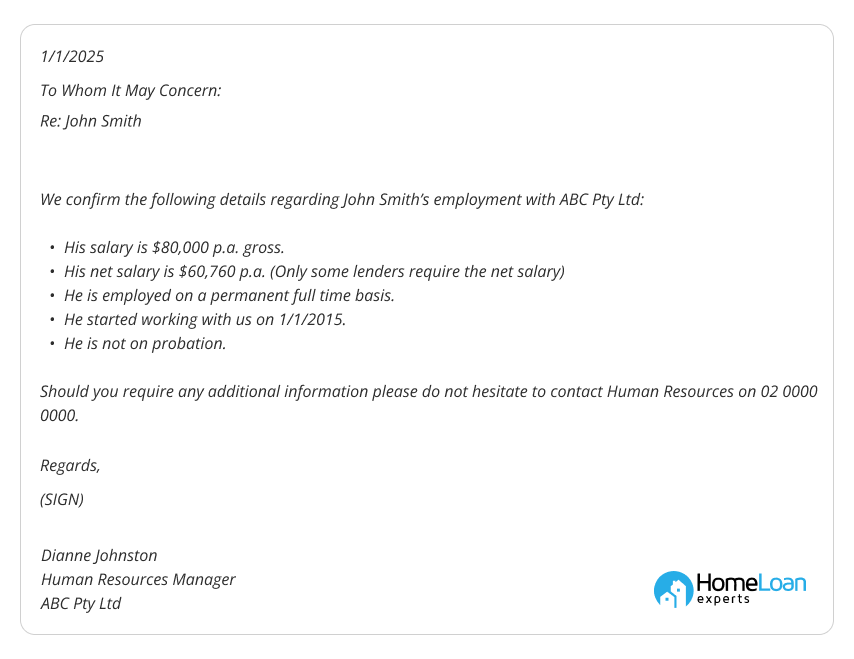

Employment Confirmation Letter Template

When you apply for a home loan, the bank will need you to provide proof of your income.

Usually your payslips, tax returns, group certificates or a Notice of Assessment (NoA) are enough.

However, a lender may sometimes require a letter of employment for a mortgage to prove your income or use it to verify the other documents you’ve provided.

You can ask your employer to use this sample letter as a template.

All they need to do is copy it onto their letterhead, amend the details, print, sign and fax it to your mortgage broker.

Please read the following section on bank requirements for confirmation of employment letters to ensure your letter is accepted!

If you’re using our services to arrange your loan then please ask your employer to fax the letter to us.

Essential Requirements For Your Employment Letter For A Bank

Australian lenders have similar requirements for employment letters and will often ask for a letter to be amended if it doesn’t meet their requirements.

Your employment letter should be:

- On a company letterhead that contains contact numbers and the company Australian Business Number (ABN).

- Dated

- Signed

- Contain the name of the person who signed the letter

- Contain the name of the employee, gross income, length of employment and status (permanent part time / casual etc) of employment

- Explanation of anything unusual about your employment, if required

Additional Templates

In some cases, banks may ask for clarification regarding your employment as a condition of your home loan approval.

Due to privacy legislation, many employers will not talk to the bank directly so you’ll have to ask your employer to write a letter for the bank.

There are a few clarifications that a bank may ask for which you can find below.

Deductions from pay

We confirm that John has a deduction of $500 per week as an additional voluntary super contribution.

This can cease at any time at John’s request.

Salary packaging

We confirm that John pays $600 per week directly into his current home loan using our salary packaging scheme.

This $600 deduction is paid pre-tax meaning that he receives $31,200 of his salary tax free and is taxed only on the remaining $48,800.

Company car

John has the use of a company car as part of his salary package.

Check out the company car page for more details.

Change of income

John has recently received a promotion and now earns $90,000 per annum gross as of 1/1/2015.

Employment stability

Although John is technically employed on a casual basis, he is considered to be a permanent member of our staff, works regular hours and is expected to continue to work here for the foreseeable future.

End of probation period

We confirm that John’s probation period ceased on 1/1/2016.

Overtime income

John is required to work overtime as a condition of his employment.

John has been working overtime on a regular basis and can reasonably be expected to continue to work overtime in the foreseeable future.

It is likely that additional work will be available should John decide that he would like to earn more than his current salary and overtime payments.

Many lenders do not accept 100% of overtime income but some do!

Self employed contractor

John works for us as a sole trader and invoices us for his hours worked.

John has no employees, provides no materials and has no major expenses so he has a stable income similar to a PAYG employee. John currently earns more $1,200 or more per week (plus GST).

We expect his contract to continue for the foreseeable future.

Getting approved as a self employed contractor is tough so please contact us to find a suitable lender.

PAYG contractor

John is on a fixed term employment contract that ends on 11/6/2015.

It is likely that his employment will be continuous and ongoing.

This is only available with some lenders.

Maternity leave

Jane is currently on paid maternity leave and will return to full time work on 29/05/2017.

While on maternity leave, she is being paid $750 per week gross and when she returns she will be paid $1,000 per week gross.

Jane can return to work earlier if she so chooses.

Year to date income

John’s Year to Date (YTD) income shown on his payslip is not an accurate reflection of his true income as he was on leave without pay during the entire month of December.

He returned to work on 1/1/2017.

Try our year to date calculator.

Pay fluctuations

John works as a mechanic in our remote mining facility on a four week rotating roster. He works 12 days in the first two weeks and only 3 days in the next two weeks.

Although his fortnightly pay fluctuates, his pay is regular and predictable.

On the first fortnight, John is paid $3,600 and on the second fortnight he is paid $600, bringing his total income to $54,600 per annum.

Simplify the mortgage maze with the 360° Home Loan Assessor

Get results on:

- Your maximum borrowing power

- The hidden costs of buying a home

- Interest-rate options based on your situation

How Recent Does The Certificate From Your Employer Need To Be?

Your letter of employment for a mortgage must be less than 6 weeks old at the time of your home loan application.

So if your letter is up to 2 months old, you can simply ask your employer to sign and date a new copy.

What If I’m Self-Employed?

If you’re a contractor, we have a template below that you can use.

However, if you’re purely a sole trader, in a partnership or operate via company and are unable to prove your income through traditional means, there are other options.

You may be able to provide older tax returns, Business Activity Statements (BAS) or an accountants letter by way of a low doc loan.

If you’re in this situation, please call us on 1300 889 743 or fill in our online enquiry form and we’ll let you know how we can help you qualify

Will The Bank Accept Employment Letters From A Foreign Company?

If you’re employed by an overseas company, some lenders may accept a confirmation of employment if it’s written in an acceptable format. They may also also ask for all or some of the following evidence:

- A copy of your employment contract

- Two consecutive payslips

- Three months of bank statements showing your salary being deposited into your account

- Tax returns for the last financial year

It all depends on the lender!

There are more requirements which you can read more about on the proving your foreign income page.

Better yet, complete our free assessment form and we’ll let you know how we can help.

Do You Need Help With Your Home Loan?

There are many other situations where the lender may require a confirmation of employment letter.

We always try to discuss your situation with the lender’s credit manager before wasting your employer’s time in asking them provide a letter.

If you’re having trouble drafting a suitable employment letter, please contact call us on 1300 889 743 or enquire online.

Our mortgage brokers specialise in unusual employment mortgages.

Still have questions? Feel free to comment below and we’ll get back to you as soon as possible.