Do you need a letter confirming your equity release?

If you are releasing up to 80% of the value of your property in equity, you generally only need to provide a stated purpose, as long as it’s an acceptable to the bank.

Some banks are more conservative and will require a letter from a financial planner or accountant if you’re planning to invest in shares or managed funds.

Typically, this is if you are releasing 90% of the property value or if your situation is out of the ordinary, such as requiring a low doc loan to prove your income.

Please call us on 1300 889 743 or complete our online enquiry form.

We know lenders that do not require a letter or other evidence confirming the purpose of your home loan cash out.

Bank requirements for loan purpose letter

The goal for this type of letter is ‘less is more’ so it’s best to keep it simple.

Whether the bank requires a financial planner letter or an accountants letter, the statement should generally include the following:

- Company letterhead including contact numbers and an Australian Business Number (ABN).

- Details of any industry memberships.

- Details of any certifications specific to financial planning/accounting.

- Dated.

- Signed.

- Name of the person who signed the letter.

- Name of the person who the letter is about, including their company (if applicable).

- Confirmation that the firm acts as the financial planner/accountant for the individual.

- Disclaimer that protects the financial planner/accountant from legal action (optional for the accountant/planner).

Most lenders will accept a faxed copy but some will require your mortgage broker to hold the original on file.

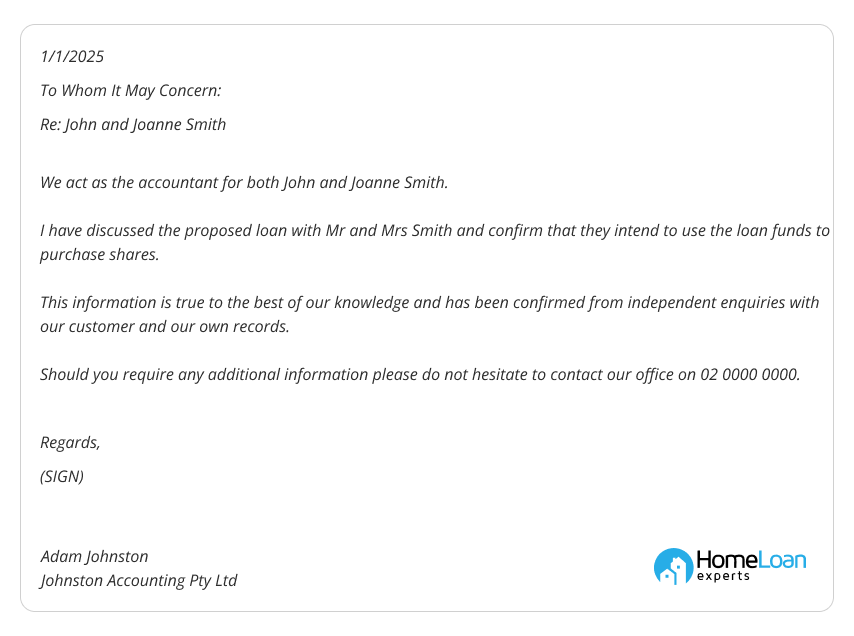

Loan purpose template for an accountant

To make it easier for your accountant, they can copy, paste and edit the below loan purpose sample letter to confirm your intent to invest in shares:

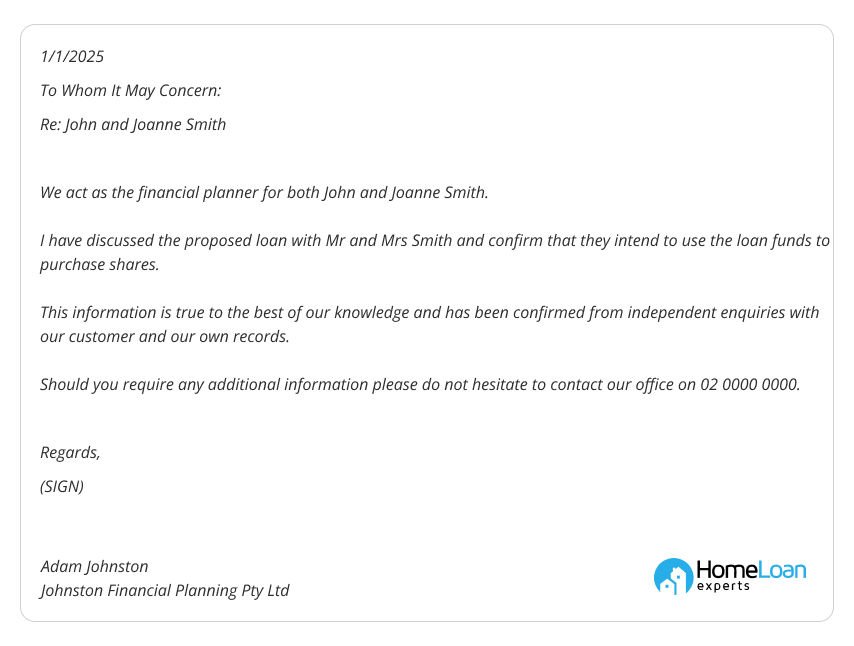

Loan purpose template for a financial planner

To make it easier for your financial planner, they can copy, paste and edit the below loan purpose sample letter to confirm your intent to invest in shares:

Do you need to provide more than a letter?

In some cases, yes, a lender will ask for a full financial plan or a statutory declaration from the borrower confirming the loan purpose.

If they require more detailed information, they will ask for it so it’s usually best to avoid providing more detail upfront.

It may only raise further questions which could delay your mortgage application and ultimately cause it to be declined.

What are acceptable purposes for cash out?

- Releasing equity as a deposit to buy an investment property.

- Investing in shares, managed funds or other stock.

- Undertaking minor renovations and repairs to your home or investment property.

- Consolidating debt.

Are you cashing out to invest in shares?

Call us on 1300 889 743 or fill in our free assessment form to speak with one of our experienced mortgage brokers.

We’re specialists equity release and refinancing and can help you build a strong case with the right lender to get your application approved.