A home loan in arrears, 6 unsecured debts plus outstanding bills – Let’s look at how we’re able to help!

- Home loan type: Debt consolidation home loan

- Customer goal: Debt consolidation with a home loan in arrears

- Loan amount: $245,800 (61% of the property value)

The story

Meet James and Jenny Williams, a couple who had both lost their jobs last year rather unexpectedly and right after each other.

This put the couple in a precarious situation.

After a protracted employment search, Jenny eventually found a job, but her salary was considerably lower than before, while James found casual employment. This meant that some weeks, he wouldn’t be paid.

While they were job hunting, they still had bills and financial commitments to meet, so they stacked up several unsecured loans.

In total, they now needed to consolidate 6 debts with a combined debt amounting to approximately $207,000:

- 2 personal loans in arrears

- 4 credit cards over limit

- A home loan in arrears

They also needed to pay off a laundry list of outstanding debts.

This included, school fees, council rates, Telstra bills, repairs to private power poles, TasWater, TasWater, car service and rego etc. which amounted to over $38,800 approximately

The problem

The main issue was that Westpac had already started the repossession process as they were already 3 months behind on their mortgage repayments. So they needed to move fast.

To make matters worse, their credit scores had also plummetted.

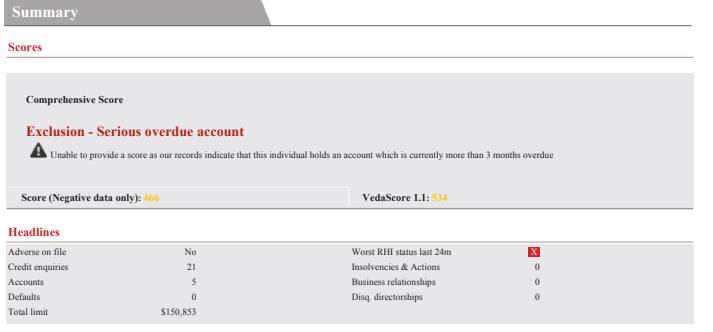

Jenny had an Equifax Score of 273 with over 28 enquiries in the past 12 months, whereas James didn’t even have an Equifax Score.

His credit report just said “Exclusion – Serious overdue account”. Suffice to say their credit scores were less than perfect.

Moreover, there simply aren’t many lenders who are willing to refinance a home loan which is in arrears, especially if both the applicants have bad credit.

Besides, the couple also wanted to roll all their debts into their home loan plus get a cash-out to help payout some outstanding bills.

And to do that, they had approached another broker who had told them in no uncertain terms that “he couldn’t help”.

Preliminary assessment

The couple found us online and filled in our short online assessment form.

Our mortgage broker and credit expert, Pramesh Vaidya got the call and immediately knew that if he couldn’t refinance their home loan in time, Westpac would have sold their house.

Since their house was not a standard property but rather a house on a large acreage of 9 hectares, this created another issue.

Luckily, before they had lost their job, the couple had a good repayment history and had built up some equity in their property.

Pramesh also quickly understood that with their bad credit, the only lender willing to lend would be a specialist lender.

After receiving their documents and going through their credit report, the goal became clear, save their property and get them a fresh start by consolidating all their debts.

Solution: Behind the scenes

He narrowed the specialist lenders to two lenders who could potentially approve such a deal.

He then ran their income and liabilities assessment (borrowing power), living expenses assessment and provided evidence that this was a one-off event due to an unexpected job loss.

Once it was established that debt consolidation could not only help the couple manage their repayments by rolling them all into a single loan; it can also help them pay less in late fees and interests on their credit cards and personal loans.

As time was of the essence, Pramesh ran the scenario directly with the two most suitable specialist lenders with one of them offering a slightly better rate and favourable term. He then made his recommendation.

After the couple accepted his recommendation, we then submitted the deal on the 30th of October.

Within 2 days later, we received pre-approval with just the valuation pending at an interest rate of 5.69% p.a.

The plan was to refinance at a much more competitive interest rate after at least a year or 12 months have passed.

The valuation soon followed on the 10th of November, and the loan got formally approved on the 16th of the same month.

He was also able to achieve all that plus access a bit of equity to pay out some of the bills with a cash-out.

A true testament to his credit knowledge and ingenuity, the time it took from the initial call to formal approval was less than 1 month.

A fresh start

The Williams couple were ecstatic and astonished when the loan got formally approved without much of a hassle.

Since they paid out all their existing debts and outstanding bills, they could start anew.

They were glad to have a fresh start.

If you’re in a similar situation, speak with one of our specialist mortgage brokers by giving us a call on 1300 889 743 or by filling in our free short assessment form for expert advice.