Can I get approved while on maternity leave?

Yes, you can get approved for a home loan while on maternity leave, however not with every lender and only a few lenders accept parents on unpaid leave.

We’ve written a page about maternity leave home loans with more information about what lenders are looking for.

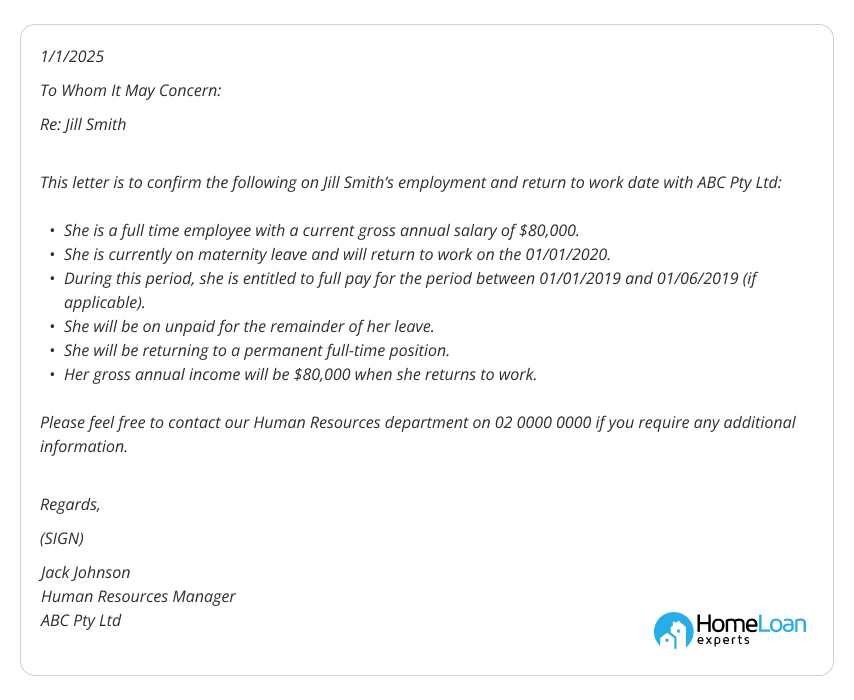

Maternity Leave Letter Template

Your employer will need to copy it on their letterhead, edit the details to match your situation, print, sign and fax it to your Home Loan Experts mortgage broker.

If you’re using our services to arrange your loan then please ask your employer to fax the letter to us at +61 2 9475 4466.

A statutory declaration is not needed.

Bank requirements for maternity leave letters

Your maternity leave letter should be:

- Dated.

- Signed.

- On the employer’s letterhead.

- Contain the name of the person who signed the letter.

- Contain the leave period particularly return to work date.

- The employment type and pay upon return.

- Pay during leave if applicable

Why do banks need a maternity leave letter?

Banks want to ensure that you can afford to make your home loan repayments without significant hardship under their responsible lending guidelines.

They will use this letter, bank statements or evidence of funds/savings and that you’ll be returning to your work to confirm that you can afford the loan.

Maternity Home Loan FAQs

Q. For parental leave, if the applicant has advance loan repayments covering the period of leave or has redraw available, does this satisfy the ‘savings’ requirement?

A. Yes. To work out how much surplus funds is required to satisfy the savings requirement, you can use our ‘Materinity Leave Living Expenses Calculator’ to do just that.

Q: Are other forms of income (Centrelink/maternity payment/parental payment) acceptable to offset the shortfall on parental leave servicing position?

A: Yes.

Q. If an applicant is due to go on maternity leave, however, are not yet on leave currently, is a letter from employer stating the leave start date and that it is no longer than 12 months sufficient?

A. Yes, however, lenders will need to verify an actual return to work date (and income level on their return) to determine the level of savings required, at the time of submission. Lenders will not be able to proceed without this information.

We have a lender on our panel who can consider your application if you’re returning to work within 2 years of parental leave.

What’s the key to getting approved while on maternity leave?

The key to getting approved while on maternity leave is to apply with the right lender.

Speak with one of our specialist mortgage brokers by giving us a call on 1300 889 743 or by filling in our online enquiry form to find out if you qualify with one of our 50 lenders.