Updated: 12 Jul, 2024

After the largest decline in house prices in the last 30 years, Sydney and Melbourne have seen dwelling values rise for the first time since 2017.

So what do the experts have to say?

BIS Oxford Economics' Price Predictions

According to the latest BIS Oxford Economics Residential Property Prospects 2019 to 2022 report, in the next three years, the median property prices are exected to rise by:

- 20% in Brisbane

- 11% in Adelaide

- 10% in Canberra

- 7% in Darwin, Melbourne and Perth

- 6% in Sydney

- 4% in Hobart

- “Stability within the federal government along with the removal of uncertainty surrounding changes to negative gearing benefits and capital gains tax discounts.”

- “A raft of announcements such as the central bank’s two rate cuts, relaxing lending guidelines and a record-low interest rate environment.”

- RBA’s interest rate cuts in June and July

- Prudential Regulator (APRA)’s eased loan assessment requirements

- Election results delivering certainty around taxation for housing

- Confidence is highest in WA (up 25 to +48 points)

- Qld (up 37 to +42 points), where expectations for house prices are also strongest

- Confidence levels in NSW (up 31 to +5 points) turned positive for the first time since Q1 2018

The report stated affordability, easing credit conditions and lower interest rates will act as a catalyst for this growth.

Reserve Bank Of Australia's Comments

RBA’s board members noted that “Conditions in the established housing markets of Sydney and Melbourne had improved a little since the previous meeting,”.

“Housing prices had stabilised in June in these cities, and auction clearance rates had picked up further, albeit still on low volumes.” – they added.

It is clear that RBA officials believe that the current downturn has run its course.

In addition, a recent paper by two Reserve Bank researchers who were not representing the central bank’s view estimated that with interest rates already very low, a percentage point drop in the expected long-term real mortgage rate would boost housing prices by 28% in the long run.

CoreLogic’s Home Value Index

Dwelling values in Sydney and Melbourne rose for the first time since 2017 last month, according to CoreLogic’s June Hedonic Home Value Index with a modest increase of 0.1% and 0.2% respectively.

Tim Lawless from Core Logic attributed the increase to:

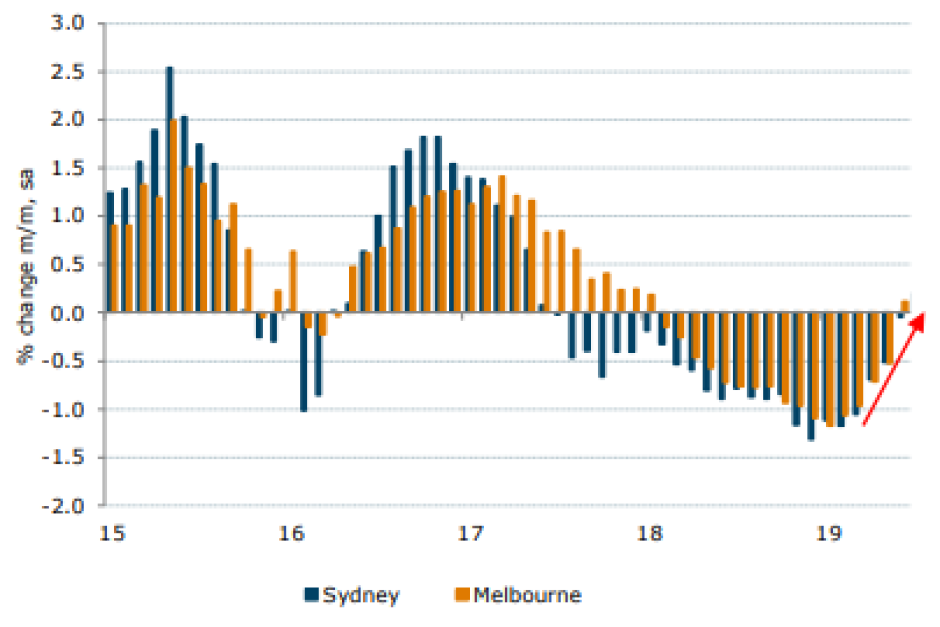

This graph of seasonally adjusted monthly house price moves, based on CoreLogic data, tells the story.

High Auction Clearance Rates

High auction clearance rates are an indicator of positive property sentiment.

Capital city auction markets recorded the highest preliminary clearance rate in over a year, reaching 70.6%. This follows last week’s final clearance rate of 65%.

Sydney had the highest preliminary clearance rate of 81.5% across a total of 303 auctions this week, followed closely by Melbourne at 70.0% and Canberra at 60.0%.

ANZ Research's Report

ANZ’s research said it expects dwelling values to bottom out and rise in the later months attributing it to easing policies and a lift in property sentiment.

They noted that people’s property sentiment has shifted from “one of pervasive negativity to cautious optimism” mainly due to:

They forecasted housing growth of 3% in 2020.

NAB Residential Property Survey

NAB released their Residential Property Survey Q2 2019 after surveying 350 property industry panellists about their thoughts on current market conditions and their forecasts for the future.

The key takeaway from the index:

Overall, the market confidence index is expected to climb up to +45 points in the next two years – markedly up from the last index when the index was forecast to +21 points more over this period.

NAB’s quarterly report also highlighted that new developments included a rebound of foreign buyers.

The report reads: “Interestingly, the trend of decline in foreign buyers of new property in 2018 and early 2019 reversed, with their market share rising to 7.1 per cent in Q2, led by a sharp jump in Vic (12.1 per cent).”

“Against a backdrop of falling house prices and interest rate cuts (with the possibility of more to come), the number of local investors in new housing and established markets also bounced but remain well below survey average levels” the report noted.

The report concluded with NAB’s view that “prices will stabilise in the near term and remain broadly flat over the next year or so. Previously, we had expected further falls of around 5 per cent in Sydney and Melbourne,”.

Are you planning to buy a property?

First home buyers saw their borrowing power increase by 15%, while investors saw an increase of 15% to 30% after banks were allowed to set their own assessment rate by prudential regulators (APRA).

This combined with RBA’s back to back rate cuts has created a record-low interest rate environment which is expected to persist; making it an ideal time for prospective buyers to enter the property market.

If you’re a prospective buyer, now is the time to get pre-approved.

Anecdotally, several real estate agents have informed us that many property owners are planning to put their properties up for sale this spring. Any buyer who is preapproved will be able to act quickly, giving them an advantage over other buyers.

Please give us a call on 1300 889 743 or fill in our online assessment form to speak with one of our award winning specialist mortgage brokers.

Can anyone predict the future?

It’s exciting to see the green shoots in the property market and so many experts giving positive news. However, it’s important to remember that nobody can predict the future.

Markets change, unexpected things happen and experts can be wrong. Ultimately the decision to buy a property is yours, and you should consider your personal circumstances, research the market and if need be then seek independent financial advice before you act.