What Is A Rental Reference Letter?

A rental reference letter is a written document providing potential landlords with information about a person’s rental history, character and reliability as a tenant. It is typically written by the property manager, but in the absence of one, your previous landlord, employer or friend can write it.

Information On Rental Reference Letter

The letter will generally have the following details:

- Basic information ontenant – name, address, contact details

- Length of tenancy

- Amount of rent might be mentioned

- If the rent was paid in full on time and late payments or other issues

- The condition of the property during the stay, like If the property was kept clean and the landlord responsibly informed about possible issues or concerns

- Character of the tenant and relationship with the landlord and neighbour is mentioned and whether there were any complaints about you

- Determine how much you can contribute as a deposit

- Get clarity on the total costs of buying a home

- Explore interest-rate options based on your situation

Rental Reference Letter Template

Importance Of Rental Reference Letter

Landlords, property managers and rental-estate agents conduct screenings to ensure potential tenants are trustworthy. It is a way to assess a tenant’s ability to manage rental payments and how they have treated their previous rental homes. A good rental reference letter increases your chances of securing a rental property by portraying you as a trustworthy tenant, giving you an edge over other applicants in a competitive rental market. You can use a rental reference letter to find a new rental property and apply for a home loan.

Don’t let uncertainties hold you back. The 360° Home Loan Assessor is your key to unlocking the best home loan deals and ensuring you have all the information you need for a successful homebuying journey.

What To Do If You Are A First-Time Tenant

As a first-time renter, you won’t have a rental history, so choose credible references like your boss, supervisor or colleague and tell them once you have applied. You need your payslip to show that you have a steady income and the ability to look after the rental property. Along with having good character, you should have a weekly salary that is at least 30% of your rent.

Rental Reference Letter For A Home Loan Application

A No Genuine Savings Solution

A tenant rental history form confirms how much you pay in rent and demonstrates your ability to save money.

If you’ve been paying your rent on time and in full, you may be in a position to borrow anywhere from 90-95% of the purchase price.

However, not all rental history letters will be accepted. Most lenders will only accept a rental reference letter from your property manager and not from a landlord.

What Is It Generally Used For?

Use a rent statement letter or landlord reference letter if you can’t prove you’ve saved a deposit.

When borrowing more than 90% of the purchase price, a lender will need to be satisfied with your ability to make repayments.

Generally, you can demonstrate this by showing proof of regular savings over a period of 3 to 6 months.

This is commonly in the form of contributions to a savings account.

These savings will need to add up to 5% of the purchase price plus the costs of completing the purchase.

Otherwise known as ‘genuine savings’, it’s a policy of almost all Australian lenders, and they tend to be quite strict on this requirement.

That means if you’ve been gifted a deposit from your parents or recently inherited a large sum of money, banks will still need to see evidence that you’ve saved 5% of the purchase price yourself.

Luckily, there are lenders out there who will consider verification of rental history from your real estate agent or property manager in place of genuine savings.

This will allow you to borrow up to 95% of the purchase price.

On top of that, you can still get the same competitive interest rates as a standard home loan.

Some lenders will even accept three months rental history backed up by a rental reference letter if you can’t show genuine savings.

Make Informed Decisions With The 360° Home Loan Assessor

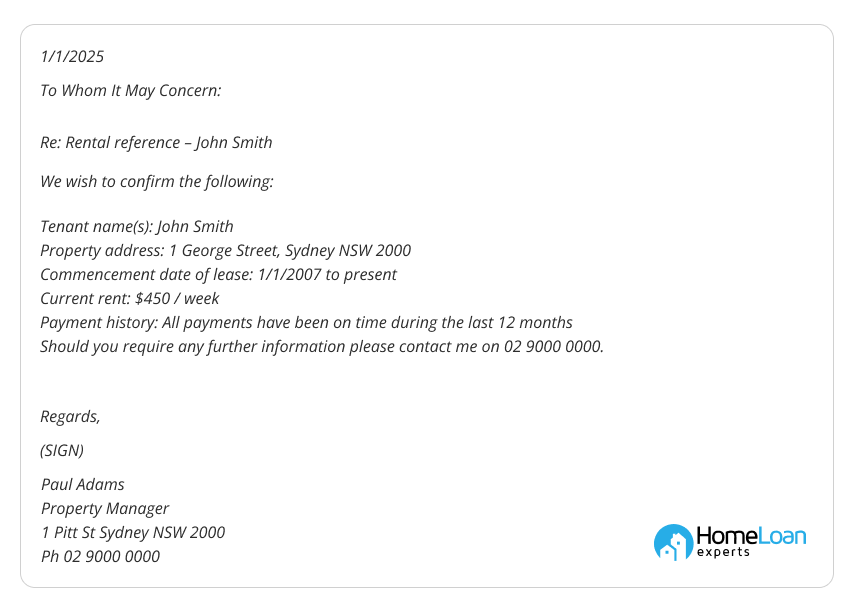

Rental History Template

Most lenders will accept the following rental declaration letter template from your real estate agent:

Bad Credit

A rental reference letter can be used to build a stronger application if you have a poor credit score and can’t prove that your deposit has come from regular savings.

Some lenders will accept your situation, but they will want to see proof that you have the ability to make your mortgage repayments.

Providing a 12-month tenant rental history form is a good indication of your capacity and can help mitigate your bad credit history.

If it’s a private rental (not through a real estate agent), the lender may also ask for six months bank statements showing rent paid.

For example, you could have a 20% deposit, but if you’re discharged bankrupt, and you can’t prove genuine savings, you may get declined unless you can provide a history of rental.

Apply For A Rental Letter Home Loan Today

Please complete our free assessment form or call us on 1300 889 743 and we can tell you how you can use your rental payments as proof of your ability to pay off a home loan.

Still have questions? Feel free to comment below and we’ll get back to you as soon as possible.

[sg_popup id=81314]

FAQs

What If I Don't Have A Rental Reference Letter?

If you don't have genuine savings and can’t provide a rental reference letter, we may still be able to get your loan approved if you have:

- A 10% deposit: With such a large deposit, some lenders will waive the genuine savings requirement, and you can still get a great deal on your home loan.

- An otherwise strong case: If you’re in a strong situation apart from meeting the genuine savings requirement, we can still help you borrow at 95%. Conditions apply, and your interest rate may be a bit higher depending on what lender we go with.

- A guarantor: If your parents are in a position to use their property as security for your home loan, you can borrow up to 105% of the purchase price without genuine savings.

How Do I Get A Rental Reference Letter?

What If I Don't Have A Property Manager?

Why Do Banks Ask For This Document?

How Do I Make Sure The Letter Isn't Rejected By The Lenders?

What If I Have Changed Addresses In The Last 12 Months?

Why Don't Banks Accept Letters From Landlords?

What About A Character Reference?

Still need answers? We're here to help!

Ask an expertOur team of mortgage experts will assist you within 24 hours.