Updated: 29 May, 2025

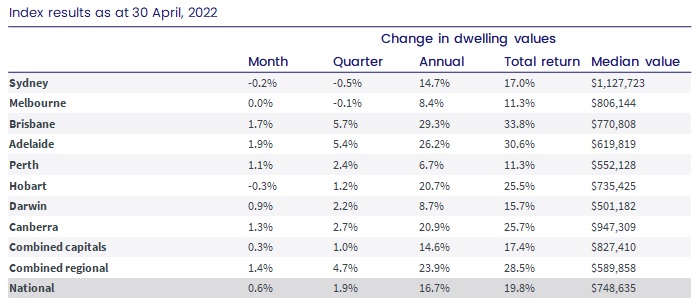

CoreLogic’s data revealed the home value index for April 2022 showed national growth of 0.6%. This is the lowest reading since October 2020.

Sydney and Melbourne are the two cities with the heaviest weighting in the home value index. Sydney was down 0.2% for the third consecutive month. Melbourne’s values flatlined in April. Hobart recorded its first decline (-0.3%) in 22 months.

Adelaide, Brisbane, Canberra and Perth all recorded a monthly growth rate above 1%.

CoreLogic research director Tim Lawless warned, however, that the trend of growth would ease in these areas. “Based on the rolling quarterly change, Brisbane dwellings moved through a peak rate of growth in December last year at 8.5%, slowing to 5.7% over the most recent three-month period. Similarly, Adelaide moved through a peak in the trend rate of growth in January at 7.4%, reducing to 5.4% in April.”

The exceptions were Perth and Darwin, where the rolling quarterly trend has gathered steam since last year. Housing values in Perth were up 2.4% over the three months to April, compared with the last quarter of 2021, when growth in the WA capital fell to just 0.4%.

“While ABS internal migration data by greater capital city is currently only reported to June 2021, the data points to a vast uplift in internal migration to Perth for the year (6,468), a substantial turnaround from the previous four-year average (-3,735).”

Regional Australia Property Market Update

The regional market remained insulated from the slowdown. Housing values were up 1.4% in April across the combined regional areas, compared with 0.3% for combined capitals.

The imbalance between available supply and demand is a key factor supporting housing price growth in regional Australia.

- Advertised stock levels were 42% below the previous five-year average.

- The volume of home sales was 20% above the previous five-year average.

The regional growth trend will slow down, however, as affordability constraints become more challenging.

The annual growth trend in home values dropped from a recent peak of 22.2% over the year ending November 2021, to 16.7% over the most recent 12-month period.

Lawless said we are likely to see a further loss of momentum in housing conditions over the remainder of the year and in 2023.

“Stretched housing affordability, higher fixed-term mortgage rates, a rise in listing numbers across some cities and lower consumer sentiment have been weighing on housing conditions over the past year. As the cash rate rises, variable mortgage rates will also trend higher, reducing borrowing capacity and impacting borrower serviceability assessments.”

Property Market Highlights

Here’s what happened to the property market in April 2022:

- Advertised inventory tracked almost 30% below the previous five-year average over the four weeks ending 24 April.

- The total advertised inventory was more than 20% below levels from a year ago in Brisbane and Adelaide, and around 40% lower than the previous five-year average in both cities. New listings were higher than normal; the shortage of available housing inventory was due to rapid absorption, as homes are selling quickly amidst high demand.

- Advertised supply levels have normalised in Sydney and Melbourne. Sydney’s advertised stock levels were in line with the previous five-year average. Listings in Melbourne were 8.2% higher.

- In Hobart, the new listing count was 46% higher over the four weeks to 24 April, compared with the same period in 2021.

- Buyer demand has declined. The quarterly number of sales was estimated to be 14% lower than at the same time a year ago.

- Most of the capital cities experienced an upward trend in rental growth in 2022. Nationally, rents were up 2.7% over the three months to April.

- House rents rose 9.1%, faster than unit rents (8.7%). However, this trend will change as demand for unit rentals increases.

- In Sydney, unit rents were up 3%, compared with 2% for house rents, over the three months ending in April. In Melbourne, unit rents were 3.6% higher, compared with 1.2% for house rents, over the past three months.

- The rolling quarterly change in rents outpaced the rolling quarterly change in housing values across most of the capital cities, which supported gross rental yields. Housing values were up 1.9% over the most recent three month period, while rents increased by 2.7%.

- Despite the upward trend, gross rental yields in Melbourne and Sydney were below historic averages, at 2.8% and 2.5%, respectively.

“On a rolling quarterly basis, we are now seeing unit rents rising faster than house rents, especially in Sydney and Melbourne, where rental conditions across the unit sector were previously much softer.

“The shift in rental demand towards units reflects both rental affordability pressures, which are deflecting more demand towards the ‘cheaper’ unit sector, and the return of overseas migrants and visitors. Rental demand from overseas arrivals tends to skew towards inner-city and higher-density precincts,” Lawless explained.

Rising Interest Rates Not Expected To Force Sales

As we enter a high-interest-rate environment, CoreLogic expects mortgage distress and forced sales to remain low.

The RBA’s latest financial stability review stated that the median repayment buffer for owner-occupiers with variable loans had grown to 21 months of scheduled repayments. This is up from 10 months during the start of the pandemic. Even if interest rates go up by 2 percentage points, the median repayment buffer would still be 19 months. The average household is ahead of its repayment schedule, further reducing the risk of default.

Additionally, since October 2021, borrowers have been assessed at serviceability buffers of 3 percentage points, up from 2.5 percentage points; so more borrowers should be able to make the higher repayments as interest rates rise, although inflation will cause challenges for those with stretched budgets.

Through the middle of 2021, 45% of home loans were on fixed rates, which temporarily shields borrowers from rate hikes. By the time those homeowners have to refinance, both the labour market and income growth will probably have improved.

The extent of the cash rate rise’s impact will depend on how quickly and how high interest rates increase.

- A higher interest rate will put downward pressure on housing growth rates.

- A higher cash rate means higher variable interest rates, leading to a reduction in borrowing power and tighter serviceability.

- RBA research also revealed the high-end housing market, with its higher concentration of investors, was more sensitive to changes in the short term.