Why might a bank need a letter regarding your credit history?

There are only a handful of lenders that will consider approving a home loan for someone who has had a credit issue.

You need to have a good explanation and evidence to back it up.

There are two types of credit problems that the bank may need letters to explain:

- Defaults, judgments, court writs or bankruptcy listed on your credit file.

- Missed payments on your current debts.

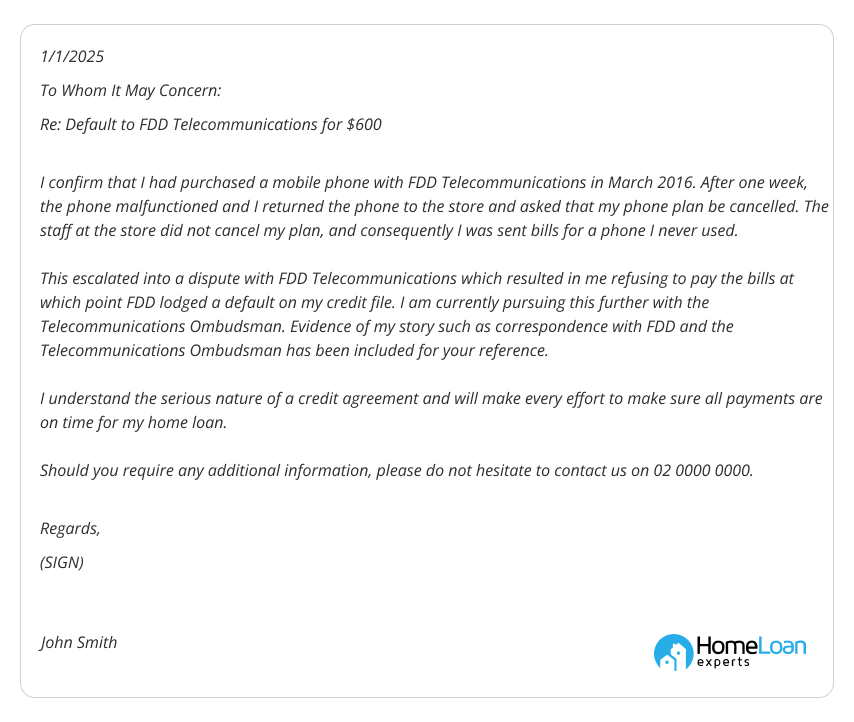

Use the below default explanation letter example to explain the reasons for the default and what steps you have taken to rectify the situation.

Default explanation letter template

Other types of default letters

There are almost limitless possible variations of the standard default letter template,

That’s because there are many possible reasons as to why you have a problem with your credit file.

Shared bills with a partner or flat mate

At my previous address, I rented with a flat mate and we had the lease and utilities in both of our names.

I moved out of the property but I was unaware that I was still liable for the utility bills.

Later, I tried to apply for a credit card and was knocked back due to a default on my credit file.

It was only then that I found out that my previous housemate had not paid the electricity bill.

Divorce

My husband and I divorced in late 2015.

I left with the children and moved to my mothers house until I could find new accommodation.

All of the utility bills were still being sent to my previous home address and were not being paid by my ex-husband.

Overseas

I went to the UK on a working holiday for two years.

Before leaving, I informed my credit card provider of my departure and asked them to mail my statements to my parents address.

My credit card provider never changed my address and was unable to contact me so a “clearout” default was lodged on my credit file.

When I returned and found out about the unpaid bill, I contacted them and immediately paid the outstanding balance.

Change of address

In late 2009, I moved to a new address and informed my internet provider of my new contact details.

Despite connecting my internet to this new address, they were still sending bills to my previous address. The account went unpaid and they lodged a default on my credit file without notifying me.

Dispute

My mobile phone carrier charged me for calls made to a foreign country using my mobile phone.

These calls were not made by me and I have no reason to call anyone overseas.

After numerous attempts to find out why they charged me for these calls, I was unable to come to an agreement with them so refused to pay the bill and they consequently lodged a default on my credit file.

I am now following up this complaint with the telecommunications ombudsman.

Payment not found

I paid my January phone bill over the counter at the post office.

Unfortunately, the money was never received by my phone carrier and as a result a default was lodged in my name.

Did not contact

My conveyancer failed to lodge my new address with council after my purchase of a new property.

Consequently, council rates were never paid and council lodged a default on my credit file.

They never once contacted me before lodging a default and I am now in the process of challenging this.

The amount owing was paid immediately after we discovered this unpaid bill.

Incorrect direct debit details

I recently switched from ANZ to CBA and informed my local gym of my new account details.

They never updated their system with the correct account number and so consequently my bill went unpaid.

As a result of this the gym lodged a default on my credit file. This bill has since been paid.

Closed account

I recently cancelled my phone contract and returned the phone to my provider.

Unfortunately, the local store never actually closed my account and bills were continuously sent to my address which I ignored as I thought they were an error.

They lodged a default on my credit file and I have since lodged a complaint with the telecommunications ombudsman.

Business failure

My husband and I had a small business that was part of a larger franchise group.

The head franchise group went into liquidation and as a result we were forced out of business.

The cost of setting up our business has left us with numerous debts that we were unable to pay.

We have since returned to our previous jobs and have repaid our debts, however, the experience has left defaults on our credit file.

Temporary unemployment

I was living in a country town that heavily relied on the mining industry.

The local mine closed which had disastrous effects on the entire towns economy which caused me to lose my job.

I was unable to find work in the town for over 6 months and despite my best efforts a default was lodged on my credit file.

I have since moved to a major city, have stable employment and have paid my outstanding bills.

Pregnancy / new baby

In late 2009, I became pregnant and was unable to work for over 6 months.

My partner and I had separated just before I found out about the pregnancy and so I was without financial support during this time. As a result, a default was lodged on my credit file.

I have since returned to work and have repaid all of my outstanding bills.

Pay date

My pay date falls on the 15th of the month, however, my home loan is due on the 13th of the month.

As a result, almost every one of my home loan repayments in late by a few days.

I intend to set up my new home loan with a payment date of the 17th of the month to make sure this problem does not occur again.

Confusing home loan accounts

My current home loan is set up so that payments can only be made from a bank account with the same lender.

I did not know this and moved my everyday cheque account to another bank.

I gave the bank my new direct debit details, however, they could not process the request.

When I tried to make manual payment to my loan, I found out that my lender did not accept Bpay or EFT payments so I was forced to go into the branch and pay cash each month.

Because of this inconvenience, I have had great difficulty making my repayments on time.

Bad advice

I had had several large unexpected expenses which forced me to use up almost all of the available funds on my credit cards.

I was able to make repayments, however, it was a struggle.

A friend of mine recommended that I talk to a debt relief organisation that recommended that I enter into a Part X agreement with my creditors.

It was only after entering into this agreement and the Part X being listed on my credit file did I find out that I had almost no benefit to do so and was charged high fees to negotiate this agreement. Nonetheless I paid my debts in full over the next year and I am now debt free.

There are many more possible situations that may result in a default, judgment or bankruptcy being listed on your credit file. If you’re having trouble drafting a suitable letter please contact us for assistance.

Bank requirements for default explanation letters

Australian lenders have strict requirements for letters explaining any credit problems you may have.

Please use the below rules as a guide to help make your home loan application as smooth as possible.

Your letter should be:

- Dated.

- Signed.

- Contain your full name and address.

- Explain what happened in as much detail as possible.

- Provide any evidence that supports why you defaulted on the credit facility including receipts, letters, insurance policies and contracts (only send copies so you can hold onto the originals).

- Include a sentence confirming that you understand how serious the credit problem was and intend never to get into that situation again.

Most lenders will accept a faxed copy but some will require your mortgage broker to hold the original on file.

Golden tips for default explanation letters

Although the bank has their own requirements for default explanation letters, there are other things to keep in mind:

- Take ownership: Don’t blame the creditor for your mistakes because it can really reflect badly on your character.

- If you were innocent: If the default was listed on your credit file by mistake, describe what steps you took to rectify the situation including all correspondence with relevant parties.

- What steps you’ll take: Declaring that you don’t intend to get into a similar situation again is good but if you can go into detail about how you plan to do that, it can work in favour of your application.

What caused the default?

When a lender assesses your loan and sees that you’ve had a problem in the past, they’ll try to ascertain if this problem was your fault or due to circumstances outside of your control.

If it was your fault, then don’t expect the lender to bend over backwards to help you unless you can give them strong reasons to prove that you’re not a high risk customer.

Good reasons for a default include illness, marriage breakdown, being overseas or a dispute with your utility provider.

Bad reasons for a default include unwillingness to pay, loss of job, bad money management and spite.

Can you provide evidence?

The credit officers working for the banks have heard every possible excuse for a bad credit history, so are unlikely to just approve your home loan without hard evidence to back up your story.

If you were divorced then provide a letter from your solicitor and if you were overseas then provide a copy of your visa.

With evidence and a good explanation, we can often get your loan approved with a mainstream lender.

Do you need help with your home loan?

If you need the services of a mortgage broker to help get your loan approved then please call us on 1300 889 743 or complete our free assessment form to speak with one of our experienced credit specialists.