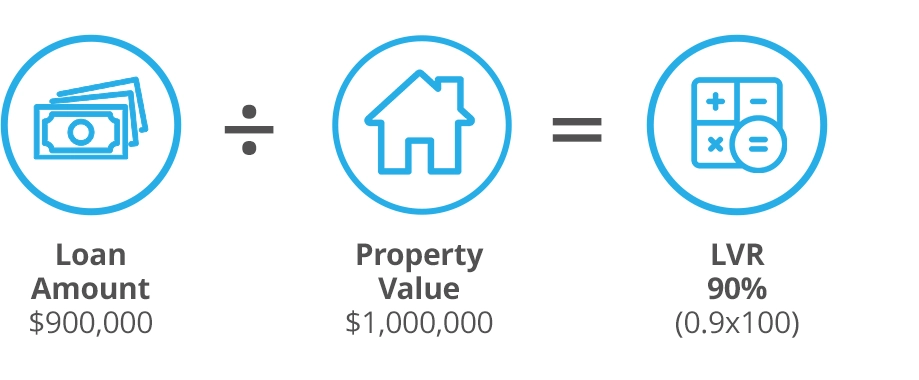

LVR Calculator

Our calculator can help you find the Loan-to-Value-Ratio (LVR) by looking at your property value and loan amount.

GET A FREE ASSESSMENT

4.8 (1,650++ Reviews)

calendar_monthUpdated: 17 May, 2024

hourglass_empty 8 mins read