The HomeBuilder grant application submission, which was extended until 14 April 2021, has now officially closed.

Existing applicants have until 30 April 2023 to submit all supporting documents (such as invoices for work done, and proof that construction has started) to their state or territory revenue office.

The tax-free grant, which was originally available until 31 December 2020, could be used to:

- Build a new home

- Renovate an existing home

The HomeBuilder grant also aimed at helping the Australian residential construction market continue business in the wake of the pandemic.

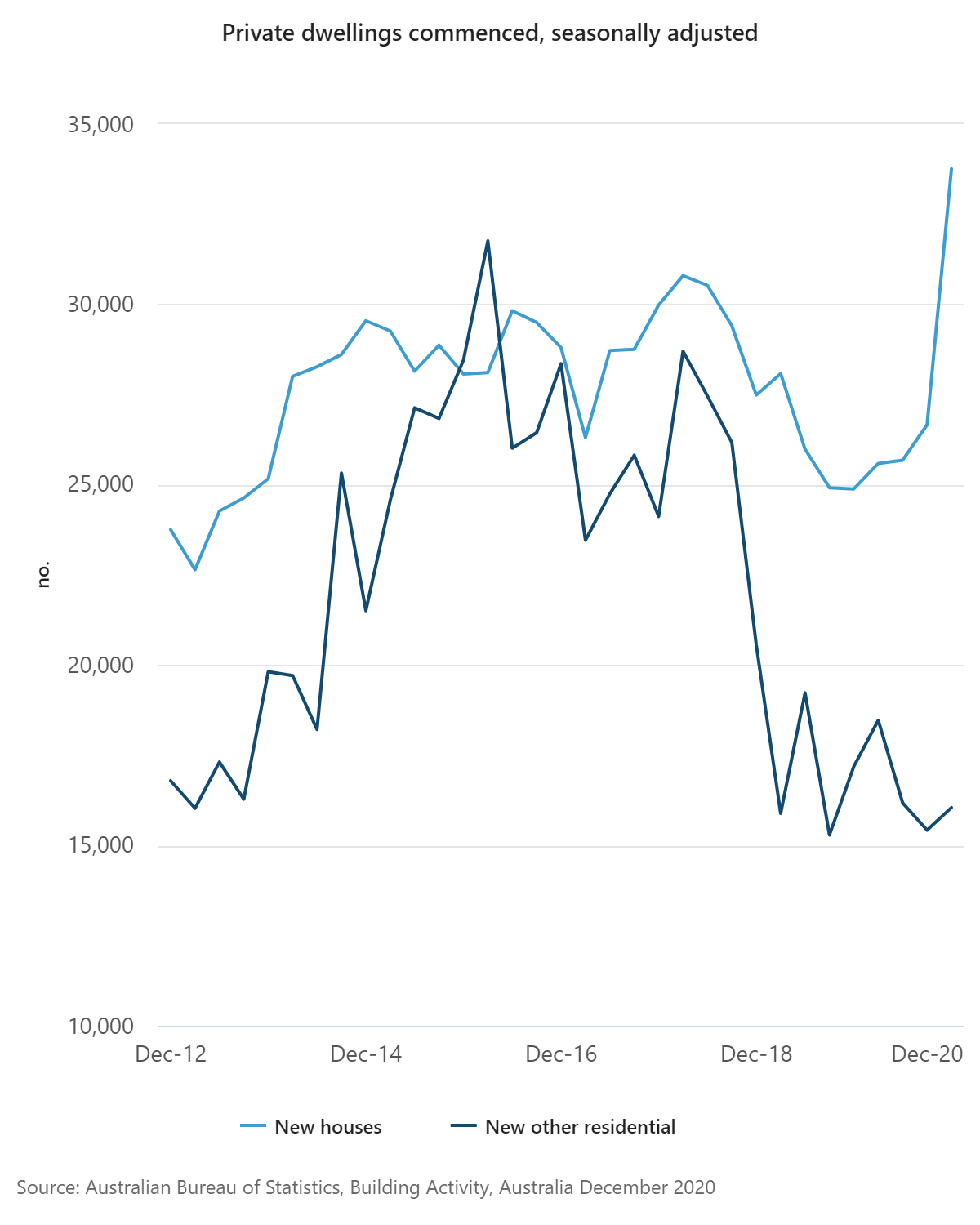

The latest data from the Australian Bureau of Statistics (ABS) shows that the number of construction commencements on detached houses hit a 20-year high of 33,761.

The Assistant Treasurer, Minister for Housing, and Minister for Homelessness, Social and Community Housing, Michael Sukkar MP suggests that HomeBuilder has driven the highest level of new home commencements in more than 20 years.

Property prices going up as interest rates are at record-low

Job figures are on an increasing trend in Australia, suggesting that the economy is moving in the right direction.

With consumer confidence improving and house prices going up, this could all be reflected in interest rates rising down the track.

If you’re looking to buy a property, now might be the best time to get pre-approval. Talk to one of our mortgage brokers by calling us on 1300 889 743 or enquire online to have a better chance at capitalising on the current market situation.

First home buyers are still buying property

Even with several government schemes for first home buyers going away, experts have said that the number of first home buyers is at the highest level.

This indicates that the property surge isn’t as bad as the one we experienced in 2015.

NAB boss Ross McEwan is supporting the introduction of schemes to help borrowers overcome rising property prices, including the possibility of First Home Buyer support.

However, it looks like the first home buyers are also aiming to change the regions by moving outside of the Central Business Districts (CBDs) to improve their lifestyles and work remotely.

This, combined with the possibility of schemes to increase property affordability, might see more first home buyers entering the market.

Apply for a mortgage before interest rates start rising!

Call us on 1300 889 743 or fill in our free assessment form and one of our mortgage brokers can help you with your situation.

We understand the current market conditions and can help you get the right loan to support your long-term financial goals.