Table of Contents

- What are the pros of buying a new property?

- What Are The Cons Of Buying A New Property?

- Case Study: Buying A New Unit

- What Are The Pros Of Buying An Old Property?

- What Are The Cons Of Buying An Old Property?

- Case Study: Buying An Old Unit

- What’s The Current Sentiment For Off-the-plan Properties?

- New Build Vs Old Home: We Can Help With Both!

The main difference between new and old properties is that new properties offer modern features, lower maintenance, and greater depreciation deductions, making them ideal for maximising tax benefits. In contrast, older properties provide established locations and value-add renovation opportunities but come with higher upkeep expenses.

What are the pros of buying a new property?

Buying a new property will give you certain advantages over established properties such as:

- Tax write-offs: New or off-the-plan properties are really good with depreciation, especially in the first five years. Investors can claim furnishing costs as a tax deduction over 5- 10 years. Investors can also claim the cost of building the investment property as depreciation over 40 years as that’s the length of time ATO says a building will last before it needs replacing. For example, on a new building that costs $250,000 to build, you could make a $6,250 tax claim (i.e. 2.5% per year).

- Attractive to tenants: Generally, newer houses/units have modern amenities, appliances and technologies pre-installed such as energy efficient heating, smart appliances, smart locks and security system etc. as such tenants are prepared to pay a premium. Being able to attract high-quality tenants means you reduce the risk/frequency of vacancy on your investment property.

- Security and protection: Home Building Compensation (HBC), formerly known as Home Warranty Insurance (HWI) is a legal requirement in all states except for TAS. It is also known as builders’ warranty insurance (in NSW, the home building compensation fund) affords certain protection against structural/major defects.

- Low maintenance overheads: Since almost everything is under builder or appliance warranty, there’s minimal maintenance required on new properties. Things break or need to replaced more often as they get older, and these costs are considerably higher on older properties.

- Government incentives: Government incentives such as the First Home Owners Grant are available for first home buyers which can reduce the upfront funds that you need to come up with. Plus you only pay stamp duty on the land value when buying a house and land package.

What Are The Cons Of Buying A New Property?

So, between an ‘old house vs new house’ is new always better? Not always.

There are some intrinsic drawbacks when buying a new property:

- Less affordable: With a new property, the developer’s margin and marketing costs are also factored into the price as such, they are sold at a premium. Moreover, since both foreign investors and first home buyers are attracted to this property type, this pushes the prices upwards even further.

- Limited opportunity: You can’t add value through renovations/improvements as easily so it may take longer to achieve capital growth. You can see the same thing happening in the case study below.

- Greater market risk: Historically, newer properties are the first to get hit when the market moves down. Established properties tend to maintain their value or adjust a few degrees over the long term.

- Limited land component: Due to the comparatively limited land component of newer properties, subdividing the property or adding a granny flat at the back is usually not viable. As a rule of thumb, 70% of your cash should go into the land and 30% in the bricks and mortar.

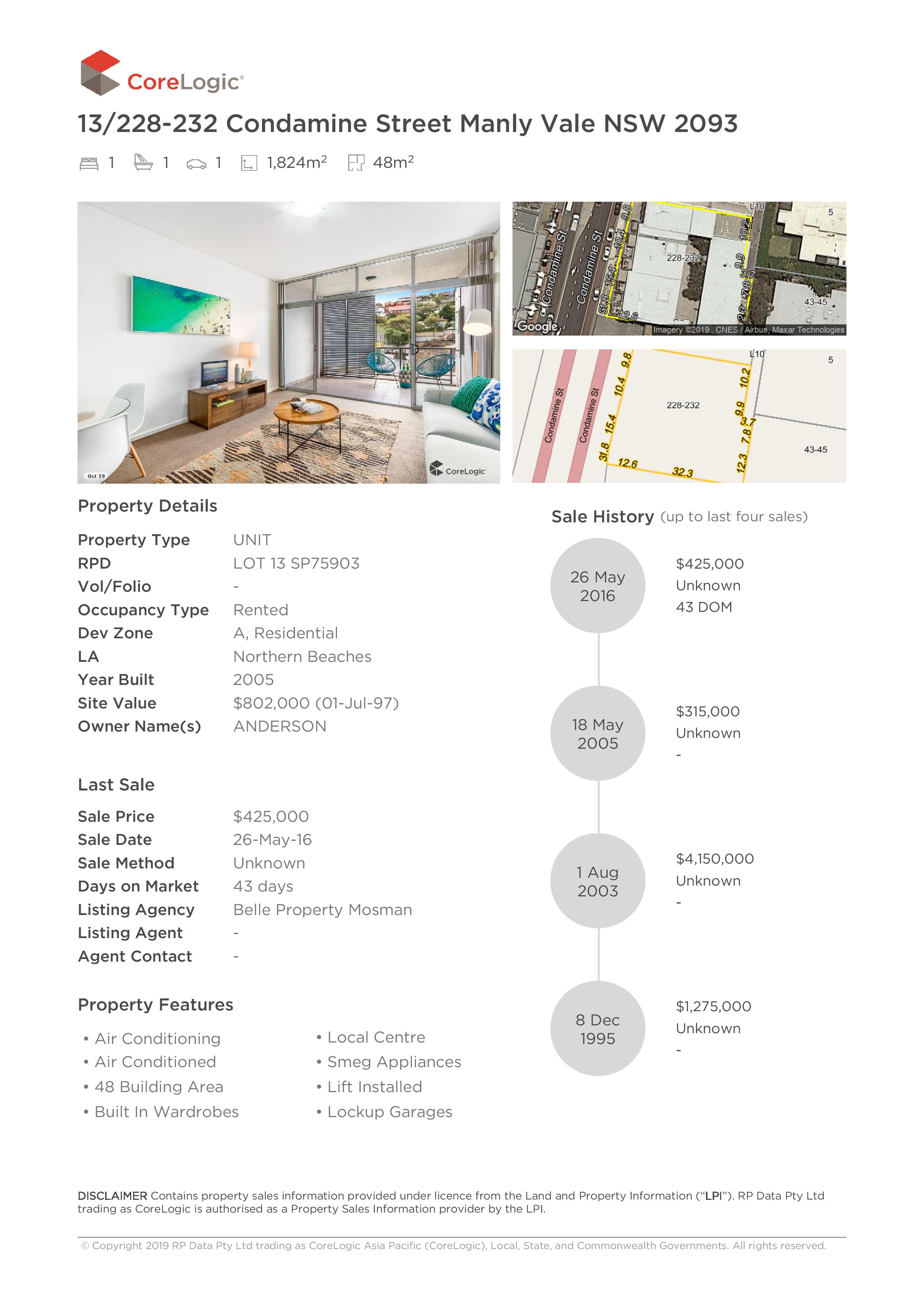

Case Study: Buying A New Unit

Property Details

A new unit on 13/228 Condamine St Manly Vale NSW 2093 that was built in 2005 was purchased in 2005 for $315,000 and sold in 2016 for $425,000.

Since the property was newly built, $0 was spent on renovations.?

Conclusion

The unit saw a 34.9% growth over 11 years (2005-2016), despite Sydney prices doubling in this time.

Significant problems with strata due to building defects during construction, this caused high strata fees during this time.

High depreciation gave tax advantages; however, this increased the capital gains tax when selling.

Cashflow: This property was negatively geared , i.e. the rent did not cover the interest on the loan and all of the expenses.

What Are The Pros Of Buying An Old Property?

Are new houses better than old?

The pros of buying an established property are magnified ten fold by a well-chosen property. Older properties are generally:

- Ideal for adding value: There’s significant potential to add more value to the property with an established property through renovations and improvements. Moreover, these costs are tax-deductible. Even a cosmetic makeover can improve the value, rentability, rental return and depreciation of an older property – something that can’t be done with a new property.

- More value in the land: Older properties tend to hold more value in the land than building itself. As generally, land tends to grow in value while building loses value over time.

- Property history: Older properties have a proven resale value since any exchange is between a willing buyer and a seller, and will likely meet the market. In addition, you’ll also have access to the property history, previous sale prices etc.

- Capital growth: Generally, an established property will outperform the average and see higher capital appreciation.

- Next to established infrastructure: Older properties tend to be located in areas with more established infrastructure such as transportation, schools, hospitals etc. These infrastructures are also drivers of property growth.

What Are The Cons Of Buying An Old Property?

The drawbacks inherent with older properties are the same as the advantages of buying new. They are:

- High Maintenance: Holding an established property as an investor means creating a buffer for unexpected maintenance and repairs. This usually puts stress on your cashflow as it will likely be negatively geared.

- Lower rental return: Older properties have lower rental returns compared to newer units.

- Less tenant appeal: Modern tenants want everything new, shiny and working, and full of lifestyle features as such generally older properties have lower tenant appeal.

- Lower depreciation writeoffs: Since the changes to tax legislation in 2017, you can’t claim depreciation on used plants and equipments found in second hand properties.

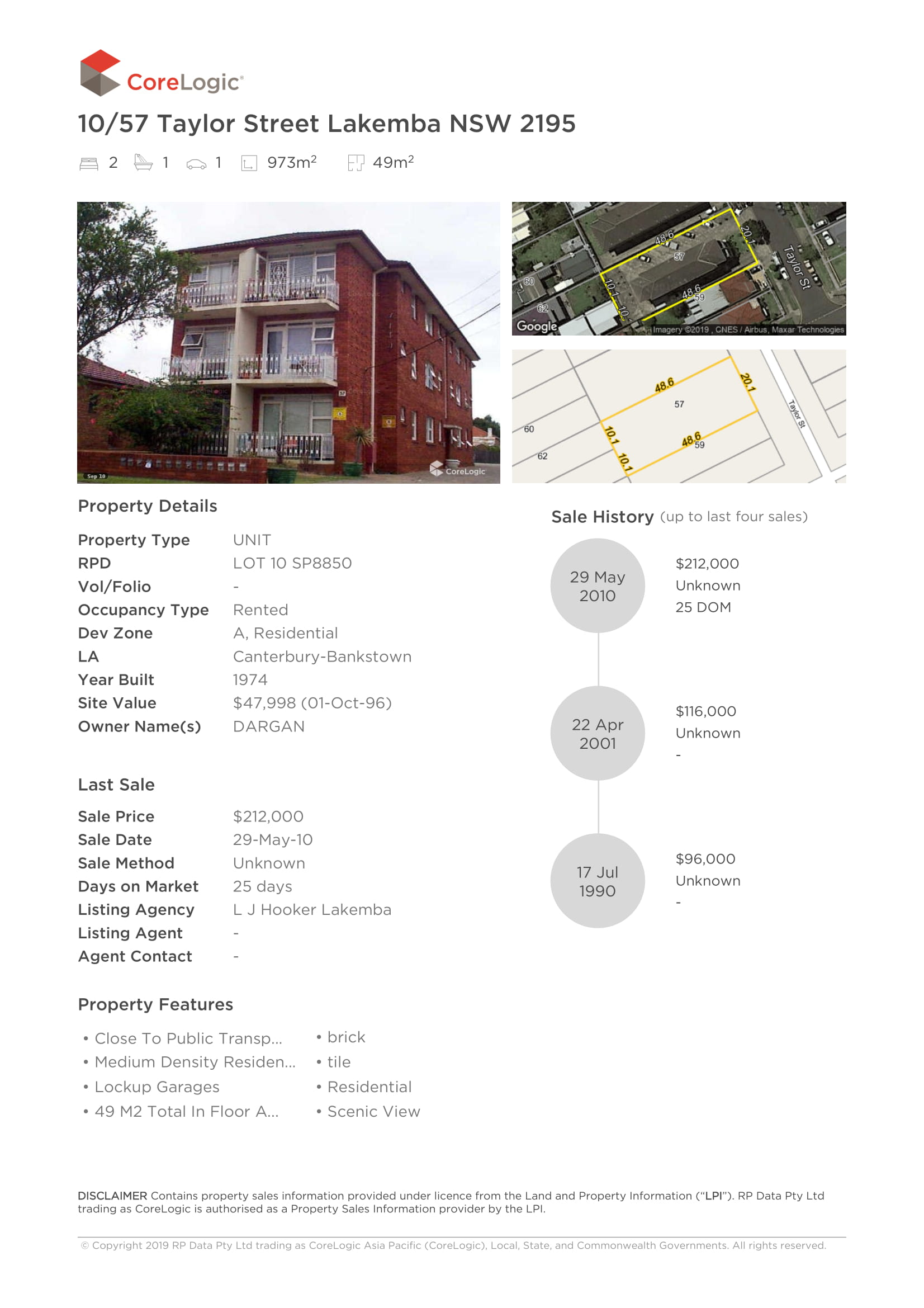

Case Study: Buying An Old Unit

Property Details

An old unit built in 1974 located on 10/57 Taylor St Lakemba NSW 2195.

The unit was purchased for $212,000 in 2010.

In 2019, the bank valuation came at $345,000, this was after a drop in the market.

A total of $20,000 was spent on renovating, primarily on the kitchen and repainting.

Conclusion

This investment unit saw a 48% growth over 9 years (2010-2019) after adding the cost of renovations to the purchase price.

Cashflow: This property is positively geared, i.e. the rent pays for the interest on the loan and all of the expenses.

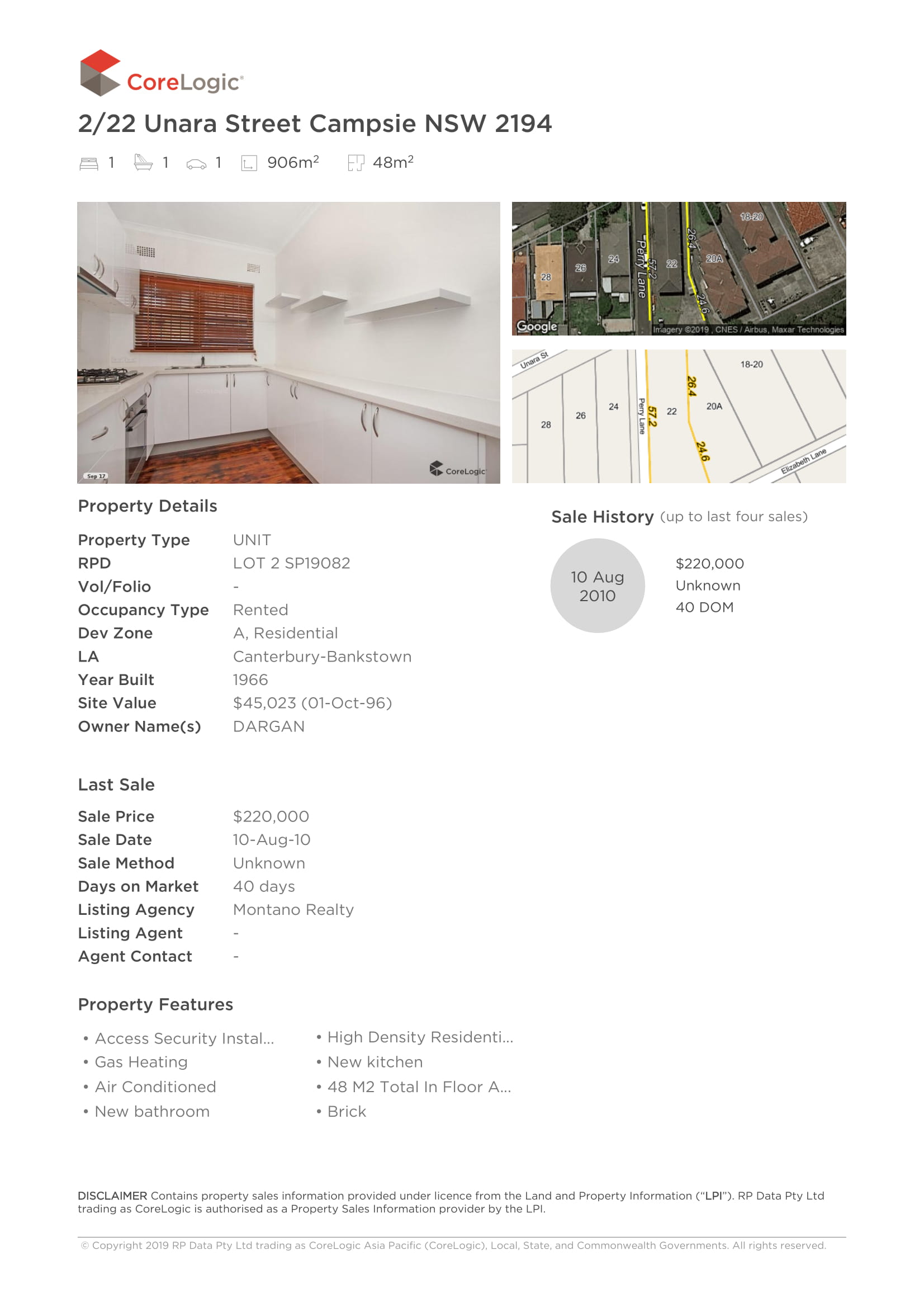

Case Study 2: Buying An Old Unit

Property Details

An established unit built in 1966 on 2/22 Unara St Campsie NSW purchased in 2010 for $220,000.

A bank valuation in 2019 came at $380,000, this was after a drop in the market.

Similar to the previous property, a total of $20,000 was spent on renovations, primarily on the kitchen and repainting.

Conclusion

The unit saw a 58% growth over 9 years after adding the cost of renovations to the purchase price.

Cashflow: This property is positively geared, i.e. the rent pays for the interest on the loan and all of the expenses.

What’s The Current Sentiment For Off-the-plan Properties?

In the last few months, buyers have been cautious with off the plan properties as the drop in prices in the last few years has resulted in many people paying more than they would have had to if they had waited until the property was completed.

That being said, the property market has now changed direction, so it’s less likely that someone buying now will experience a drop in the value of their property.

Buyers should be cautious when buying an off the plan property as they are speculative, high-risk investments.

You’re committing to buy a property now but nobody can approve a loan so far in advance of settlement, so if your situation changes or lending policy gets tighter then you may not be able to get a loan and may lose your deposit.

For this reason, off the plan purchases are best left to people in very strong financial circumstances who have substantial deposits.

New Build Vs Old Home: We Can Help With Both!

Whether you’re looking to buy new or old, we can usually help you get approved for a mortgage to buy one.

Speak with one of our specialist mortgage brokers today by giving us a call on 1300 889 743 or by filling in our short no-obligation assessment.