Making an offer on a house below the asking price is all about knowing what the property is worth and adjusting your offer based on market conditions and the vendor’s motivation for selling. By gauging these factors effectively, you can craft an offer that is competitive yet realistic, ensuring you don’t miss out on the opportunity. The key is to align your offer with market trends and the seller’s urgency, which can increase your chances of success in negotiating a lower price.

Let’s get into more details.

How Much Below The Asking Price Should You Offer?

Generally speaking, before COVID-19 lockdowns, 75% of all houses sold by private treaty were sold at a discount to the listed price. The discounts varied but mostly were between 4% and 6%.

A low offer is anything below the average discount on a similar home in a similar area at the same time. For example, if you determine that there are few buyers in the market and you want to purchase a home for 10% less than the asking price, you might start off by offering 15% less. In rising markets, however, stick closer to the average discount.

To better understand how much below the asking price you should offer, you need to be able to gauge how hot the property market is and understand what is motivating the seller to sell. This information will help you come up with a realistic offer that gets accepted. Otherwise, you risk your offer being ignored. This is one of the main reasons new prospective homebuyers lose out at property negotiations.

What Are The Market Conditions?

There are three things we can look at to determine quickly how hot or cold the property market is:

- Auction clearance rates

- Average days on market

- Property market clock

1. Auction Clearance Rates

The auction clearance rate is the percentage of auctions that result in a successful sale, either at auction, before the auction or just after the auction.

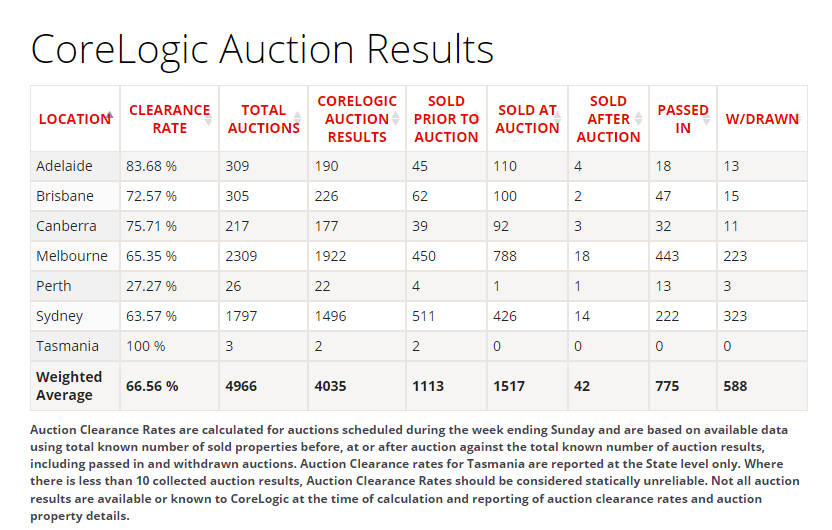

This data (example in the chart below) is freely available on CoreLogic’s website and helps quickly gauge how much heat is in the property market.

(Note: This chart is from 2022.)

What the auction clearance rate tells us about the market:

- 40%: falling market, buyers have the advantage

- 50%: steady or slightly falling market

- 60%: steady prices

- 70%: seller’s market

- 80%: strong seller’s market, which usually means prices are rising fast

- 90%: completely insane

In Sydney and Melbourne, the clearance rate is a reliable indicator, whereas in Perth and Adelaide, most properties are sold by private sale so the auction clearance rate isn’t that useful.

2. Days On Market

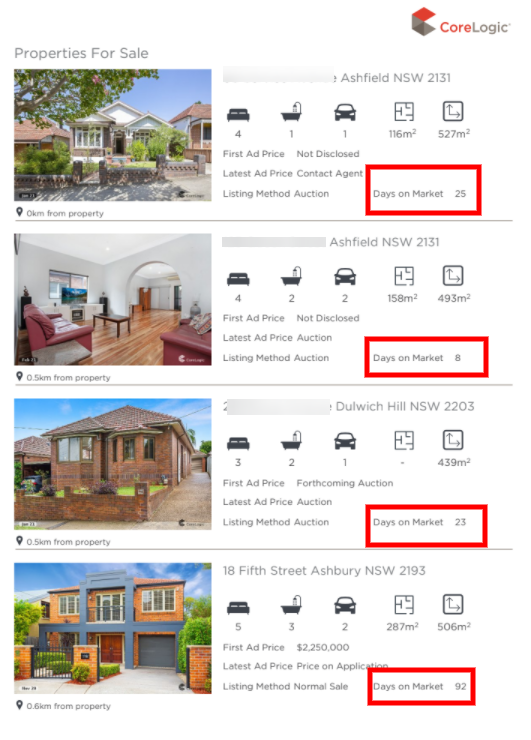

How long a property stays on the market is another useful metric to gauge buyer interest in a particular property or area. Fewer days on the market means there is more competition and you’ll need to make an offer closer to the asking price. More days on market means there is less demand/competition in the area and you can get away with offering less.

For example, if you find a house that has been on the market for 60 days but most recent sales in the area have taken 30-45 days, you can start off with a lower offer than the average vendor discount. This situation could also mean the vendor has unrealistic price expectations.

You can quickly find the average days on market for a suburb using property listing websites. These will also allow you to see how long properties you’re interested in have been on the market. Your mortgage broker can provide you with a suburb and property report for any homes in which you’re interested.

For free property and suburb reports, speak with one of our mortgage brokers today by giving us a call on 1300 889 743 or by filling in our free online assessment form.

3. Property Market Clock

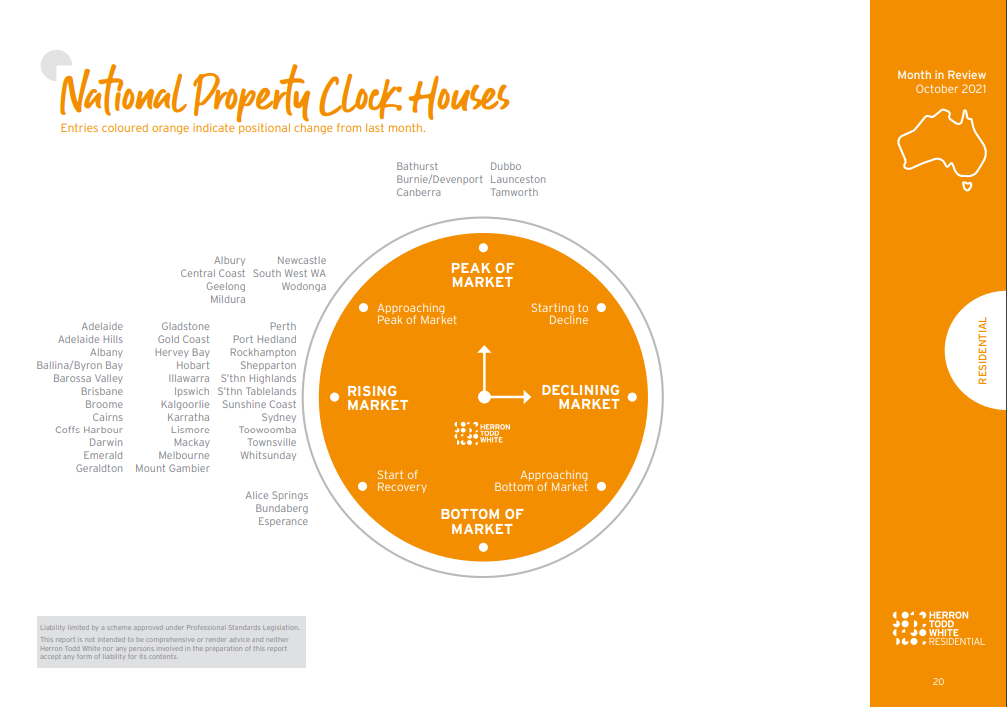

The Herron Todd White monthly report gives us an insight into where the major cities and regions are in their property cycle, using a ‘property clock’.

Making a lower offer can work when the market is declining or is at the bottom of its cycle.

Whereas, in a rising market, the chances of your lower offer getting accepted are slim.

For example, using the image above most cities are rising or are already at market peak, it means there are no opportunities for big discounts at this point in the cycle.

Get Enrolled For The

Home Buyers Program

Thinking of buying a home?

Learn how to buy a house and avoid costly mistakes in under 2 hours.

Learn MoreUnderstanding A Vendor’s Motivation For Selling

A low offer works best when the vendor requires a quick sale. So you also have to understand the seller’s motivation.

A quick sale is more common than one might think. Many homeowners who are selling have already found another property. This often means their real-estate agent is under pressure to finalise a sale quickly.

It could also be divorce, financial stress, plans to relocate for a new job, or a death that is forcing the homeowner to sell.

This is why it’s so important to talk to the real-estate agent and ask a lot of questions.

Remember, your offer, although low, should give favourable terms and conditions to the seller so that it is still attractive to them.

For example, a low offer with a shorter finance date and a quicker settlement date could attract a seller wanting a quick sale.

Alternatively, if the sellers are relocating for a new job in three months, they may prefer a longer settlement period so they do not have to move out of the property before they relocate.

Fast Track to Approval: Your Home Loan Checklist

A well-curated checklist to improve your chances of a home loan approval.

Disclaimer: Over the next few days, you’ll receive additional guides to help you on your homebuying journey. Occasionally, you’ll receive carefully curated home-buying tips, offers & schemes, and news articles. You can unsubscribe any time you want. View our Privacy Policy

How To Make A Counteroffer

Once you’ve made your offer, you may receive a counteroffer from the vendor, so you should be prepared to either accept it or make your own counteroffer.

For example, if a property is advertised for $700,000, and you put in a written offer for $625,000, the vendor might counter with $675,000, even if they are willing to sell for $650,000.

Be prepared to counter their offer but move quickly with this, as the seller may have other bidders.

How Do You Make A Low Offer In A Rising Market?

You should almost always make your offer below the asking price. But in rising markets, stick closer to the average vendor discount in the area where you’re looking to buy. Remember to consider the market conditions and vendor’s reason for selling, and adjust your offer accordingly.

If markets are rising, and you’ve found a property that you really like, you may have to pay a premium.

There is no better way to get information that can help you make this decision than to go to property inspections and auctions, and talk to real-estate agents.

Should I Make A Verbal Or Written Offer?

It is generally recommended that you put your offer in writing. This is because even if a verbal offer is accepted, there is no guarantee the vendor will honour it.

You should always get your conveyancer to help you put your offer in writing.

Do You Need A Pre-approval To Make An Offer?

As discussed above, price isn’t the only factor vendors are considering when looking at offers. They’re also looking at the buyer.

A buyer with a pre-approval is more likely to be seen as serious, especially if the vendor requires a quick, decisive sale. It helps them avoid uncertainty with settlement and finance dates.

To get pre-approved, please speak with one of our specialist mortgage brokers by giving us a call on 1300 889 743 or by filling in our free online assessment form today.