Real Cash Out Refinance Example – Summary:

| Details | Description |

|---|---|

| Goal | To refinance their investment property and cash out equity to pay off some debt and use it as a deposit towards an owner-occupied property. |

| Problem | Couple with low credit scores and arrears in their rates notice. |

| Loan Amount | $309,970.00 (refinance) and $85,985 cash out (refinance). |

| Security | Freehold house in Aveley, WA. |

| LVR and Term | 90% LVR LVR (loan to value ratio), 30-years loan term |

| Annual Income | $240,600 combined, excluding rental income. |

| Solution | Get an exception to credit policy to get the maximum 90% refinance cashout. |

Cash Out Refinance: The Story

A couple from Western Australia were looking to buy a house for themselves and their five children. They both worked, with a combined income north of $240,000 a year, and owned an investment property. So, they felt confident that they were going to get approved and were seeking the maximum cash out they could get.

However, when they approached their bank, ANZ, to refinance their existing mortgage and cash out some of the equity to pay off debts and put down a deposit, they were declined. They then approached another major lender, CBA, which also declined.

As usually happens, they found Home Loan Experts after doing some research online and filling in our online enquiry form.

90% Cash Out Refinance: The Problem

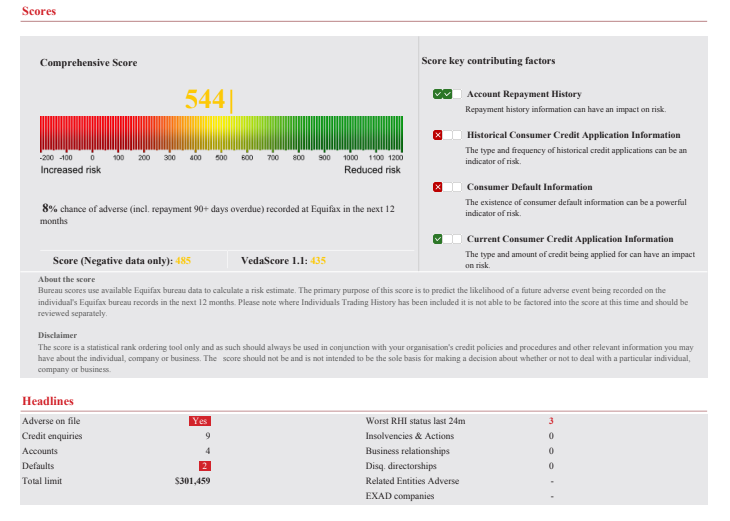

The couple got a call from one of our specialist mortgage brokers, Mandy Shrestha and as part of our fact-finding process, she pulled out the couple’s credit reports (which doesn’t show up as a credit enquiry). Both of them had credit scores in the low 500 range. This is considered below average.

They had:

- A couple of paid defaults

- Multiple dishonoured payments on their savings account

- Three late repayments (read about Repayment History Information here) in the last 24 months.

On top of that, Mandy uncovered that they were in arrears on their council rates as well.

These credit issues, combined with the fact that they were looking to cash out refi with a Loan-To-Value Ratio (LVR) of 90%, meant that no major lender was willing to assist. Most major lenders will limit cash out refinancing loans to an LVR of 80%.

Mandy had existing relationships with a couple of specialist lenders that could potentially assist, provided she and her clients could put together a strong application with good supporting documents. Knowing this, Mandy went to work immediately, collecting required income documents, credit reports, employment contracts, bank statements and more, for a full assessment.

How We Got The 90% Cash Out Refinance Approved

The main challenges lay in explaining the low credit score and the arrears in council rates. This was done with extensive Broker Assessment Notes offering a good explanation for the couple’s credit issues. Our broker provided these to lenders, highlighting that the couple both had stable jobs, their credit issues were behind them, and their income could service the loan amount applied for with a surplus.

After getting a holistic view of the couple’s financial situation, Mandy worked on identifying possible lenders and sending out loan scenarios.

After multiple specialist lenders said they couldn’t do the cash out or they could provide only up to 70% LVR, there was one lender that was ready to assist.

There were still a few issues that needed to be addressed, though. For one thing, the couple’s investment property was in a CAT-5 location, which typically means a cap of 80% LVR on any loans secured on property in that area. But our broker was able to get an exception to this, after much back and forth, and get the loan approved.

Ultimately, the couple was able to get the 90% LVR refinance with cash out, which they used to pay their debts. The couple is now preparing to buy a house in the next six months.

Are You Looking To Do A Cash Out Refinance?

If you’re looking to do a cash out refinance to invest, buy a house or pay off debts, then speak with one of our specialist mortgage brokers by calling us on 1300 889 743 or fill in our free assessment form.