Updated: 18 Apr, 2025

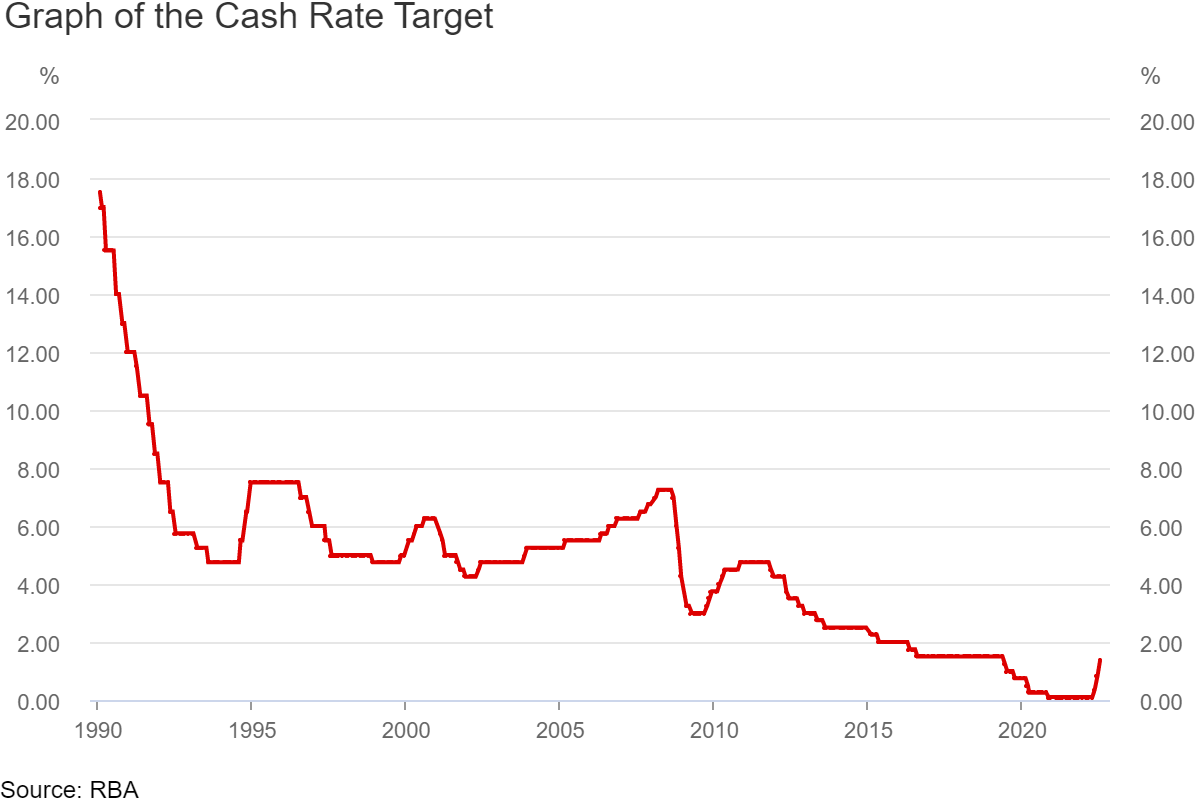

The Reserve Bank of Australia (RBA) increased the cash rate by 0.50 percentage points in July, taking it even higher, to 1.35%.

How Does The Cash Rate Increase Affect My Interest Rate?

Lenders add a margin to the official cash rate to determine the variable interest rate at which they lend to customers. So if you have a variable interest rate, then it will almost certainly go up with the increase of the cash rate.

Did The Big Four Pass On The Rate Rise?

All the big four banks will be passing on the rate increase on their variable-rate home loan interest rates in full:

- ANZ: 0.50 percentage points, effective from 15 July 2022

- CBA: 0.50 percentage points, effective from 15 July 2022

- NAB: 0.50 percentage points, effective from 15 July 2022

- Westpac: 0.50 percentage points, effective from 20 July 2022

How Much Is My Monthly Repayment Going to Increase?

The following chart shows how much the extra .50 percentage points (or 50 basis points) in interest will cost homeowners, based on the size of their loan. (These example loan repayments were determined using our repayment calculator, based on the lowest variable rate we can offer over a 30-year term as of 5 July 2022. Rates are subject to change from this date.)

| Loan Amount | Before Increase (2.51%) | After Increase (3.01%) | Difference |

|---|---|---|---|

| $500,000 | $1,978 | $2,111 | $133 |

| $600,000 | $2,374 | $2,533 | $159 |

| $700,000 | $2,769 | $2,955 | $186 |

| $800,000 | $3,165 | $3,377 | $212 |

| $900,000 | $3,561 | $3,799 | $238 |

| $1 million | $3,956 | $4,221 | $265 |

How To Lower Your Repayments

Home Loan Experts CEO Alan Hemmings gives tips on how you can minimise your mortgage repayments:

- Make additional or more frequent repayments if you can afford the more regular or increased repayments.

- You can change your repayment schedule from monthly to weekly or fortnightly.

- You can pay more than the minimum and maintain the difference as interest rates increase. This depends on whether you can maintain the additional repayments as interest rates continue to rise

- Ensure you are on a competitive interest rate. We still have a few lenders whose variable rates are below 3%. (That may change following the latest increase.)

- Use an offset account to reduce the interest payable on your mortgage.

What To Do Now

- For homebuyers, find out what your borrowing power will be with the new interest rates, to see if you can afford a home loan.

- For homeowners, review your current home loan to ensure you’re getting a competitive deal. If not, refinance.

- Negotiate with your current lender and try to get a lower interest rate.

Home Loan Experts can help. Our mortgage brokers know how to get you the best rate in a rising market or refinance to keep your home loan competitive. Call 1300 889 743 or enquire online to speak to one of our expert brokers today!