Help to buy is a new shared equity scheme aiming to help 40,000 Aussie households buy a home (new or existing), with government assistance.

The scheme was announced by the labor government in 2022 and is set to launch in late 2025, the scheme works a bit like VIC’s homebuyer fund or WA’s Homeshare.

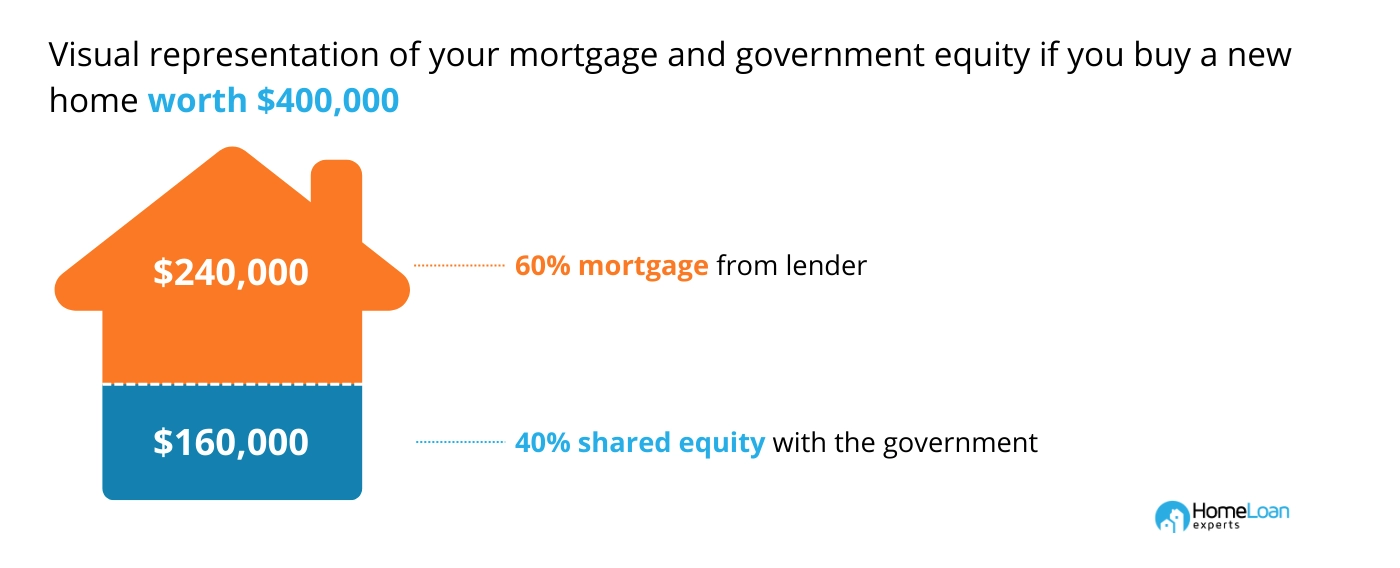

The federal government chips in up to 40% of the property price and in return, owns the same share in the home. But how exactly does this scheme work? And what are the requirements? Let’s find out today.

What Is The Help To Buy Scheme And How Does It Work?

Help to buy is a shared equity scheme to help eligible Aussies buy a home with just a 2% deposit. The government chips in up to 30% for an existing home or 40% for a new build, reducing the size of your mortgage as well as your monthly repayments.

The goal of this scheme is to help more people get into the property market sooner, with less upfront savings. So, you won’t need to pay rent on the government’s share but you’ll need to repay their portion over time or when you decide to sell the property.

As per housing Australia, there are 10,000 spots available each year for four years, starting from the scheme’s launch in late 2025.

Help To Buy Eligibility Calculator

Discover your eligibility for the Help To Buy Scheme with our user-friendly calculator. By answering a few simple questions, you can instantly find out if you meet the criteria and qualify for the scheme.

What Is The Eligibility Criteria For The Help To Buy Scheme?

| Metric | Eligibility Requirements |

|---|---|

| Income | |

| Property ownership and residency | |

| Age and citizenship | |

| Deposit and other expenses | |

| Type of housing | Participants can purchase a new or existing home that is one of the following types:

|

| Other requirements | Must pass the serviceability test of the lender and qualify for a home loan |

Let our Home Loan Experts navigate the requirements of the scheme for you. We’ll sort out whether you qualify. Call us on 1300 889 743 or fill in our assessment form, free, today.

| Region | Property Price Cap | Updated Price Cap | Savings On New Home At Maximum Price | Savings On Existing Home At Maximum Price |

|---|---|---|---|---|

| NSW – Sydney and regional centres (Newcastle, Lake Macquarie and Illawarra) | $950,000 | $1,300,000 | $520,000 | $290,000 |

| NSW – rest of state | $600,000 | $800,000 | $320,000 | $240,000 |

| VIC – Melbourne and regional centre (Geelong) | $850,000 | $950,000 | $380,000 | $285,000 |

| VIC – rest of state | $550,000 | $650,000 | $260,000 | $195,000 |

| QLD – Brisbane and regional centres (Gold Coast and Sunshine Coast) | $650,000 | $1,000,000 | $400,000 | $300,000 |

| QLD – rest of state | $500,000 | $700,000 | $280,000 | $210,000 |

| WA – Perth | $550,000 | $850,000 | $340,000 | $255,000 |

| WA – rest of state | $400,000 | $600,000 | $240,000 | $180,000 |

| SA – Adelaide | $550,000 | $900,000 | $360,000 | $270,000 |

| SA – rest of state | $400,000 | $500,000 | $200,000 | $150,000 |

| TAS – Hobart | $550,000 | $700,000 | $280,000 | $210,000 |

| TAS – rest of state | $400,000 | $550,000 | $220,000 | $165,000 |

| ACT | $600,000 | $1,000,000 | $400,000 | $300,000 |

| Northern Territory | $550,000 | $600,000 | $240,000 | $180,000 |

How To Apply For The Help To Buy Scheme

Want to know how the Help to Buy scheme could work for you? Talk to our team to learn how it compares with other government support available and to understand your options.

Even if you don’t qualify for the scheme, there are other programs for you to choose from, including the following:

- If this is your first home, there are other schemes and government grants for home buyers, including the First Home Guarantee.

- You can apply for a guarantor home loan, which helps you borrow up to 105% of the security’s value.

- There are also no-deposit and low-deposit home loans available.

Frequently Asked Questions

When will the help to buy scheme start?

Help to buy scheme’s expected launch date is late 2025. It was announced by the labor government in 2022.

How much can I save with the scheme?

How much does the Government contribute?

What is the minimum deposit I need to contribute?

What are the benefits of the scheme?

Can I increase my stake in the property?

Still need answers? We're here to help!

Ask an expertOur team of mortgage experts will assist you within 24 hours.