Updated: 29 May, 2025

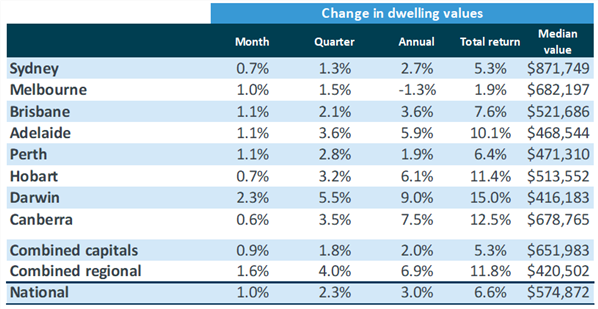

In 2020, overall Australian home values were 3% higher, with regional housing values rising by 6.9% – over three times higher than that of combined capitals.

In December, the national home value index rose 1%, which was the third consecutive month-on-month rise in home values – following a sharp 2.1% drop between April and September.

Source: CoreLogic Home Value Index, December 2020

So what happened to Australia’s housing market in 2020?

It’s no surprise that there was an immediate drop in property transaction activities due to COVID-19 restrictions.

However, as Australia was able to flatten the curve by taking swift actions to manage the crisis, restrictions slowly eased.

With the ease of such restrictions, combined with the reduction in interest rates and an easing of lending criteria, buyers became confident to enter the property market. In summary:

- Regional markets performed better than capital cities, as working from home and remote working opportunities became available.

- All capital cities, except for Melbourne experienced a higher gain for houses than units. Unit values were only 0.2%, compared to 2.6% for housing.

- 4 of the 8 capital cities experienced dwelling values lower to their previous peaks. These cities were Sydney, Melbourne, Perth and Darwin. Melbourne’s value was 4.1% lower than their March 2020 peak, Sydney’s was 3.9% below it’s July 2017 peak, Perth’s values and Darwin’s values remain 19.9% and 25.7% respectively below their 2014 peaks.

- Rental yields suffered downwards pressure throughout COVID-19. The rental yields across combined regional areas reduced from 5.03% in 2019m to 4.83% in 2020.

- The total number of residential dwellings advertised for sale remained low throughout 2020. There was a peak in November with 165,000 properties listed, but it was still 18% lower than the same period in 2019. At the end of 2020, there were 21% fewer properties for sale than at the end of 2019.

- However, despite the low listing numbers, annual home sales were 8% higher compared to 2019.

- Auction conditions were volatile during 2020, with a large number of auctions withdrawn during the lockdown as a result of a ban on home inspections and onsite auctions. As the year progressed, auction clearance rates regained traction and held firm around 70% since the first week of November to end December 2021.

- Homes are selling faster. Across combined capital cities, the median days on market reduced from 43 days over the three months ending July to 33 days throughout the December quarter.

- Vendors were also discounting their asking prices, with median discounts reducing from 3.6% to 2.8%.

2020 was a year of extremes for Australia’s property market. Home values were resilient to the massive price falls, even during the worst of the COVID-19 downturn.

In the final quarter of 2020, housing markets across the country experienced a rise in value due to strong demand and low advertised supply.

Will there be distressed properties in 2021?

The risks associated with the ending of the mortgage deferral period and fiscal support have diminished.

The mid-year economic and fiscal outlook estimates that around 600,000 fewer employees will need JobKeeper through December.

According to the Australian Prudential Regulation Authority (APRA), home loan deferrals dropped $68.2 billion in October, down from $195 billion in June.

As the March 2021 deadline for mortgage deferrals is approaching, it seems less likely that there would be significant distressed properties coming onto the market.

However, the new restrictions associated with COVID-19 could set back the economy and cause a negative albeit temporary impact on the housing market.

What are the predictions for Australia’s property market in 2021?

- The Reserve Bank of Australia (RBA) has said that the cash rate will remain low for at least three years. This means that mortgage interest rates would remain low. Borrowing money to buy a home would be cheaper and low interest rates would also increase buyer confidence.

- Australian expats are returning home. These expats usually consist of young families who are looking for areas where they can raise their family. Also, with banks and lenders adopting a digital home loan process, it is possible for them to secure a mortgage.

- The housing market will still experience an undersupply, as there will be a higher demand for properties.

- People will be looking for homes with backyards, a space for home offices and space where their children can learn. With low interest rates, home buyers would be willing to stretch their spend to secure these homes.

- Buyers would be shying away from newer developments and turning towards older apartment blocks. There will be a shortage of older apartment blocks as they’re in high demand.

- Seasoned investors would sell off poor performers and upgrade to better quality investment to add to their portfolio.

- First-time investors are keen to jump in and reap the benefits of lower interest rates.

- This would be a great time for first home buyers to get onto the property ladder, with a range of government incentives. As prices are increasing, young Australians might need to take the help of their parents to enter the market.

Are you buying property in 2021?

Whether it’s your first time buying a home, or you’re adding to your property portfolio, discuss your property goals with our mortgage broker.

We can help you achieve your property goals by discussing the right strategy and getting the mortgage that suits your situation. Call us on 1300 889 743 or fill in our free assessment form today.