Why do lenders ask for Business Activity Statement (BAS)?

BAS was introduced in 2000 by the Australian Tax Government (ATO) as a way for businesses to report their GST and PAYG withholding tax obligations.

Due to the Global Financial Crisis (GFC) in 2008 and the introduction of the National Consumer Credit Protection (NCCP) Act in 2010, it became a requirement for lenders to obtain some verification of your income for a low doc loan.

The idea behind using BAS statements was to allow lenders to verify a client’s turnover and decrease the risk that comes with low doc loans.

What are the lenders' requirements?

- ABN – Most lenders require ABN and GST registration for a minimum of two years. However, one of our lenders requires only one year.

- BAS – Most lenders require 12 months’ BAS. However, some of our lenders can also get you a low doc loan with 6 months’ BAS.

- Credit history – Your credit history must be clear of any adverse listings and your debts must be paid on time. Some exceptions are available.

- Savings history – If you’re borrowing over 60% of the property value (LVR) you may have to prove genuine savings.

How is my income calculated?

Most lenders will require your previous four quarters’ BAS, which equates to twelve months of statements. However, some of our lenders require only two BAS!

Each quarter’s turnover will be calculated to produce a gross annual turnover. Most lenders will then use 40% of your turnover as your income.

For example, if your gross annual turnover is $300,000 per annum then lenders will consider using a maximum of 40% of this figure, which means your declared income would be $120,000.

However, some of our lenders will use 50% of your turnover, which will vastly increase your borrowing power.

Some lenders also calculate annualized income, which means they will accept the latest 2 quarters, if you had 2 bad first quarters, and annualize it mitigating the loss or lesser sales for the bad quarters.

One of our lenders uses a different percentage of your turnover depending on the industry that you work in. You can use our BAS income calculator which will work out your income using the same method as three of our lenders.

Note: Not all lenders use similar methods for the BAS income calculation, which might lead to different incomes being used.

Do you need help applying for a low doc loan with your BAS? Please call us on 1300 889 743 or enquire online and one of our mortgage brokers will call you to discuss your situation.

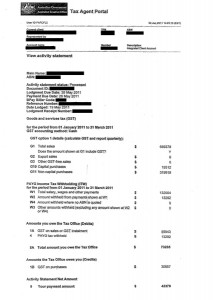

Example Of BAS

Do banks accept handwritten BAS?

Unfortunately, financial institutions do not accept handwritten Business Activity Statements (BAS).

They will usually require ATO Portal printouts (an example is shown on the left), or a copy of electronically lodged BAS from your bookkeeper.

BAS Statements are required to be lodged quarterly with the ATO. It is recorded via the Electronic Lodgement System (ELS) which can be found on the ATO website.

Some lenders, however, can approve home loans with an alternative proof of income, such as an Accountant’s Letter or Income Declaration.

So if you only have handwritten BAS then we may still be able to assist you with your home loan.

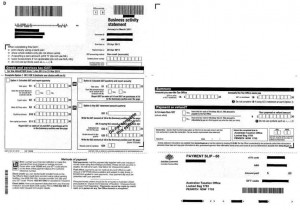

Example of blank BAS to be completed by hand

The ATO will deliver the blank Business Activity Statement via post according to the cycle chosen when you first submit your application to register the Australian Business Number (ABN).

Be careful while selecting the preferred cycle as this cannot be amended within the first year of your ABN registration.

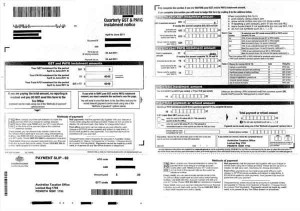

Example of ATO issued complete quarterly GST statement

This is an example of a Business Activity Statement (BAS) if you were to use accounting software.

When using most accounting software products the tax portal will sync and upload information automatically for you.

This will relieve you from having to write the entire content yourself in the BAS, which means that you will not have to double up on your work load.

Three Golden Tips

Not everyone uses the 40% rule

Not every lender uses the 40% rule. Some lenders use a higher percentage of turnover or calculate your income using a different method. Knowing which lender to approach can significantly increase your borrowing power.

For example, one of our lenders uses 50% of the turnover shown on your BAS as your income. This means that your income is 25% higher than someone who has applied with a lender who only uses 40%.

Other specialist lenders can look at the income, expenses and wages shown on your BAS and can use this to calculate your income. This works well for people who have low business expenses such as those who are in the service industry.

See our low doc loan calculator for more information.

Using BAS as income evidence

You may be able to get a low doc home loan with no BAS but you have to provide an alternative document to prove your income.

BAS is the most widely accepted form of income verification for low doc loans amongst the lenders. For low doc loans, the majority of lenders will accept BAS as a substitution for any other form of income verification.

Large variances in total sales

Lenders do not look at large variances between quarterly BAS total sales favourably. Often a good explanation must be provided for the variances to be accepted.

Apply for a mortgage today!

Knowing which lenders will accept BAS as income verification is important when applying for a mortgage.

Enquire online or call us on 1300 889 743 to find the lender right for your low doc loan! We’ll help you choose a competitive loan from our panel of specialist low doc lenders.