Updated: 29 May, 2025

Did you know following the introduction of comprehensive credit reporting, your credit score can drop by 22% following just one missed credit card repayment? – even if you’ve never missed any credit card repayments before this.

Misconceptions surrounding comprehensive credit reporting

According to a 2019 study by Experian (one of the three largest credit reporting body in Australia):

- Young adults aged between 25-34 years have seen a consistent increase in their credit scores since CCR was rolled out. However, despite being the most impacted age group, millenials are also the least aware (30% unaware).

- Close to half (48%) of Australians surveyed were still unaware that credit providers in Australia were sharing more personal financial data. The Big Four banks have already started sharing most of their credit data with credit reporting bodies such as Equifax, Experian and Illion since Septemeber 2019.

- Almost all Australians (95%) surveyed believed that paying their utility bills on time improves their credit score. When in practice, it has no impact whatsoever.

- 90% of Australians believed having high-value assets improves their credit score. It doesn’t.

Key concept of comprehensive credit reporting

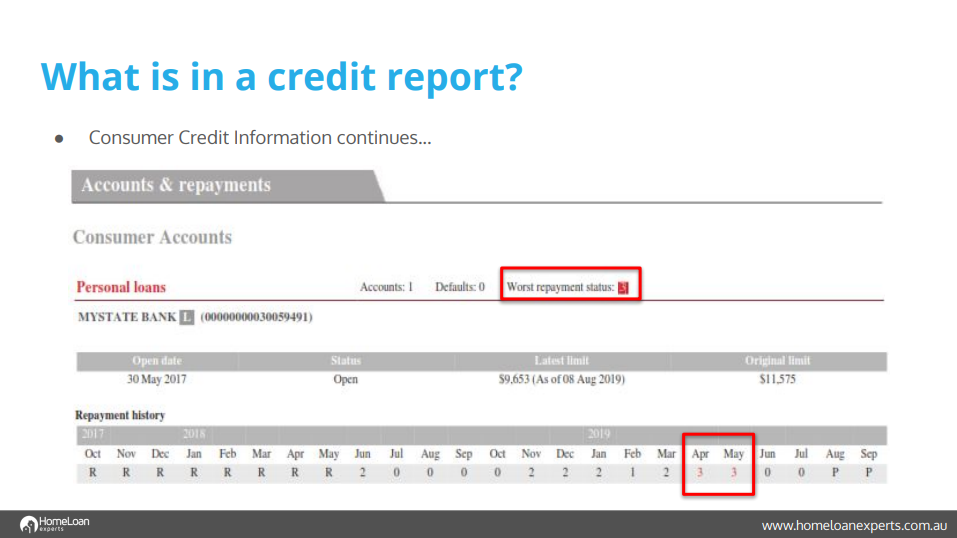

The most significant change for consumers is the 24 month repayment history, historically only negative information (such as defaults, bankruptcies etc.) were captured and reported.

This can be beneficial as the inclusion of ‘positive’ information can balance out the ‘negative’ information previously reported.

As you can see, monthly repayment history on credit accounts such as mortgages and credit cards are shown for the last 24 months. This reflects whether you have paid the minimum amount required on time each month or not.

What does each CCR code mean?

The codes are set out under the Australian Credit Reporting Standards (ARCA) and are a quick way for lenders to scan your repayment history.

The scores are explained below:

- O: Account paid on time

- 1: 0-29 days overdue

- 2: 30-50 days overdue

- 3: 60-89 days overdue

- 4: 90-119 days overdue

- 5: 120-149 days overdue

- 6: 150-179 days overdue

- X: 180+ days overdue

- C: ‘Account is closed’

- A: ‘Not associated’

- R: ‘Not reported’ – the bank or credit provider didn’t provide payment history for this period, which is a fault with the credit provider, not necessarily you as an account holder.

- P: ‘Pending’ – purchases made with a credit or debit card that are pending (for up to 5 days) but have been deducted from your available funds until the merchant finalises the payment.

- O: ‘Other’

- T: ‘Transferred’ – a balance transfer of your debt with one lender to another usually to save on interest repayments on a credit card or store card.

How do you adjust to comprehensive credit reporting?

Here are 3 steps to help you take control of your credit score in this relatively new environment.

Step 1: Make your repayments on time

Any repayment that is due over 2 weeks stays on your credit report as a late repayment for up to 2 years.

Timely repayments have never been this important as a single missed repayment can drop your credit score by 22%.

This drop increases to 26% with two missed credit card repayments, and a staggering 42% for those with three or more missed credit card repayments in the last three months.

Since, you can’t afford to miss a single repayment, here are some tips to manage your repayments:

- Set up a direct debit so you can avoid simply forgetting to make repayments.

- Set up notification with due dates for all your credit acccounts.

- Ensure you have enough funds in redraw if you are going on holiday

- Close any unused or rarely used credit facility.

Step 2: Get your credit report and track your credit score

One of the most worrying finding was that 59% of consumers surveyed hadn’t checked their credit scores, and only 15% checked their scores regularly.

Get a free credit report from one of the three credit reporting bodies directly. Remember you’re entitled to one free credit report every year.

Better yet, track your credit scores online via one of their partners.

- Equifax (formerly Veda) is Get Credit

- Experian is Credit Savvy

- Illion (formerly Dun & Bradstreet) is Credit Simple

Signing up to their online service is pretty simple. You’ll require one form of ID such as your drivers’ license or medicare card to sign up.

Step 3: Avoid multiple late repayments

If you’ve already missed a repayment, avoid multiple late repayments as they impair your credit rating to a point where it could impede your ability to get credit at competitive rates in the future.

Why you should welcome CCR?

Overall, CCR will allow credit providers to better verify loan applications and assess credit risk by accessing your full repayment history, including your total debt leading to better turnaround times and accurate assessment.

For example, recently, Macquarie adopted CCR as such they no longer require home loan statements for home loans being refinanced. This saves time and effort on all fronts.

CCR will also help consumers with bad credit, who have demonstrated a good repayment history since then, as lenders will take this into consideration when assessing a deal.

For a more indepth coverage of CCR, please refer to our comprehensive credit reporting page.

Do you have a low credit score?

Applying with the right lender is key to geting approved with a low credit score. As such, we can usually find you a solution from our panel of 40 lenders.

For all your home loan needs, speak with one of our award-winning specialist mortgage brokers by giving us a call on 1300 889 743 or by filling in our short assessment form.