Updated: 09 May, 2025

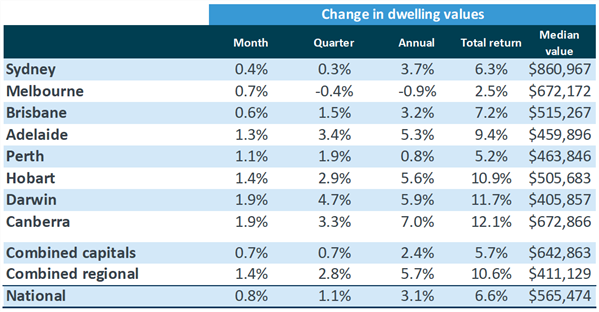

The Australian property market is continuing its recovery, with housing values for November 2020 rising 0.8%. This is on the back of the 0.4% rise in October 2020.

- Melbourne’s values experienced a 0.7% growth, surpassing the 0.4% and 0.6% growth experienced by Sydney and Brisbane respectively.

- Canberra and Darwin have recorded the highest growth at 1.9%.

- Adelaide, Hobart and Perth continue their trajectory, with values rising by more than 1%.

What are the signs of recovery?

- Housing demand is rising due to government stimulus measures like the extension of HomeBuilder and changes to stamp duty in Melbourne.

- The risk associated with repayment holidays period ending has lessened as mortgage holders are returning to their normal repayment schedule.

- Regional areas are outperforming their capital cities, with a combined growth of 1.4% compared to 0.7% for capital cities. Queensland led the growth, with a 3.2% rise in the three months to November followed by New South Wales at 3.1%.

- The unit market is underperforming due to low investment activity, high levels of stock, and weak rental conditions. Capital city unit values fell 0.6%; however, house values experienced a 1.1% rise.

- CoreLogic’s settled sales estimates over the past three months from November 2020 were 1% higher than the same period last year.

- The auction clearance rates were 70% in November, which is above the decade average of 61%.

According to CoreLogic’s Head of Research, Tim Lawless, “Low advertised stock levels, together with a rising number of active buyers, is creating a renewed sense of urgency in the market. Buyer demand is mostly fueled by a surge in owner occupiers rather than investors, looking to take advantage of historically low interest rates, generous government incentives and an increased state of normality.”

Why didn't the Australian property market crash during the pandemic?

Eliza Owen, head of Residential Research Australia, outlined the following factors that explain why our property market did not plunge:

-

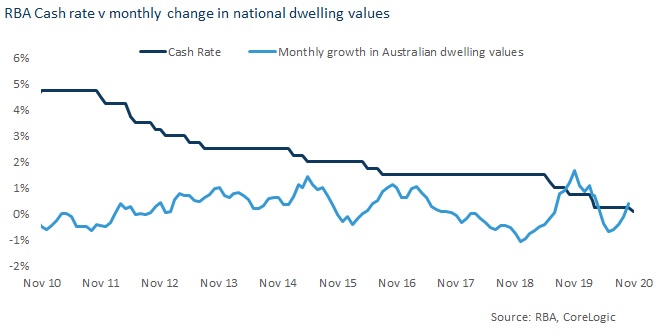

- The Reserve Bank of Australia (RBA) reduced the cash rate to stimulate economic activity, which lowers bank funding costs and encourages banks to offer low mortgage rates. The official cash rate sits at 0.1%. RBA research suggests that a 100 basis reduction in cash rate could lead to an 8% increase in property values over two years.

- As banks and lenders were offering the option for repayment holidays to borrowers who were affected by COVID-19, this reduced the need for forced sales. For borrowers who deferred their mortgage repayments, they did not have to sell their homes, which contributed to low levels of stock throughout 2020. The low level of stock insulated dwelling values.

- People working in hospitality, tourism and arts faced job losses during the pandemic. However, this cohort was less likely to have mortgage debt.

- The Australian property market is not one homogenous market. There have been corrections in property values since March 2020. The Inner East of Melbourne experienced a 9.6% decline. On an aggregate level, the severe loss in housing values has been contained.

Wouldn't the low rates cause a housing bubble?

With interest rates at historic lows, this has the potential to create a housing bubble.

Philip Lowe, the Governor of the Reserve Bank of Australia (RBA) commented on this.

“At the moment I’m not particularly concerned about housing prices rising too dramatically, largely due to population growth dynamics. Sydney and Melbourne have been most affected by the rapid slowdown in population.”

Lowe is optimistic for first home buyers because:

- First home buyers can buy the property they’ve wanted as interest rates are low, and will remain low.

- Housing prices across Australia are no higher than they were three years ago.

- People are responding to the incentives that federal, state and territory governments have laid out.

- There is strong demand from first home buyers.

Young Australians geared to buy their first home

New research by Westpac revealed the pandemic is influencing home ownership goals for young Australians.

Before COVID-19, only 7% were hopeful to buy their first home. The number has increased to 16% of the cohort hopeful to buy their first home in the next five years.

- 54% no longer want to keep paying rent.

- 39% are looking for stability.

- 37% are looking for financial security.

48% are more optimistic about entering the property market than they were 12 months ago due to factors like:

- House prices

- Low-interest rates

- Opportunity to live in new locations

The research also found that nationally 59% of young Australians (Gen Z) have reconsidered the type of suburb or area they want to live in.

They are looking to buy their first home in the following locations:

| Capital City | Distance from city centre | First home location |

|---|---|---|

| Sydney | Up to 10 km from city centre | Western suburbs Sydney CBD inner-city suburbs Northern suburbs (e.g: Ashbury and Marrickville) |

| Melbourne | About 20-40 km from city centre | Eastern suburbs Northern suburbs Melbourne CBD inner-city suburbs (e.g: Mitcham and Croydon) |

| Brisbane | About 10-20km from the city centre | Brisbane CBD inner-city suburbs Northern suburbs Southern suburbs (e.g: Chermside and Zillmere) |

| Perth | Up to 10km from the city centre | Northern suburbs Perth CBD inner-city suburbs Eastern suburbs (e.g: Dianella and Nollamara) |

| Adelaide | About 10-20km from the city centre | Southern suburbs Northern suburbs Western suburbs (e.g: Bedford Park and Bellevue Heights) |

Whether you’re a first home buyer researching the property market and looking for a home loan, or a seasoned investor looking for your next investment opportunity, our mortgage brokers are here to help.

Call us on 1300 889 743 or fill in our free assessment form.