Key Points

What is a 98% home loan? A 98% home loan is essentially a 95% home loan with the cost of Lenders Mortgage Insurance (LMI) up to 3% added on to your home loan balance.

Since LMI can cost tens of thousands of dollars, adding that to your loan (LMI capitalisation) means you don’t have to come up with the extra funds upfront, allowing you to buy a home to live in sooner rather than later.

A 98% home loan is essentially a 95% home loan with the cost of Lenders Mortgage Insurance (LMI) up to 3% added on to your home loan balance.

Since LMI can cost tens of thousands of dollars, adding that to your loan (LMI capitalisation) means you don’t have to come up with the extra funds upfront, allowing you to buy a home to live in sooner rather than later.

Will I get approved? - You must have a minimum deposit of at least 5%.

- You must be buying a property to live in (owner-occupier). It cannot be an investment purchase.

- You must be earning a sufficient income to meet your loan repayments, living expenses and your existing debt without hardship which is known as serviceability ratio.

- You must have a clear credit report, that means no prior defaults, judgement, writ or bankruptcy. Low credit scores can be considered.

- Refinances are not accepted.

- The maximum loan amount varies between $900,000 – $1.15 million on a lender specific basis.

- You must have a minimum deposit of at least 5%.

- You must be buying a property to live in (owner-occupier). It cannot be an investment purchase.

- You must be earning a sufficient income to meet your loan repayments, living expenses and your existing debt without hardship which is known as serviceability ratio.

- You must have a clear credit report, that means no prior defaults, judgement, writ or bankruptcy. Low credit scores can be considered.

- Refinances are not accepted.

- The maximum loan amount varies between $900,000 – $1.15 million on a lender specific basis.

Lenders available: Select bank and non-bank lenders are available. Contact us now to find out more.

Select bank and non-bank lenders are available. Contact us now to find out more.

Discover if you qualify: Talk to one of our specialist mortgage brokers to find out if you qualify for a 98% home loan.

Talk to one of our specialist mortgage brokers to find out if you qualify for a 98% home loan.

Which lenders offer a 98% mortgage?

Only a select few lenders allow home buyers to borrow up to 98% of the property value. Most lenders limit their lending to 95% of the property value inclusive of LMI.

Their qualifying criteria are stricter since you’re borrowing at a high loan to value ratio (LVR).

It is important to note that there are other lending criteria to consider besides the one listed above, which are based on your individual circumstances such as your employment history, rental history, income etc.

So, to find out if you qualify, please speak with one of our award-winning specialist mortgage brokers by giving us a call on 1300 889 743 or by filling in our short assessment form.

Temporary COVID-19 changes: 98% home loans

A number of major banks that were offering 98% home loans, including Virgin Money and BOQ, have pulled out of this space due to the uncertainty around the property market and the economy.

Interestingly, their lending criteria for these types of loans was initially very strict which meant most people didn’t qualify.

As one of our senior mortgage brokers put it, “they (banks) look for reasons to decline rather than reasons to approve these types of loans.”

It has been the case for some time now that specialist lenders with flexible lending policies have been the go-to lenders for 98% home loans, irrespective of the current climate.

A few select banks and non-bank lenders are still offering this home loan.

How much deposit do I need?

You’ll need a minimum deposit of 5% of the property value plus funds to cover property purchasing costs such as stamp duty, legal fees, application fees etc.

Typically, the two biggest costs associated with buying a property are LMI fees and stamp duty.

Since only the LMI fee can be added on to your loan balance, you’ll have to come up with the stamp duty fees out of your own savings.

It is for this reason that 98% home loans are most suitable for first home buyers as they’re exempt from stamp duty (up to a certain price threshold based on the respective state’s policy).

However, that is not to say 98% home loans are not suitable for second home buyers or upgraders. Just that you’ll need to come up with the cost of stamp duty along with a 5% deposit.

To calculate how much the stamp duty will be in your case, please use our stamp duty calculator.

If you’re unclear about the deposit or the LMI applicable, please speak with one of our specialist mortgage brokers who’ll give you an approximation of the deposit required, and the LMI applicable over the phone.

And once we do a full assessment of your financial situation, a detailed ‘Funding Position’ will be provided to you, similar to the one described in our case study below.

Just to clarify, this home loan is available to both first home buyers and second home buyers as well.

See What Your Low Deposit Can Achieve!

Unlike traditional calculators, the 360° Home Loan Assessor offers a full breakdown of your borrowing capacity, deposit contribution, and costs involved. Find out how close you are to approval and explore flexible low-deposit loan options.

Get StartedHow much in LMI can I capitalise?

First, you need to work out how much the LMI fee will be in your case. You can use our LMI calculator to do just that.

Basically, the loan amount including the LMI cannot exceed 98% of the property value.

That means for a $500,000 property, your loan amount cannot exceed $490,000 with the LMI fee included.

It should be noted here that since you’re borrowing at such a high LVR, your LMI premium will be higher.

Are the interest rates higher for 98% home loans?

Yes, the interest rates on 98% home loans are slightly higher than standard home loan interest rates.

The higher interest rate reflects the increased risk lenders are taking on by lending you a very high percentage secured against the property value.

The idea is to switch to a lower rate mortgage once your loan to value ratio has fallen below 90% in a couple of years. This will allow you to buy a home now, and switch to a more competitive rate later.

However, if you can contribute additional funds, so as to reduce your loan amount to 95% inclusive of LMI, your interest rates will be much more competitive.

Do I need genuine savings?

Not necessarily.

Typically, for loans greater than 90% of the property value, lenders want to see that you have saved up the deposit yourself over time, which is known as the genuine savings requirement. It demonstrates to the lender that you are financially responsible and have a savings habit.

This genuine savings requirement is something that often gets home buyers knocked back for a mortgage, simply because they aren’t aware of it.

However, there are specialist lenders who can consider borrowers with no genuine savings of their own, but the interest rates will be higher.

Simply put, it’s better to have genuine savings as it will give you more lender options.

Alternatively, we can use rent as genuine savings to qualify with a major lender.

To find out which lenders don’t need genuine savings, speak with one of our specialist mortgage brokers by giving us a call on 1300 889 743 or fill in our online assessment form.

Are there any postcode restrictions?

Yes, since lenders are taking on higher risk with this type of loan, they want to ensure that the property (security) that they’re taking on is readily marketable and is located in a prime location.

Generally, only properties located in CAT 1 and CAT 2 properties are considered for 98% LVR loans. CAT 3 located properties are only accepted on a case by case basis.

You can use our postcode calculator to work out whether or not your location is acceptable.

Are there any property restrictions?

Yes, for 98 per cent home loans, lenders will only consider residential houses and apartment units or flats with less than 5 floors with no more than 50 units in the building.

From a lending perspective, you definitely want to avoid:

- Off the plan properties;

- High-density apartments;

- Studio apartments;

- Small sized apartment (less than 50 square meters); and

- Large acreage properties.

Are construction loans accepted?

There are only a couple of lenders that accept 98% construction loans. Only borrowers in a strong financial position may qualify.

Case study 1: 98% home loan for a first home buyer

When Jenna* found her ideal first home, she found us online and got in touch with us.

The NSW property she liked was valued at $600,000, and she had around $34,000 (around 5%) she could put towards the purchase.

She also had a personal loan of $17,400 with a monthly repayment of around $500.

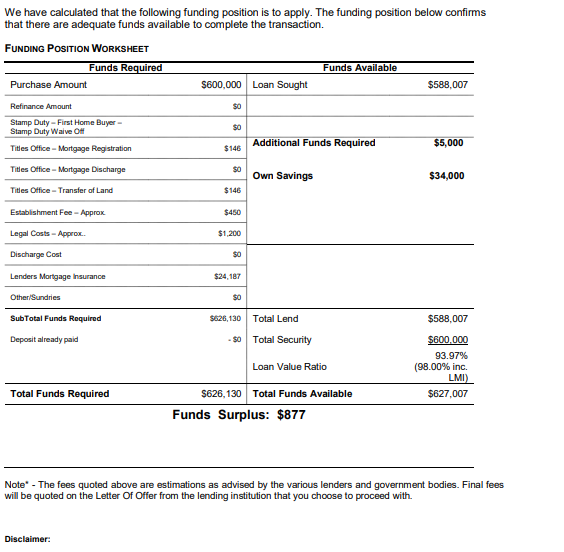

After one of our specialist mortgage brokers had an initial Q & A with Jenna, a funding position calculation was carried out.

Key points from the funding calculation:

- The total loan amount sought is $588,007 which is 98% of the property value inclusive of LMI.

- As a first home buyer in NSW looking to purchase a $600,000 property, the stamp duty is waived.

- The LMI fee applicable in this case is $24,187, which is more than 3%, the difference of $5,000 will need to be contributed from Jenna’s end.

- The total fund contribution required from Jenna’s own savings is $39,000 ($34,000 plus $5,000). This includes the fees to cover transfer fees, registration fee, lender setup fee and legal fees/solicitor fees.

After a thorough assessment of her financial situation, income, credit history, we submitted the deal.

The loan has been formally approved and Jenna is now awaiting settlement.

*Name has been changed to protect privacy.

Do I qualify for a 98% home loan?

There is only one way to be sure, that is to have one of our mortgage brokers do a full credit assessment and a funding position calculation for you.

We’re here to help you get the best deal based on your situatio!

Get started on your home buying journey by giving us a call on 1300 889 743 or by filling in our online assessment form.

[sg_popup id=65221]