Updated: 09 May, 2025

Table of Contents

- How much extra are borrowers paying on their home loans?

- Why are people not switching lenders?

- What are discretionary discounts?

- Complicated home loan discharge process

- ACCC’s recommendations

- You can save money by switching lenders

- What are the benefits of switching home loans?

- Are you happy with your current home loan?

Australians with older home loans are losing thousands of dollars by not checking for better home loan rates.

Borrowers are spending far too much repaying their home loans by not seeking a lower interest rate from their exisitng lender or switching to a new lender.

You could be saving thousands of dollars on your home loan if you just make the switch!

The Australian Competition and Consumer Commission (ACCC) has published its final report on the home loan price inquiry, that began in October 2019.

An interim report published in April 2020 that focused on prices charged revealed that existing home loan customers paid a higher interest rate compared to new customers.

How much extra are borrowers paying on their home loans?

Dubbed the “loyalty tax“, an existing customer with a home loan between three and five years was paying a 0.58% higher interest rate compared to new customers.

According to ACCC’s final report, the following was the average difference in interest rates paid by new and existing variable rate customers as of September 2020:

| How long has the existing customer held the mortgage? | Average difference in interest paid |

|---|---|

| Less than 1 year | 0.29% |

| Between 1 and 3 years | 0.47% |

| Between 3 and 5 years | 0.58% |

| Between 5 and 10 years | 0.71% |

| More than 10 years | 1.04% |

The final report focused on identifying challenges that customers faced when switching lenders and making cost-effective recommendations to address these challenges.

Why are people not switching lenders?

- They assume they won’t save much by switching lenders. Customers believe they are getting a better deal by staying with the current lender.

- They are not compelled to make the switch unless there’s a change in their circumstances (divorce, moving house, etc.)

- Their existing lenders are offering discretionary discounts to dissuade them from switching lenders.

- Borrowers do not have easy access to transparent pricing regarding their home loans.

- The home loan discharge process is too complicated and varies vastly from lender to lender.

What are discretionary discounts?

In its April 2020 interim report, the ACCC reported that borrowers did not have easy access to transparent pricing information about home loans due to opaque discretionary discounts.

Discretionary discounts are offered by lenders on a case by case basis after the lender has assessed the customers’ applications. These discounts are not advertised on their websites.

The presence of discretionary discounts means:

- Borrowers face high search costs to determine the actual price lenders charge form home loans.

- Borrowers have a weaker negotiating position since they’re not aware of the competitive prices available even if they’ve spent time and effort to find a home loan that suits their needs, due to the lack of sufficient information.

- Borrowers are paying more on their home loan when they could have opted for a competitive interest rate.

- A customer would have to apply with a lender to know what discretionary discounts or interest rates are available. Lodging too many home loan enquiries in a short time span will affect their credit score.

Complicated home loan discharge process

The Mortgage and Finance Association of Australia (MFAA) said that it had received reports of lenders taking between 15 days and 40 days to discharge a mortgage.

The challenges that borrowers face during the discharge process are:

- The lengthy and complicated discharge process deters borrowers from switching to a better-suited lender.

- Also, lenders employ retention strategies to persuade existing customers to stay. This can confuse customers who are trying to make the decision that is right for them when choosing between lenders.

ACCC’s recommendations

| Challenges | Recommendations |

|---|---|

| Existing home loan customers are not motivated to switch. | Lenders should provide customers with a prompt communicating the benefits of switching. |

| They were not aware of the benefits of switching lenders. | Lenders should use a standardised discharge authority form that is easy to access, fill out and submit. |

| Borrowers did not have easy access to transparent pricing information about their home loans. | Lenders should have a maximum time limit to complete the discharge process. |

| The discharge process is too complicated and varies from lender to lender. | The ACCC should continue to inquire into and monitor competition and pricing in the home loan market under government direction. |

These recommendations will not come into effect without discussion and consultation from the relevant stakeholders.

You can save money by switching lenders

ACCC’s report noted that the big four had granted price reductions, including discretionary discounts to over 600,000 home loans in the 12 months to 30 September 2019.

The borrowers would have faired better if they had switched.

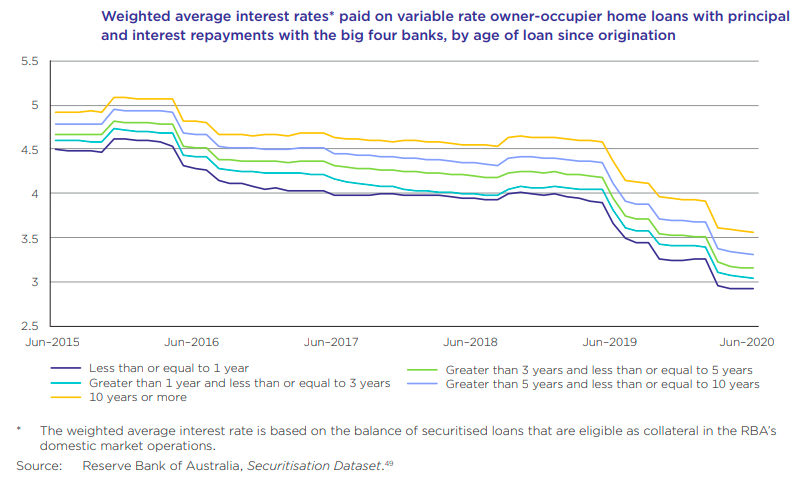

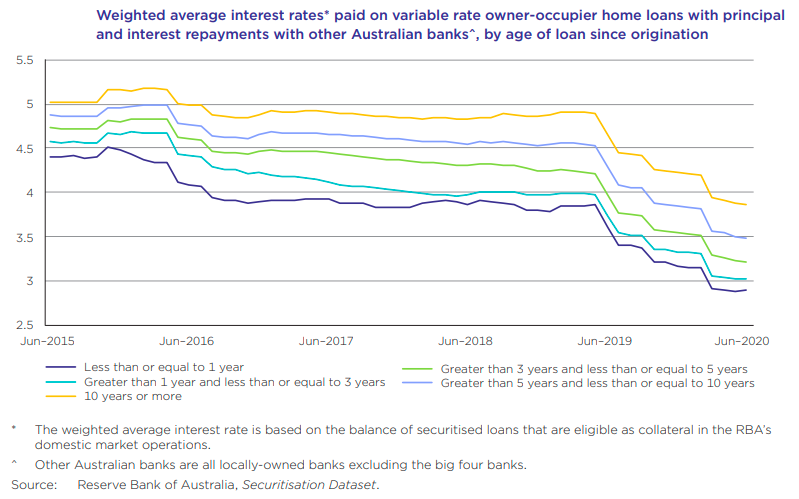

The Reserve Bank of Australia (RBA) also observed that as of December 2019, as the borrower’s home loans get older, the gap between what existing and new customers paid widened:

- Those with home loans between 3 and 5 years old paid, on average, around 58 basis points above the average interest rate for new loans.

- Those with home loans between 5 and 10 years old paid, on average, 71 basis points above the average interest rate for new loans.

- Those whose home loans were greater than 10 years paid, on average, 104 basis points above the average interest rate for new loans.

What are the benefits of switching home loans?

Besides the huge savings by switching lenders, the other benefits are:

- You get a home loan that suits your changing circumstances.

- Lenders will be incentivised to innovate and offer better home loan products due to pressure from their customers.

- Customers will get product features like offset and loan structuring (split mortgage options, take an extended interest-only repayment period or an extended fixed interest rate period.)

- Better customer service through the use of technologies like mobile apps, online banking, access to services and features through physical branches.

Are you happy with your current home loan?

Do not be complacent with your home loan. It’s good practice to annually review your home loan so that you’re getting a good deal in your current situation.

You can take the help of mortgage brokers when you’re switching home loans or reviewing your home loans.

- The switching process might seem daunting and lengthy, but our mortgage brokers can help you save the legwork. We’ll guide you through the documents and information required to discharge your existing loan.

- We will assess your situation and recommend a home loan product that fits your goal and situation.

- We are legally obligated to operate under Best Interests Duty. We will outline our reasons as to why we’re recommending you the home loan. We will outline the benefits of choosing the recommended home loan and its additional features.

- We have over 50 lenders on our panel, each specialising in niches from bad credit, low doc loans, low deposit, etc. We are experienced in helping borrowers in complex lending situations and know the complicated credit policies of our panel of lenders.

- We let you know upfront how much it would cost when you want to switch lenders or home loan products.

- We can negotiate a competitive interest rate based on the strength of your application.

Whether it’s negotiating a lower interest rate or better features on your home loan, our mortgage brokers are here to help.

Call us on 1300 889 743 or fill in our free assessment form.