Updated: 12 Jul, 2024

Victoria has planned an increase in its property tax. This hike will further increase an already high stamp duty Victoria has compared to other states.

The plan is now hotly debated; many charge the state government of unfairness.

If the planned tax hike goes through, homebuyers in Victoria will be subjected to a 50% tax hike, starting from July 1, 2022. In addition, for properties breaking the $2 million cap, homebuyers will face a surcharge of $110,000 stamp duty and a 6.5% dutiable value.

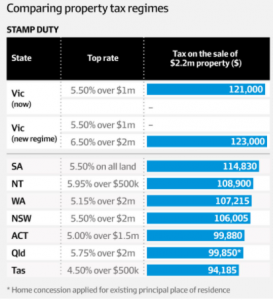

Below is a table that compares stamp duties in various states. It also shows the before and after position for Victoria once it goes ahead with the tax hike.

As you can see in the table, Victoria already has the highest stamp duty. South Australia (SA), which comes second, has a stamp duty lesser by 5.09% than Victoria. If Victoria increases the stamp duty as planned, the gap will further widen to become 6.64%. It is not a good look for the state.

Property experts strongly condemn the state government’s decision to increase its tax. They point out that it is unreasonable to burden the property market that already brings in 50% of the state revenue. And that, it is unfair to homebuyers that they have to pay more tax, especially when Victoria has the highest property tax in the country.

The affordability of houses in Victoria will further decrease due to the tax hike. If possible, rational homebuyers would instead consider looking for properties outside the state.

Home loan seekers will face a hard time with their application process, given the added sum they must be liable for.

Convincing lenders to be flexible with their policies would be even more difficult. In such a case, applying through a mortgage broker would be the best option.

Are you looking for a home loan in Victoria?

Our expert brokers can help you get a home loan in Victoria.

Call us on 1300 889 743 or enquire online, and we can then discuss your situation with you.