The Labor opposition party recently announced a Help To Buy scheme to make it easier for low- and middle-income home buyers to get onto the property ladder. The scheme will go into effect with the First Home Guarantee and the Regional First Home Buyer Support Scheme. Let’s find out what each of these schemes offers and which one is better for you.

Labor’s Help To Buy Scheme

The Help To Buy Scheme allows home buyers to purchase with a 2% deposit without paying Lenders Mortgage Insurance. Here are the basic details:

The Help To Buy Scheme allows home buyers to purchase with a 2% deposit without paying Lenders Mortgage Insurance. Here are the basic details:

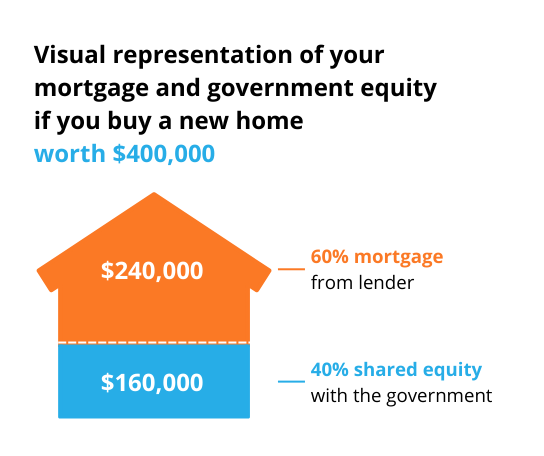

- The government pays a large portion of the price of the home and retains ownership of that portion – up to 40% for new homes or 30% for existing homes.

- Homeowners would not pay rent on the portion of their home the government owns.

- The homeowner eventually would buy the government’s portion, either during the term of the loan or when they sell the house.

Liberal’s First Home Guarantee

The First Home Guarantee (formerly known as the First Home Loan Deposit Scheme), helps first home buyers with a deposit as low as 5% buy a home without paying Lenders Mortgage Insurance (LMI). Under this scheme, the government does not own a stake in the home, rather, it acts as guarantor for up to 15% of the value of the property. The First Home Guarantee is one of the plans under the Coalition’s Home Guarantee Scheme. The other schemes are the family home guarantee for single parents with dependants and the Regional Home Guarantee buying in regional areas. Note that not all lenders will be participating in all schemes. Home Loan Experts brokers can connect you with a participating lender with whom you can qualify for a place. Call us on 1300 889 743 or complete our free assessment form today!| Details | Help To Buy | First Home Guarantee |

|---|---|---|

| Who proposed it? | Australian Labor Party (ALP), under Anthony Albanese | The Coalition Government, under Scott Morrison |

| When will it apply? | The government has not confirmed a date for when the scheme will commence. | First Home Guarantee is already in effect; however, from 1 July 2022, price caps have increased and more places have become available |

| What is it? | It is a shared equity scheme where the government contributes 40% for new builds and 30% for existing properties. | It is a guarantor scheme where the government acts as a mortgage insurer and guarantees up to 15% of the property value so that borrowers do not have to pay Lenders Mortgage Insurance (LMI). |

| What is the minimum deposit? | 2% | 5% |

| How many places are available?* | 10,000 places each year* | 35,000 places each year* |

| Is it only for first home buyers? | No. It’s available for anyone who does not own property | Yes. |

| Who can apply? | Australian citizens | Australian citizens |

| What is the income cap? | Single applicants with an annual taxable income of less than $90,000 or less than $120,000 for couples | Single applicants with an annual taxable income of less than $125,000 or less than $200,000 for couples |

| What are the benefits of the scheme? | You get into the market sooner with a smaller loan, which equates to smaller repayments and less interest.

You do not need to pay rent on the portion of the property owned by the government. |

You get into the market sooner and don’t need to pay LMI.

You own 100% of the home. The government does not have a stake in your property. |

| What are the disadvantages of the scheme? | The government owns a portion of your property, which you have to buy back while you own the home or when you sell it. | A larger loan, which means higher repayments and you pay more interest over the life of the loan. |

Help To Buy Vs First Home Guarantee: Which Is Better For Me?

Which of these two schemes would serve you best depends on your particular situation. Let’s take a closer look. Remember that Labor’s plan will go into effect only if it wins the election in May 2022.If you can afford only a small deposit

If saving a large deposit is difficult for you, then Help to Buy is the better plan. It requires only a 2% deposit, compared with 5% for the First Home Guarantee.If you have a relatively low income

For potential buyers at the lower end of the income scale, Help to Buy is designed to offer a better chance at owning a home. The income caps are lower than for the First Home Guarantee, you can borrow a smaller portion of the price of the property, and the amount you pay over the life of the loan will be lower. The tradeoff is that the government owns a portion of your home and a proportionate share of your equity. If your income level rises, or you otherwise become able to pay the government for its stake, then you can eventually own the entire home and keep all your equity.If competition for places is fierce

The First Home Guarantee has many more places for the coming financial year (35,000 to just 10,000) if you need to be in one of these two plans, you have more chances there than with Help to Buy. However, Labor has pledged to make the First Home Guarantee available as well.If your focus is on retaining your equity

Equity is a huge benefit of homeownership and it is important to try to maximise it, whether you are an owner-occupier or you’re buying an investment property. In the First Home Guarantee, the government never has a stake in your home, so you benefit from 100% of any equity gains. In the Help to Buy scheme, the government can own as much as a 40% stake in your equity (in exchange for paying an equal proportion of the price of the property). But if it allows you to get onto the property ladder, partial equity may be better than nothing.Home Loan Experts Tip

Striking a balance between a larger share of the equity and a lower total cost to the buyer may be a good choice for some home buyers. For example, say a home buyer pays the required 2% and gets the government to pay 18% – just enough to avoid Lenders Mortgage Insurance – rather than the maximum 30%-40%. This way, the home buyer still saves 18% of the cost of the property and retains an 82% share of the equity in the home, as opposed to just 60%-70%. This may be an especially good idea for buyers who anticipate earning a larger income later on.Which Scheme Offers Higher Price Caps

| Region | Price Caps For Help To Buy | Price Caps For First Home Guarantee |

|---|---|---|

| NSW – capital city & regional centres | $950,000 | $900,000 |

| NSW – rest of state | $600,000 | $750,000 |

| VIC – capital city & regional centre | $850,000 | $800,000 |

| VIC – rest of state | $550,000 | $650,000 |

| QLD – capital city & regional centre | $650,000 | $700,000 |

| QLD – rest of state | $500,000 | $550,000 |

| WA – capital city | $550,000 | $600,000 |

| WA – rest of state | $400,000 | $450,000 |

| SA – capital city | $550,000 | $600,000 |

| SA – rest of state | $400,000 | $450,000 |

| TAS – capital city | $550,000 | $600,000 |

| TAS – rest of state | $400,000 | $450,000 |

| ACT | $600,000 | $750,000 |

| NT | $550,000 | $600,000 |

Disclaimer: Over the next few days, you’ll receive additional guides to help you on your homebuying journey. Occasionally, you’ll receive carefully curated home-buying tips, offers & schemes, and news articles. You can unsubscribe any time you want. View our Privacy Policy