Table of Contents

- Why the current mortgage system kind of sucks

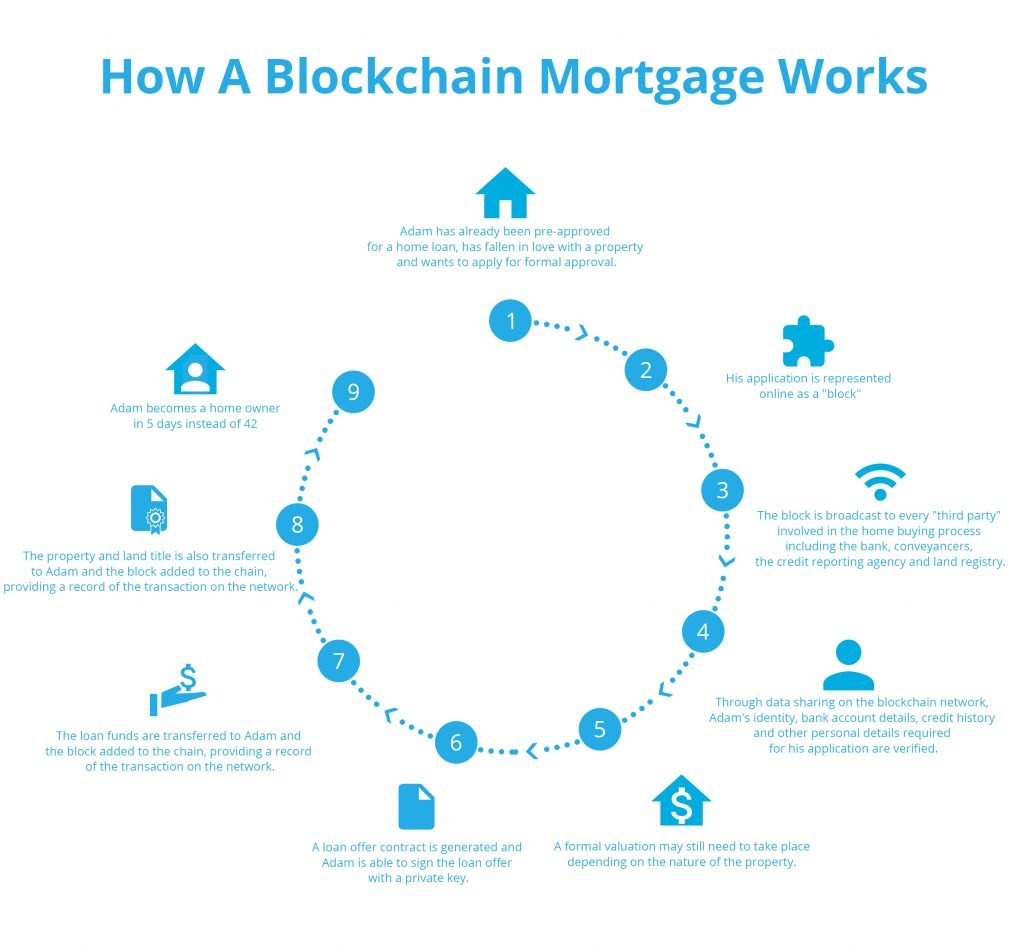

- How does blockchain technology work in home loan?

- What does this all mean for you as a borrower?

- Is it safe?

- Will this put brokers out of a job?

- When will blockchain mortgages be available in Australia?

- Is Cryptocurrency accepted as a deposit?

- Who is currently using blockchain?

Note: Blockchain mortgages are not yet available in Australia.

Let’s face it: applying for a home loan involves a lot paper work, a lot of third parties and confusing fees that you’re not entirely sure why you’re paying.

Blockchain mortgages could eliminate the costs and inefficiencies of third party intermediaries like the banks, giving you a much smoother and cheaper home loan process.

Why the current mortgage system kind of sucks

Did you know that it currently takes and average of 42 days from submitting your home loan application to reaching settlement?

At each point, you’re dealing with professionals like mortgage brokers, bank officers, solicitors and real estate agents, each adding their own time and fees to the home loan process.

Although many of them are offering advice and information, these professionals are also stuck completing administration tasks that could be completed by a computer.

For example, banks need to check your asset-to-debt ratio, while conveyancers need to complete a title search and transfer ownership of the property.

What this leaves you with is a long and drawn-out process.

Of course, the checks and balances required to get your application assessed, such as checking your ID and credit history, are necessary.

But with all of this information already available on secure online databases, why are you left paying the fees of our archaic banking and regulatory system?

How does blockchain technology work in home loan?

Blockchain technology is simply a list of records linked together and “encrypted” or secured so that they’re only accessible to authorised parties.

Currently, private information such as bank accounts and government records such as property titles, are held by private and public institutions.

Authorised individuals such as mortgage brokers and bank managers need to access this information manually when assessing your eligibility to meet the bank’s lending policy as well as your borrowing power.

Similarly, this private and public information needs to be updated when you’re actually approved for your mortgage, its registered with your bank and when you actually become the new owner of land and property.

Each time information is exchanged or a transaction takes place, it moves between “ledgers” and someone needs to confirm each move (third party intermediaries).

With blockchain mortgages, the information or data required to assess and approve your loan application would be securely stored on a network where these ledgers would be updated automatically and in real-time.

The use of this distributed ledger technology (DLT) technology would allow your loan contract to be generated automatically, set up your home loan account and transfer and register ownership of the property.

What does this all mean for you as a borrower?

- It could significantly reduce upfront application and ongoing mortgage fees.

- The development of “smart” contracts, code-based sets of rules and application programming interface (API) technology allowing multiple parties to communicate and share information with each in real-time is way more convenient for everyone.

- It could significantly speed up the application and settlement process. Experts believe it could reduce the time from application to settlement from 42 days to about 5 days.

- It opens up peer-to-peer (P2P) lending with investors on the blockchain network, creating competition for the banks and setting a price war when customers will reap the savings.

In addition to this, more accurate record-keeping through data sharing means there’ll be an indisputable paper trail to rely on to detect fraud and eliminate human error.

This is a problem for the banking industry but does it benefit you?

Indirectly, yes it does.

If banks are better able to detect fraud, it means the industry regulator, the Australian Securities and Investments Commission (ASIC), will have more confidence in the industry.

More confidence means less stringent requirements for banks to hold capital which means more competitive lending policies.

What it eventually means is more tough loans can get approved and at cheaper rates and fees.

Is it safe?

Blockchain technology would see home loan transactions move from the hands of the banks to a network of private computers known as “nodes”.

It sounds pretty scary but sophisticated online security, known as cryptography, upholds the integrity of this public ledger.

Cryptography is a set of rules that have been coded into the block chain system: instead of a human maintaining security and validating contracts, it’s done automatically and in-real time with this code.

If anything, it’s actually more secure than the current banking system.

Will this put brokers out of a job?

The home loan you receive won’t be decided by the blockchain system.

You will still need to be assessed by a bank or a mortgage broker that recommends a suitable mortgage product for you.

Blockchain doesn’t circumvent responsible lending.

Where it adds value is when your loan application is submitted with the lender.

When will blockchain mortgages be available in Australia?

There are many reasons why blockchain technology is not currently being used in the Australian home loan and financial services industry.

One reason is that the banks have particularly old systems that are hard to untangle.

It’s just too difficult and expensive for them to move to this technology any time soon.

In saying that, smaller lenders who are more agile are trialling this technology as we speak.

The other reason is because of regulation.

Australia has a highly-regulated financial system which is a good thing for protecting you as a consumer.

The downside is that it can stifle innovation in providing a much cheaper and more streamlined home loan experience.

However, we believe it’s only a matter of time before decisions are made as to how best to regulate this new technology.

Is Cryptocurrency accepted as a deposit?

Yes, some lenders will accept cryptocurrency for your deposit. Otherwise, you need to sell it in return for Australian dollars. Some lenders are willing to accept cryptocurrency if you can provide a bigger deposit. We’ve seen people do it.

Usually, for situations like this, your Home Loan Experts broker will get all of your documents together and then put a scenario forward to several lenders. Then we can apply with the right one and get you approved the first time around. It’s a little more work, but it gets results.

Who is currently using blockchain?

Experts agree that blockchain technology will be huge part of the home loan industry in the next 5-10 years.

The earliest adopter and widely-know application of blockchain technology was Bitcoin in 2009, the first decentralised digital currency or cryptocurrency.

There have been many applications of blockchain since then.

Moneycatcha

Australian-based software company Moneycatcha is trialling its blockchain regulatory system, Regchain, with HSBC Australia.

Regchain help to ensure banks and brokers are meeting the regulatory requirements set out by the Australian Securities and Investments Commission (ASIC) and the Australian Prudential Regulation Authority (APRA).

ANZ and Westpac

In 2017, ANZ and Westpac partnered with IBM and shopping centre operator Scentre Group to use blockchain technology instead of paper bank guarantees on commercial property leasing.

Celsius

Celsius uses blockchain and smart contract technology (Ethereum) to provide a platform for P2P lending (not mortgage lending as yet).

These loans will pay higher interest to lenders and charge lower interest to borrowers by splitting the bank profits between the members of the community.

Australian Mortgage Marketplace (AMM)

AMM is the newest kid on the block and is set to start offering blockchain-backed home loans by the end of 2018.