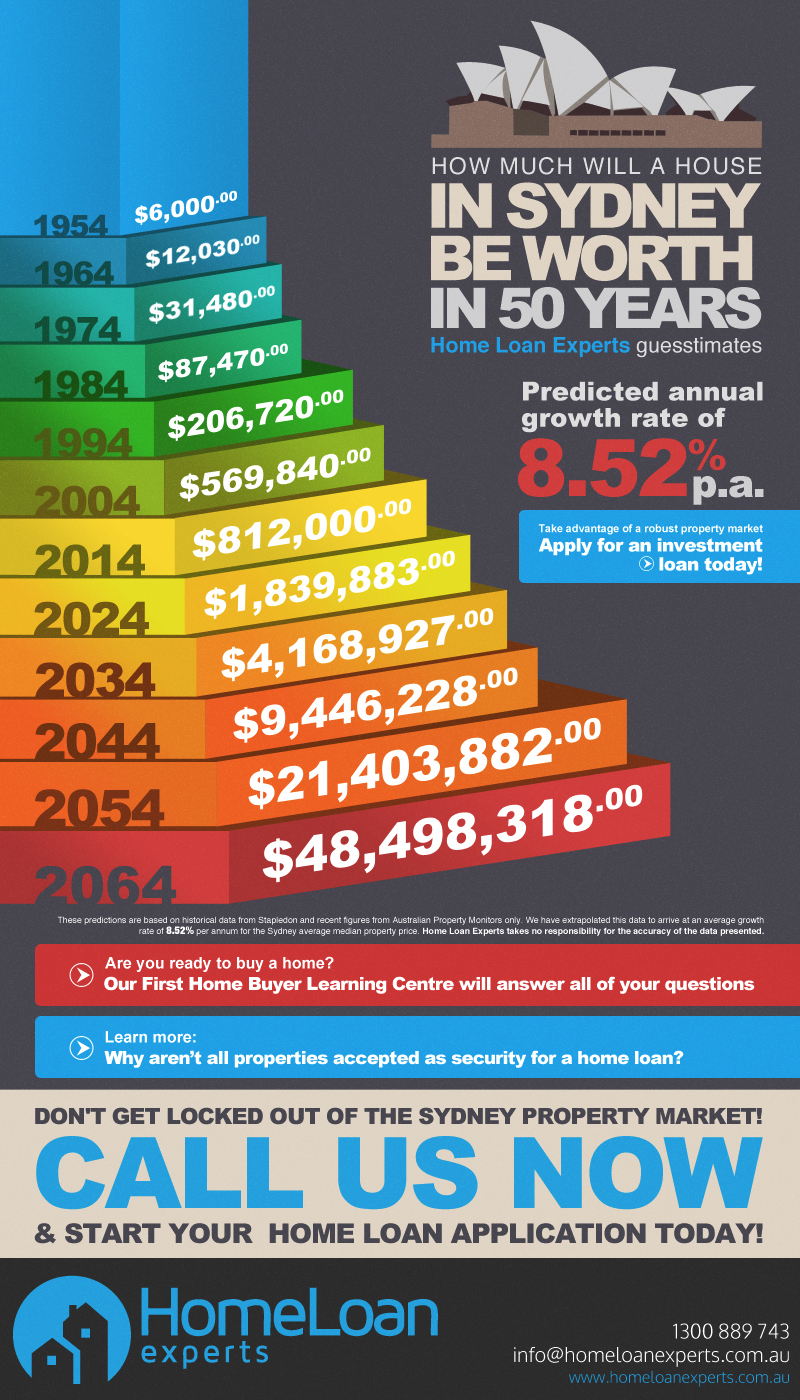

Using historical June quarter real estate data for the past 50 years from 1954 to 2004, a 2007 report by Dr Nigel David Stapledon of University of New South Wales’ School of Economics found that the median Sydney house price had grown at an average rate of 8.52 per cent per annum. This would have placed the median property price at $569,840 in 2004.

More recent figures from Australian Property Monitors (June quarter house price report) have placed today’s average Sydney house price at $812,000, an increase of more than $100,000 in the 12 months to June 2014.

With all things being equal, including the historically low interest rates and the current housing supply shortage, a continued average 8.52 per cent per annum increase could see the Sydney median house price reach $1.84 million by 2024, $9.45 million by 2044 and a staggering $48.5 million by 2064!*

“It’s hard to say what property prices will do in the future however it’s likely that one day Sydney will go the way of cities like New York where most people rent instead of owning their own home,” Home Loan Experts managing director Otto Dargan said.

“I think this generation will be the last to have a chance of owning a quarter acre block. For the next generation, the Aussie dream of owning your own home will simply be out of reach and most of them will be living in apartments.”

Even the rest of the developed world, as highlighted in a recent International Monetary Fund report, has suggested that the overall Australian property market is way above historical norms in relation to house price to income ratio.

Is there any light at the end of the tunnel?

From the state of the economy, the job market and overseas investment, there is no one root cause for Australia’s booming housing market. What is even less clear is when, if at all, prices will head south.

Although QBE has suggested slowing growth for some Australian regions, most notably Melbourne, Canberra and Perth, Sydney is still predicted to grow by 9 per cent over the next three years.

If you’ve been considering buying a home before increasing property prices lock you out of the market indefinitely, call us today on 1300 889 743 or fill in our free assessment form.

You may be able to borrow more than you think and we can find you a home loan at a competitive price that best suits your needs.

*Disclaimer

These property price predictions are an example only and are based solely on an extrapolation of historical data from the Stapledon research paper and recent figures from Australian Property Monitors. Through this extrapolation we’ve arrived at an average growth rate of 8.52% per annum for the Sydney median house price.

The content on this website has been prepared without taking into account the objectives, financial situation or needs of any particular individual. It does not constitute formal, financial or investment advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to their objectives, financial situation and needs and, if necessary, seek appropriate professional advice.