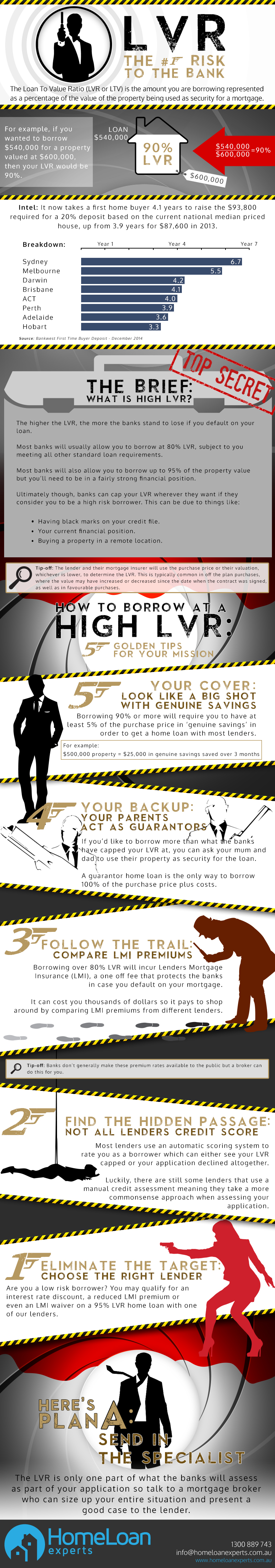

5 golden tips to borrow at a high LVR

- Can you build your genuine savings? Borrowing 90% or more will require you to have at least 5% of the purchase price in ‘genuine savings’ in order to get a home loan with most lenders. For example, you’ll require around $25,000 in genuine savings in order to purchase a $500,000 property.

- Can someone act as guarantor on your mortgage? If you’d like to borrow more than what the banks have capped your LVR at, you can ask your mum and dad to use their property as security for the loan. Otherwise known as a guarantor home loan, it’s the only way on the market to borrow 100% of the purchase price plus costs.

- Compare LMI premiums Borrowing over 80% LVR will incur Lenders Mortgage Insurance (LMI), a one off fee that protects the banks in case you default on your mortgage. It can cost you thousands of dollars so it pays to shop around by comparing LMI premiums from different lenders.

- Go with a lender that doesn’t credit score Most lenders use an automatic scoring system to rate you as a borrower and it can either see your LVR capped or your application declined altogether. Luckily, there are still some lenders that don’t use credit scoring meaning that they take a more commonsense approach when assessing your application.

- Go with a bank that still offers great discounts on 95% home loans Are you a low risk borrower? You may qualify for an interest rate discount, a reduced LMI premium or even an LMI waiver on a 95% LVR home loan with one of our lenders.

What is LVR?

The Loan To Value Ratio (LVR or LTV) is the amount that you are borrowing represented as a percentage of the value of the property being used as security for a mortgage.

For example, if you wanted to borrow $540,000 for a property valued at $600,000 then your LVR would be 90%.

Use our LVR calculator to work out the LVR of a property you’re thinking about buying.

Why is LVR important while applying for a home loan?

Borrowing at a high LVR is a big risk to banks and the higher the LVR, the more they stand to lose if you default on your loan. This means that it can become harder for you to get approved since the lender wants to minimize risk as much as possible.

Most banks will usually allow you to borrow at 80% LVR, subject to you meeting all other standard loan requirements.

The problem is that it now takes a first home buyer an average of 4.1 years to raise the $93,800 required to buy a house in Australia based on the current national median house price, according to the Bankwest First Time Buyer Deposit – December 2014 report.

In Sydney alone it takes 6.7 years, followed by Melbourne at 5.5 years.

Luckily, some banks will allow you to borrow up to 95% of the property value but you’ll need to be in a fairly strong financial position.

Ultimately though, banks can cap your LVR wherever they want if they consider you to be a high risk borrower. This can be due to things like:

- Having black marks on your credit file.

- Your current financial position.

- Buying a property in a remote location.

Send in an expert mortgage broker

The LVR is only one part of what the banks will assess as part of your application so talk to a mortgage broker who can size up your entire situation and present a good case to the lender.

Call us today on 1300 889 743 or complete our free assessment form and we can tell you what your borrowing options are.