Can Contract Workers Get A Home Loan?

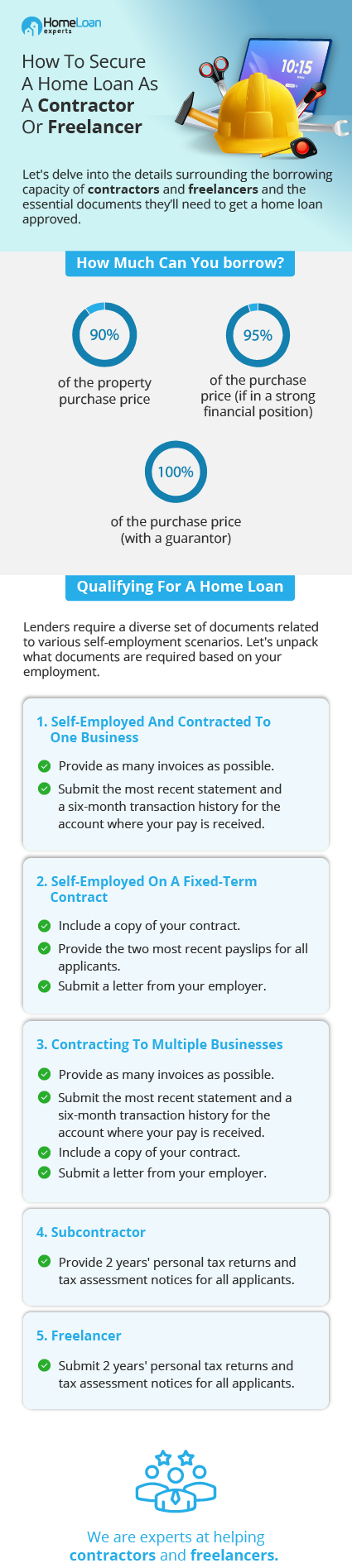

Yes, it is possible for contract workers to get a home loan. The requirements will differ depending on the type of contract worker you are. For example, if you are self-employed with a fixed-term contract, you will need:

- A copy of your contract

- The two most recent payslips

- A letter from your employer

If you are a subcontractor, you will need:

- Two years of personal tax returns

- Tax assessment notices

Contract workers aren't all treated the same!

Each type of contract worker is treated differently by the banks:

Are you a subcontractor?

Subcontractors can be employed on a PAYG basis or as a self-employed contractor. Subcontractors are common in the mining and construction industries, with many working a commissioned job.

Are you a PAYG contractor?

PAYG contractors are employed on a fixed-term, short-term or long-term contract, usually with an end date or in some cases with an automatic roll-over to a new contract.

They can receive normal holiday and sick leave benefits (depending on their contract terms) while also having their tax withheld and super paid for.

PAYG contractors and those working a commissioned job generally have to prove a strong track record of experience in the same industry as well as future employment stability. Many lenders require over 12 months in your current role as well as evidence that your contract will be continuous and ongoing.

However, one of our banks can consider lending to people employed on a PAYG contract with normal home loan rates even if they have one day on the job!

Get Approved for a Home Loan as a Contractor

Finding the right lender is the key to getting approved for a home loan while working as a contractor. That’s where we come in.

Speak with an expertAre you a self employed contractor?

Self employed contractors are usually sole traders with a registered ABN who invoice their employer and then pay for any expenses such as their own wages from their business’ income.

In other cases they set up a company or trust which enters into the contract, which then employs them on a PAYG basis.

Management consultants in most cases come under the category of self-employed contractors.

Most self-employed borrowers need to be in their current role for two years before they can get a mortgage. However, one of our lenders looks favourably upon contractors and those working on commissioned jobs if they just contract to one main employer and if they work for an hourly or daily rate.

In these situations, you’ll need to prove your current income with your invoices as well as your prior income in past roles.

If you’re in a white collar profession and have no expenses of your own then we can help you even if you’ve been in your job for just one day!

If your pay fluctuates significantly then you may need to prove more than a 12 month employment history to enable the lender to accurately determine your income.

Generally the lender will calculate your average income less any GST component and taking into account 2 – 4 weeks in unpaid holidays each year.

We can help self employed contractors in most situations, even if they have set up their own company which invoices the company they contract to.

In particular, if you have no staff other than yourself and no major expenses, one of our lenders can approve a loan for you!

We deal with self-employed contractors on a regular basis so we know how to get your home loan approved!

Speak to a member of our team today on 1300 889 743 or complete our free assessment form and find out how we can help you obtain a mortgage!

to discover how we can assist you in securing a home loan

Are you a mining contractor?

Mining contractors are a special case because they earn some of the best salaries in Australia. However, they may have fixed term employment contracts or may move between mines depending on the availability of work.

One of our lenders can approve mine worker home loans by taking a common sense approach and acknowledging that most workers can easily find alternative employment in the event that their contract is not renewed.

Are you an IT contractor or IT consultant?

IT consultants are the most common type of contractor that we work with. Specialist IT advisers are some of the highest paid workers in Australia yet many lenders don’t understand their industry and decline their loan applications!

Due to the low number of skilled IT consultants in Australia and the high demand from employers we believe IT industry contract workers are actually a very low risk and so we are happy to assist you.

Are you a construction contractor?

A construction contractor may work on a construction project until its completion or the contract may be rolling so that they continue to take on projects for the company. If the contractor provides his own materials he may be considered by the banks as being self-employed.

This means that he will be assessed in the same way as a self-employed contractor and may be required to provide the bank with two years’ recent tax returns. However, if they just provide the labour, they may be assessed like any other contractor.

Are you a freelancer or journalist?

Freelancers are typically paid on a per article basis or are employed for several projects.

As a freelance worker your income can be assessed using several different methods depending on the frequency, reliability and ongoing nature of your income.

Are 100% LVR home loans available for contractors?

Yes, 100% LVR home loans with no LMI are available. However, the lending criteria are very strict.

This home loan is only suitable for high income experienced (3 years+) industry professionals.

Contractor home loan policies

What do the lenders think?

Contractors are typically treated like casual employees by the banks. They are considered to be in a very unstable employment arrangement with a high chance of having their contract cancelled, even if they are employed through a major contractor management firm such as Contract1 or Ambit.

What documents will I need to provide?

In most cases, you’ll be asked to evidence your income and future employment stability through a letter of employment.

If you require an employment letter template please contact the Home Loan Experts team on 1300 889 743 and our mortgage brokers will be able to provide you with one.

The secret to getting a home loan while working as a contractor is to apply with the right bank!

Please fill in our free online assessment form to speak to a mortgage broker who can help you to get approved!

Which lenders can help?

Contract worker home loans are usually sourced through major banks that specialise in ABN contractors & PAYG contractors.

Non-conforming non-bank lenders may also be able to help, however in most cases we prefer to work with major lenders as then you can get a very competitive interest rate.

Which loan types are available?

All loan types such as professional packages, basic loans, lines of credit and fixed rates are available.

How much can I borrow?

You can borrow up to 90% of the property value plus LMI (Lenders Mortgage Insurance) using a bank loan depending on what type of employment contract you have with your employer.

If you’re in a strong financial position we can help you to get approved for a 95% or 100% mortgage (100% only available as a guarantor loan).

What can I use the loan for?

The home loan can be used for home / domestic use, investing, purchases, mortgage refinances and construction purposes.

Who is this loan for?

This type of home loan is for PAYG contract workers / contractors, subcontractors and self-employed contractors that have only themselves working in their own business and who contract to one main employer / client.

Low doc loans are also available.

Am I eligible for any discounts

Professional packages and basic loan discounts are available and you should be eligible for a significant discount below the bank standard variable rate.

Our expert brokers know the policies of all the major lenders in Australia and know which ones are more willing to extend you a discount. Call us on 1300 889 743 or complete our free online assessment form to talk to one of our mortgage brokers who can get you competitive rates for your home loan application.

What are the loan features?

All home loan features – interest only, fixed rate, line of credit, 100% offset, redraw, extra repayments – are available!

Apply for a mortgage today!

Contract employees usually have a high chance of getting their loan approved, if the loan is submitted to the right bank.

We are experts in this field and would love to help you buy a home even if you’re on income proection payments, or get a better interest rate by refinancing. We can even help mining contractors, IT contractors & freelance journalists who have great difficulty obtaining a loan from most banks.

Please call us on 1300 889 743 or complete our free assessment form for a quote for a contractor mortgage.