When Australia went through economic downturns during the 1991 recession or the 2007 Global Financial Crisis, property prices fell. However, the property market fared better than the share market.

Australia’s property market has been largely insulated from the broader decline in prices due to the repayment holiday schemes which has prevented the surge of distress sales and listings from entering the market.

There is a considerable increase in the number of people interested to buy a home, but no change in the number of people who want to sell.

So what will happen to Australia’s property market due to COVID-19?

Property prices will continue to rise in 2021

Even with half of Australia in lockdown, house prices haven’t slowed down significantly. Despite COVID restrictions in place in 2020, house prices increased by an average of 16.9% across all capital cities. Although the rate of price rises may slow down slightly for a few months, experts believe that the upward trend will continue into late 2021 and the beginning of 2022. NAB has predicted that there will be a 18.5% increase in property prices in 2021, and haven’t made any changes in their prediction despite the lockdowns in place. They are in agreement with other experts in saying that the property market will accelerate as soon as the lockdowns lift.Below are the forecasts made by experts at the beginning of the lockdowns in 2020:

Property market forecast: prices will fall

Gareth Aird, Senior Economist at CBA outlined five reasons why property prices will fall due to COVID-19:

- The unemployment rate might peak at 8%. The government shutdown has caused massive job losses. The sudden spike in unemployment will have an immediate, but short term impact on the property market.

- Unemployment puts downward pressure on rents, and falling rents generally mean falling prices. Policy changes and obligations regarding tenant and landlord evictions and rental arrears are causing even more uncertainty. The number of would-be investors will fall over the next six months.

- Consumer sentiment around property prices is negative. The Westpac-Melbourne Institute Index of Consumer Sentiment plunged 17.7% to 75.6 in April. This index has had a strong relationship with dwelling prices, so if households expect prices to fall, they will.

- Foreign investment in the property market will drop due to enforced shutdown.

- Net overseas migration has dropped to zero, and Australia’s growing population led to a demand in housing. Halt in migration will lead to high vacancy rates, drop in property prices and construction.

According to data from SQM research, there could be a 30% decline in dwelling prices by the end of 2020.

SQM Managing Director Louis Christopher commented that there will be a 30% correction in house prices if restrictions are in place for longer than six months.

Signs of market slowdown

CoreLogic’s early market indicators reveal signs of housing market slowdown:

- Its housing value index has revealed a decline in housing value growth since mid-March 2020 down to -0.06%. (This is important as this is the first downturn the index has seen in quite a while).

- According to the CMA (comparative market analysis) report that is generated by real estate agents to research recent comparable sales and market trends, there has been a drop in agent activity and listings. During the first week of April, there was a 19.9% decline in the CMA reports generated, and new listing volumes declined at 26.3%.

- The number of new residential listings advertised for sale during the 28 days to Easter Sunday 2020 was 24,051; which is the lowest listing ever for the past 4 years since 2016.

- The number of property valuations ordered in the week ending on 12 April 2020 has down 24%. The data includes valuation for the purpose of refinancing, purchase, construction and mortgage in possession events. There were 75.3% valuations ordered for refinancing, which suggests that borrowers are taking advantage of low-interest rates.

The decline of activity shows signs of a sharp slowdown in property activity. However, consideration needs to be taken to the moderation of supply against less demand for property. Which is why property values will not have sharp drops like those seen in transaction volumes.

Consumer sentiment around property prices will plunge

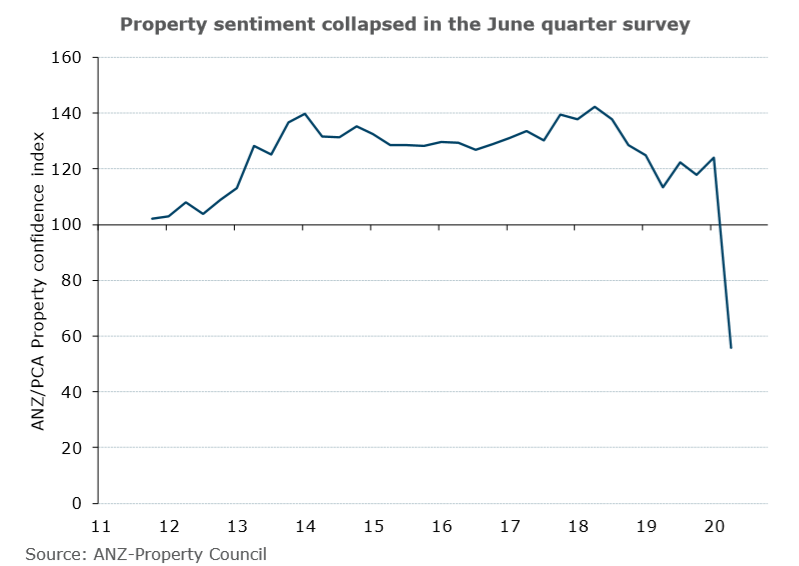

The ANZ Property Council Survey for June 2020 revealed a huge drop in consumer sentiment across the Australian property market due to COVID-19.

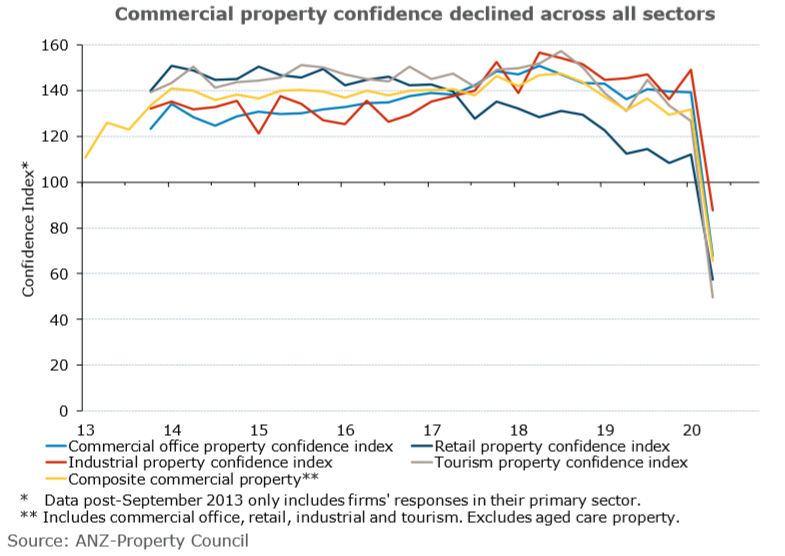

ANZ Senior Economist, Felicity Emmett comments, “Just as the lockdown measures have been broadly-based, the deterioration in sentiment has been equally widespread. Sentiment across the residential, office, industrial, retail and tourism sectors have all been sharply impacted. Not surprisingly, the tourism sector has been the hardest hit.”

The ANZ/PCA Property confidence index went below 100.

Even the commercial property confidence has dropped across all sectors, with the inability of tenants to pay rent and uncertainty regarding how fast the market will cover.

Low immigration might lead to rent falls

AMP Capital, chief economist, Dr Shane Oliver notes, “With the shutdown of the immigration into the country, that could lead to rent falls by as much as 10%.”

There will be a rise in vacancy rates over the next few months. If the lockdown stretches out longer, there will be fewer immigrants to Australia and a decrease in housing demand. Young people might move back to their family home.

Existing landlords insurance can cover loss of rent (contact your insurer to be sure) however many insurers are not offering new policies.

While growth in rent values was gaining momentum, the pandemic has dampened this.

There could be higher vacancies as job security worsens and short term rentals are converted to long term accommodations.

According to CoreLogic, gross rental yields compressed 2 basis points over March 2020 to 3.76%.

The fall in rent prices is further aggravated by less demand due to fall in migration and reduction in existing tenancy demand.

Is the Australian property market going to crash?

CoreLogic’s Tim Lawless said that, considering the temporary nature of this crisis, along with unprecedented levels of government stimulus, leniency from lenders for distressed borrowers and record-low interest rates, housing values are likely to be more insulated than sales activity.

“The extent of any fall in housing values is impossible to fathom without first understanding the length of time this health and economic crisis persists. Arguably, the longer it takes to contain the virus and bring economic operations back to normal, the higher the downside risk to housing values,” he said.

Furthermore, Australia’s banking system has increased its resilience after the 2008 financial crisis. There are various stimulus packages announced to support Australia’s economy so people can keep their jobs and their business afloat even during the pandemic.

RBA Governor, Philip Lowe remains optimistic about Australia’s economy. He said, “Our monetary response is keeping funding costs low across the economy and credit available. The fiscal response is providing significant support to both jobs and incomes.”

Eliza Owen, CoreLogic’s Head of Research Australia, said the shortage in available housing supply, thanks to fewer property listings and lower seller activity, could be one of the reasons behind the market’s “relative stability”.

Property market is still open

The property market is still open, and there are buyers and sellers.

Banks have updated their lending policies to take into consideration the unique situations borrowers are in. Some lenders are accepting JobKeeper payments as income, kerbside and desktop valuations are accepted with higher LVR, fixed interest rates are low and some are even offering refinance rebates.

Even with the ban on open homes and auctions, buyers and sellers are opting for online auctions and virtual property inspections.

Impact of COVID-19 on property investors

Property investors are well placed to withstand the COVID-19 crisis due to the following reasons:

- Property market is resilient to survive the pandemic and it will rebound.

- The various government schemes like JobKeeper payments, will prevent significant property price falls.

- The property market was experiencing strong conditions before the pandemic which will insulate the market now.

- Rental income will experience the worst hit. Rents will trend lower due to extra supply, which will drag down median rents until leases are finalized and domestic tourism is opened.

- Majority of property investors are in a good position to manage low rents. (low interest rates between 2% to 3% on property loans)

- Prices will fall over the short term but real estate investment is a long term strategy that has shown resilience.

- Low supply of volume of dwellings for sale in large parts of Australia and property demand is quite favourable due to low mortgage rates and support for first home buyers.

- There might be opportunities in off market purchases as buyers with strong business will look pass the pandemic and position themselves for longer term growth.

- There will be a flexibility in negotiations between landlord and tenant and the balance between supply and demand factors.

How the property market is affected by the coronavirus depends on location, property type and price points.

The May 2020 Herron Todd White report provides an in-depth analysis of how each state and suburb is performing during the coronavirus pandemic.

Property prices are resilient

According to a Department of Parliamentary Services report, the median house price in Sydney was $27,4000.

According to CoreLogic, in March 2020, it was $1,020,849. This is an increase of 3,625.7%.

Even Hobart saw similar growth in median house prices from $15,200 in 1973 to $513,325 in March 2020, which is an increase of 3,277.1%.

These house prices increased despite the fact that Australia was going through the 1973 oil crisis, two recessions in 1982 and 1997, 1987 stock market crash, 1997 Asian Financial crisis, 2000 dot-com bubble, 2003 SARS outbreak, 2008 Global Financial Crisis and the 2009 eurozone crisis.

Furthermore, even now, during the coronavirus pandemic, the decline in the momentum of property values is mild even though there is a decrease in agent activity and listing volumes.

Listing volumes and seller activity remain low, which leads to a lower supply of dwellings. According to recent CoreLogic data, in the 28 days ending 19 April, new listings were down by -28.7%. This could be a factor that is preserving the stability in property prices.

The mortgage repayment holiday offered by banks and non-banks also reduced the risk of people selling their property if they could not afford their mortgage.

Vendors are also expecting the property values to rise once the economy returns to full-scale production.

What are the signs of green shoots in the property market?

- Restrictions lifted: In the coming weeks, the government might lift restrictions imposed due to the pandemic. The bigger impact would be if international border restrictions are lifted, so there are immigration and population growth.

- Industries will recover: The industries that have taken the hit will start to recover. People will be employed and earn a steady income.

- Improving consumer sentiment: As consumer sentiment starts improving, the early movers will jump onto the property ladder – so there would be increases in auction clearance rates, a decrease in vacancy rates, etc.

- Property prices rise: Due to the limited stock levels, the supply in the property market will be underpinned by strong buyer demand. Therefore, the supply and demand imbalance will cushion the price falls and property prices might start rising.

The CoreLogic housing value index for 30 April 2020 show that values have not seen any material decline.

Auction clearance rates have improved over recent weeks after the easing of restrictions.

Even the consumer sentiment has recovered almost 70% of the decline over the past six weeks.

Read more about it in CoreLogic’s Housing Market Trend for May 2020.

As a point of note, Australia has already passed its three peaks in the number of coronaviruses (COVID-19) cases.

- 28th of March 2020 – Peak in new cases

- 5th of April 2020 – Peak in active cases

- 17th of April 2020 – Peak in deaths

That’s not to say that the peak in economic challenges have also passed, however it does appear that Australia will be far less affected than many other countries that are yet to reach their peaks and could be part of the reason why international investors are interested in Australia’s share market and property market.

Is now the right time to buy?

If you’re expecting property prices to fall, then you can still buy now by offering less, which protects you from future falls.

If you prefer to wait, then get pre approved and ready so you can buy at the right time.

Our mortgage brokers can help you navigate the entire home buying process for you during the COVID-19 pandemic.

Call us at 1300 889 743 or fill in our free assessment form.

Want an in-depth analysis?

If you’d like an overview of key economic indicators and a summary of predictions for the Australian property market then watch this video from one of the buyer’s agents that we work with.