Why does a bank need a letter from your lender?

Many banks require a statement for all of your debts when you apply for a home loan but few lender issue statements for their loans.

The simplest way to get around this problem is to ask your lender to fax a letter to your mortgage broker confirming that the loan has been paid on time.

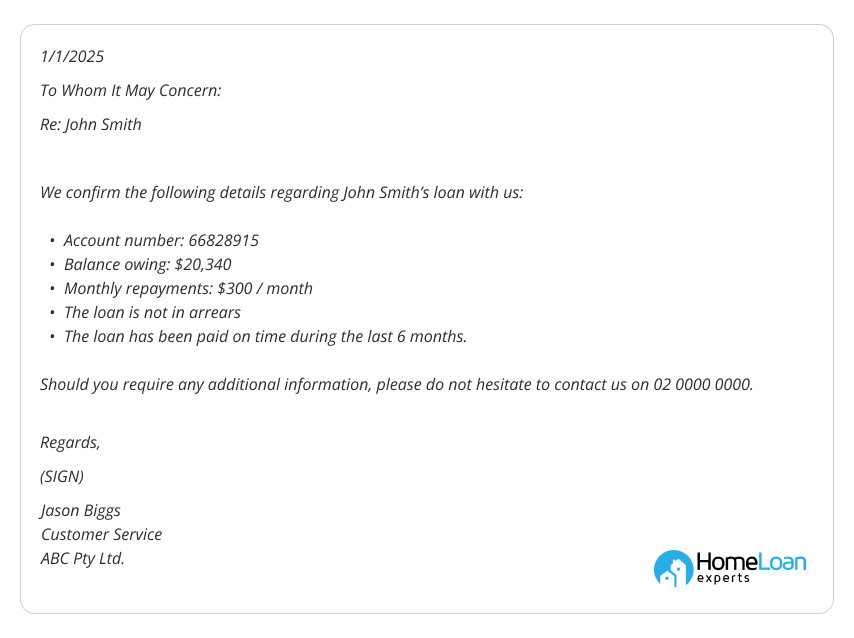

Home loan repayment letter template

You can ask your lender to use this sample letter as a template. All they need to do is copy it onto their letterhead, amend the details, print, sign and fax to your mortgage broker.

If you’re using Home Loan Experts to arrange your loan, please ask your lender to fax the letter to us.

Bank requirements for loan history letters

Australian lenders have strict requirements for home loan repayment letter templates.

They often ask for a letter to be amended if it doesn’t meet their requirements.

Your repayment history letter should be:

- On a company letterhead including contact details and the lenders ABN.

- Dated

- Signed

- Contain the name of person who signed the letter

- Contain the account number, name of the borrower, loan amount, repayment amount, that the loan is not in arrears and that the payments have been on time during the last 6 months.

- In some cases a payout figure will be required, however this is usually for fast refinances or settlements, and so is not required when applying for your loan. Include any accrued interest, exit fees and break fees for fixed rate loans.

Most lenders will accept a fax copy however some will require your mortgage broker to hold the original on file.

Do you need help with your home loan?

If you need the services of a mortgage broker to get your loan approved then, talk to us!

Please call us or enquire online to speak to one of our experienced staff.