Updated: 22 Jul, 2024

Metropolitan Melbourne and regional Victoria are currently in the third stage of the government’s COVID-19 recovery plan.

Following a series of lockdowns designed to bring the COVID-19 outbreak under control, Victorian real estate is slowly moving back towards “business as usual”.

What are the signs of Melbourne’s property market recovering?

- Melbourne held 604 auctions with a clearance rate of 75.8%, in the week ending October 2020. This time last year, there were only 255 auctions, with a clearance rate of 69%.

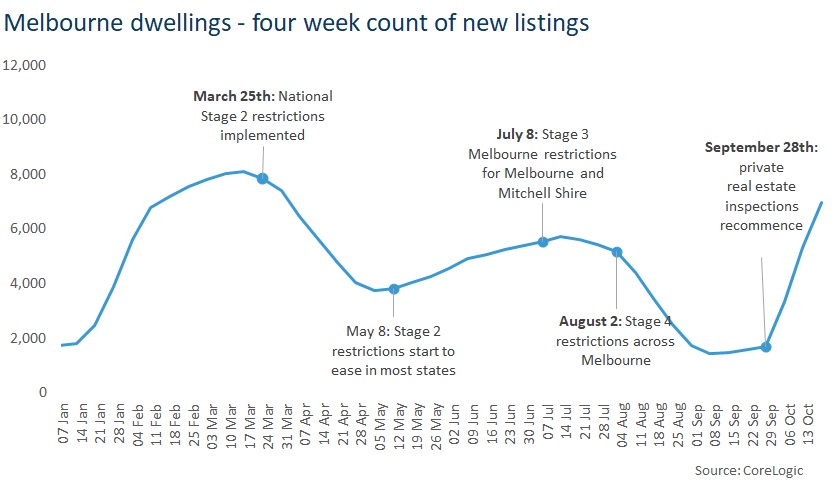

- The number of new listings in Melbourne increased 330% in the four weeks ending 18 October 2020. This brought stock levels up to 6,974 from the 1,606 new listings in the previous four-week period.

- New listing volumes have increased since onsite inspections were allowed from 28 September 2020.

- New stock added to Melbourne’s market increased to 5,379 properties, but the change in stock was only 4,790, suggesting the stock on the market has been absorbed over the past 4 weeks.

However, the increase in stock across Melbourne could mean:

- The property market is on the rebound, with vendors choosing to sell to meet the rising demand OR

- Forced selling is a possibility, with households in Victoria not being able to make mortgage repayments.

Elizabeth Owen, CoreLogic Head of Research points out that large increases in property listings are a signal of a rebound.

After months of restrictions, the pent-up demand from sellers has led to more stock being added for sale in Melbourne.

“However, due to the lag between an initial property listing and a sale, it will be a few weeks before we can understand how strong buyer appetite is,” Owen adds.

Melbourne’s Home Value Index

| Date | Home Value Index | Median Value |

|---|---|---|

| 30 June 2020 | -1.1% | $683,529 |

| 31 July 2020 | -1.2% | $678,334 |

| 31 August 2020 | -1.2% | $667,520 |

| 30 September 2020 | -0.9% | $666,796 |

| 31 October 2020 | -0.2% | $666,240 |

Table: Melbourne’s Monthly Home Value Index (CoreLogic)

October experienced the lowest decline since June 2020 at 0.2% as private home inspections were reintroduced, leading to a surge in new property listings, a recovery in buyer activity and an increase in clearance rates.

If this trend continues, Melbourne might experience a recovery like other capital cities over the coming months.

What property restrictions are in place in Victoria?

From 27 October 2020, if you live in metropolitan Melbourne, you can move house within the area. Besides moving houses, you can also:

- Attend a property inspection or auction in regional Victoria remotely.

- Accept the help of your friends and family to move house.

- Put your home on the market for private sale or auction.

- Attend auctions on-site with up to 10 people, plus the people needed to conduct the auctions.

- Conduct pre-arranged property inspections for private property, commercial and display homes for up to 10 people.

- Allow tradespeople into your home to carry out repairs and maintenance.

Thanks to a lower number of active cases and a slower rate of local transmission, regional Victorians were a step ahead of their metropolitan counterparts, having moved into stage 3 on 16 September 2020.

From 8 November 2020, an easing of lockdown restrictions will allow property buyers to travel between metropolitan Melbourne and regional Victoria for private inspections and auctions.

Are you looking to buy property in Melbourne now?

As Melbourne is showing signs of recovery, and Australia’s property market has recorded its first rise in the national home value index since April, consumer confidence is increasing and low-interest rates are likely to incentivise people to purchase homes.

Here are some tips to help you secure a property post-lockdown.

- Real estate agents and sellers are selling properties to buyers who are showing keen interest. Getting pre-approved for a mortgage is a good step to show that you’re a serious buyer.

- With auctions increasing in Melbourne, know the value of the property before you make a bid. Be auction ready to ensure you’re not overpaying for the property.

- Do not put in an offer without a contract. Take the help of our recommended conveyancers in Victoria.

Our mortgage brokers are here to help. Please call us on 1300 889 743 or fill in our free assessment form.