Are you under the impression that it’s impossible to buy a house with just a 5% deposit?

You’d be surprised to learn that there are some solid ways to get a property without saving up for that 5% deposit.

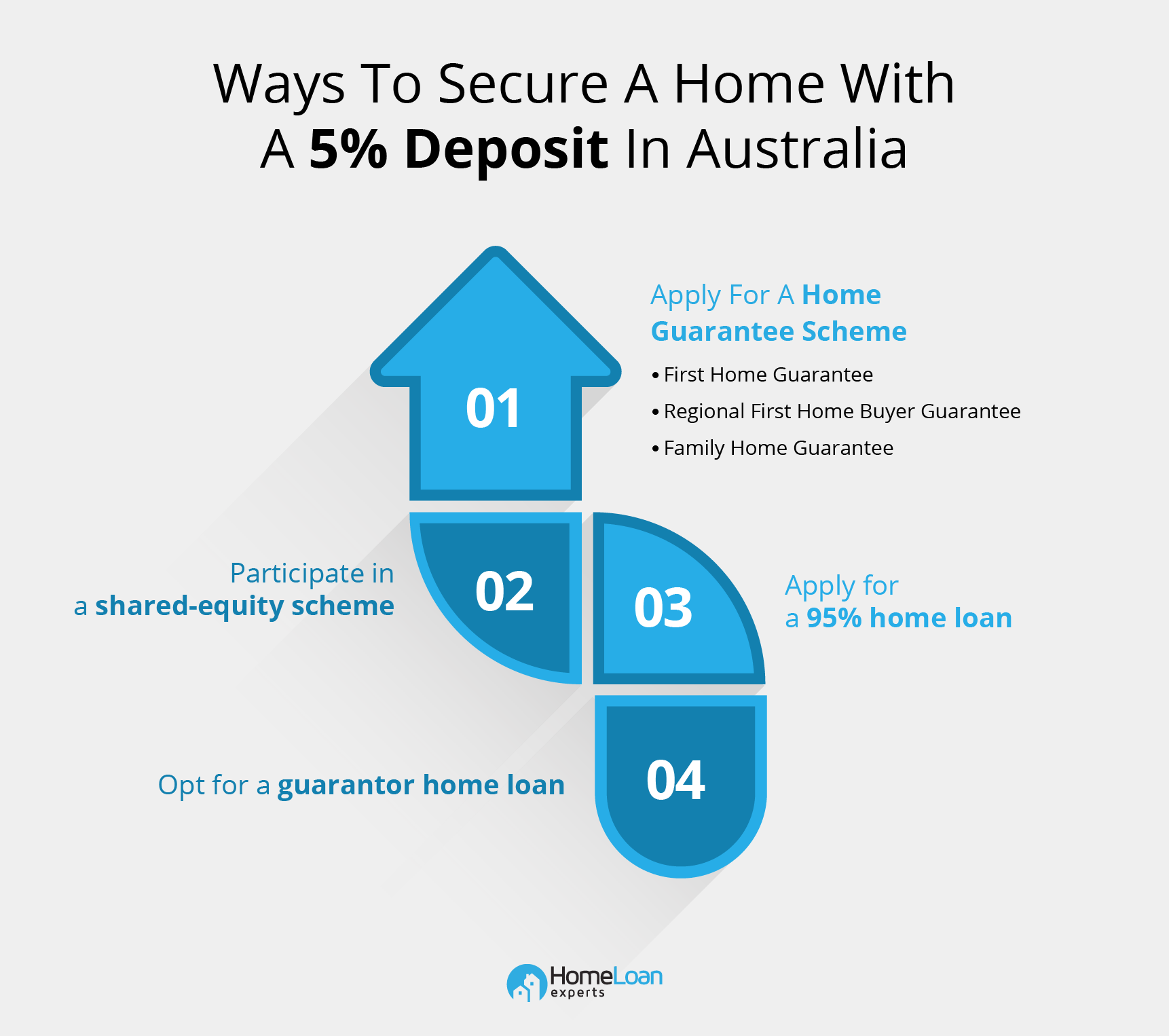

Let’s walk you through your options:

- Low Deposit Home Loans

- First home guarantee

- Guarantor Home Loans

Is 5% Enough For A Deposit?

It is completely true that most lenders prefer a deposit of at least 20%, but there are some edge-cases and workarounds you can use to lower your deposit to 5%. The only catch is you’ll end up paying slightly more in Lenders Mortgage Insurance.

Alternatively, if you are a first home buyer, you may be eligible for First Home Guarantee, which you can use to purchase your first home for as little as 5% deposit.

There are also guarantor options to lower your deposit.

Let us now discuss these options.

Low Deposit Home Loans

Low deposit home loans, as the name suggests, allows you to purchase a home at a low deposit. These loans are great for borrowers who haven’t been able to save a 5% deposit due to various reasons.

But lenders perceive these loans as being riskier, so they mitigate the risk by charging LMI, which helps protect the lender in the event you are no longer able to repay your loan.

Why go this route?

- Buy sooner (without a 20% deposit)

- Take advantage of property growth to improve your equity

What’s the downside?

- Harder to refinance ealy

- Risk of negative equity in case of price drops

First Home Guarantee

The first home guarantee scheme (part of Home Guarantee Scheme) lets eligible first-time buyers purchase a home at 5% deposit.

How it works

The government backs your loan by covering the other 15% needed to meet the usual 20% deposit threshold. So, the lender is protected, and you save big on LMI.

Key benefits

- Lower upfront costs

- Faster way into the housing market

- No need for a guarantor or large deposit

Who’s Eligible?

To qualify, you’ll need to:

- Be a first home buyer

- Be at least 18 years old

- Be an Australian citizen (or PR in some cases)

- Have a taxable income under $125k (or $200k for couples)

- Be planning to live in the home

Allowed Property Types

- Brand new or existing homes

- House and land packages

- Off-the-plan properties

- Land with a building contract

There’s a cap on property values depending on your location. For example:

- NSW: Up to $900k in cities, $750k elsewhere

- VIC: $800k in cities, $650k elsewhere

- QLD: $700k in cities, $550k elsewhere

Full price cap table available via the government’s site.

Limited spots

Only 35,000 spots are available per year, so it’s best to check in with a broker ASAP to see if you’re eligible.

See What Your Low Deposit Can Achieve!

Unlike traditional calculators, the 360° Home Loan Assessor offers a full breakdown of your borrowing capacity, deposit contribution, and costs involved. Find out how close you are to approval and explore flexible low-deposit loan options.

Get StartedGuarantor Home Loan

A guarantor home loan can be the best option for you if you have a family member (usually a parent), who can help use their home’s equity as extra security for your loan.

This means:

- You will save on the deposit

- You can avoid LMI

- You can potentially borrow more

For instance, if you want to buy a $1 million home with a 5% deposit, it’s usually not enough. But if your parents put up $150K of equity from their home as security, the lender now sees you having 20$ and thus you avoid LMI.

Once you build equity or repay a portion of the loan, your guarantor can be released from the agreement.

Lenders Who Offer 95% Home Loans

At Home Loan Experts, we have lenders on our panel who let you borrow up to 95% of the property value if you’ve saved between 5% and 10% of the value as a deposit. First-home buyers can even include the First Home Owners Grant as part of the deposit.

Lenders are favourable to those who have a stable job and earn regular income. Waived LMI home loans are also available for certain professionals.

| Pros | Cons |

|---|---|

| You can become a homeowner sooner, even with a smaller deposit, making it an attractive option for those struggling to save for a deposit. | Some lenders may charge higher interest rates for low-deposit home loans, as they perceive them as riskier investments. |

| Various government schemes are available to help you buy a home without paying Lenders Mortgage Insurance (LMI), reducing upfront costs. | Government assistance schemes often have limited places available, and there are price caps that can restrict your choice of properties. |

| You can start building wealth and equity in a property, potentially benefiting from appreciation over time. | If property prices decline, there is a risk of falling into negative equity, where you owe more on your mortgage than the property is worth. |

Fast Track to Approval: Your Home Loan Checklist

A well-curated checklist to improve your chances of a home loan approval.

Do I qualify?

Generally speaking, you’ll need:

- A good income: Lenders tend to be quite strict when assessing your means of paying off a 5% deposit home loan, otherwise known as your ‘serviceability ratio’.

- Stable employment history: Although there are exceptions, this usually means that you’ve been working in the same job for the past 6 to 12 months.

- A clear credit history: Your credit file must have minimal credit enquiries and be free of defaults. As a general rule, credit cards, rent and bills like utilities and mobile plans need to have been paid on time for the past 6 months.

- Strong asset position: Lenders will assess your income to asset position relative to your age. It’s assumed, for example, that if you’ve been working full time for a few years that you’ll have a car and a decent amount of savings relative to your income.

- Little to no existing debt: Having more than one credit card and/or personal loans is a red flag for most lenders.

- Proof of 5% in genuine savings: This is usually in the form of consistent deposits into a savings account over a period of 3 months. There are some exceptions to this though.

- Non-traditional property or location: Banks are pretty conservative when it comes to property located in high rise units and small or regional. There are other types of ‘unusual property’ that may see your home loan application declined.

Want to know if you qualify for a 5% deposit home loan?

Fill in this free and easy assessment form or call us directly on 1300 889 743 and let us help you find the right home loan for your needs.

Do you qualify for a 5% deposit home loan?

Speak to an experienced mortgage broker that specialises in 5% deposit home loans.

It can sometimes be difficult to get approved but with a professional to help you present a strong case you’re in with a better chance.

Call 1300 889 743 or fill in our free assessment form and we can tell you which home loan option is right for you.

Frequently Asked Questions

How Much Can I Borrow?

With a 5% deposit, you can borrow up to 95% of the property value.

When you’re borrowing more than 80% of the property value, LMI is usually applicable.

Is A 5% Deposit All I Need To Buy A Property?

Can I Avoid Paying LMI?

What If I’m Not Eligible For Reduced LMI?

Can The 5% Deposit Come From Anywhere?

What Strategies Can I Use To Save A 5% Deposit?

What If I Have A Bad Credit History?

Still need answers? We're here to help!

Ask an expertOur team of mortgage experts will assist you within 24 hours.