Updated: 19 Jul, 2024

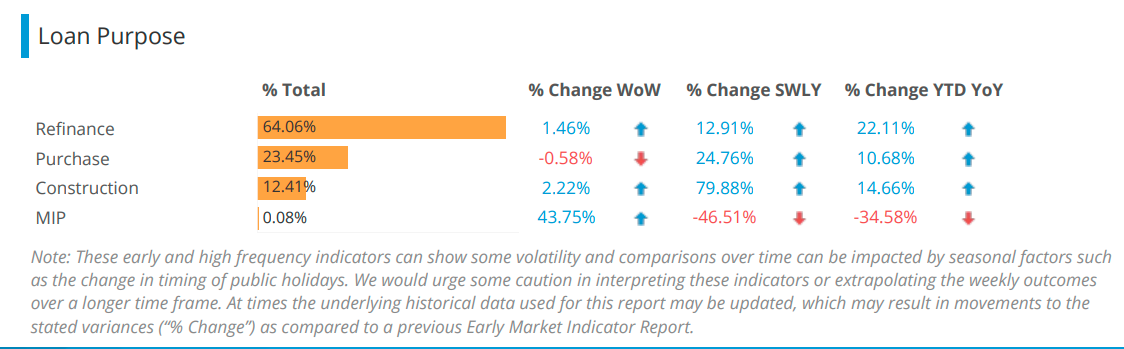

According to CoreLogic’s early market indicators (as of 27 September 2020), refinancing mortgages rose 1.46% over the past week. Refinancing was up 22.11% year on year, compared to a 10.68% rise on mortgages for a new purchase.

Source: CoreLogic’s Early Market Indicators Report

So why are people refinancing?

- Banks are offering attractive cashback offers to lure customers.

- Mortgage interest rates are low.

- Their fixed rates are expiring soon.

- They’re not happy with the services of their current lender.

- Their home loan product does not have all the features customers require.

What are the pros and cons of refinancing?

| Pros of refinancing | Cons of refinancing |

|---|---|

| If you qualify, you could get thousands of dollars in refinance rebates. | There are costs associated with refinancing, and it can be time-consuming. |

| Get a lower interest rate on your home loan. | If you have less than 20% equity, then you end up paying LMI fees. |

| Better management of your finances. | Refinancing could affect your credit score as it leaves an enquiry on your file. |

| Get more access to loan features. | It resets the loan term. |

The pros of refinancing are:

Refinance rebates

Some lenders are offering up to $4,000 in refinance cashback.

Note that there are qualifying criteria regarding the loan amount, LVR, etc. You have to read the fine print carefully before you decide to take the offer.

Lower interest rates

Since the Reserve Bank of Australia (RBA) announced the record low cash rate of 0.25%, most of the lenders have passed on the rate cut.

Their variable and fixed-rate home loan products are competitively priced.

A 2020 report by the Australian Competition & Consumer Commission (ACCC) found that existing customers have been paying loyalty tax by staying with their current lender.

Better management of finances

If you’re refinancing to a lower interest rate, then the lower repayments can help to manage your finances.

A shorter loan term can even help you pay off your home loan debt faster.

Access to loan features

The current home loan may not have the features you require like redraw and offset or one that gives you flexible repayment options so you can pay off your mortgage faster.

There are many more benefits to refinancing your home loan.

However, before you decide to refinance your home loan, understand the cons of refinancing.

The cons of refinancing are:

Refinancing fees

When you’re refinancing to another lender, there are fees involved. From discharge fees to setting up a new loan, it could amount to thousands of dollars.

You can use our refinance calculator and work out the costs of refinancing your home loan.

LMI territory

If you have less than 20% equity, then you might have to pay Lenders Mortgage Insurance (LMI) fees, even if you’re refinancing with the current lender.

Affects your credit score

When you refinance, you are applying for another home loan, which will make a credit enquiry.

If you keep making refinancing applications, then it will leave too many enquiries in a short time which lowers your credit score.

Resets the loan term

When you refinance, it resets the loan term.

If you’d already paid off five years of your 30-year loan term, if you refinance to another lender, then you’re paying off 35 years worth of interest.

Time-consuming

Depending on your current and new lender, the refinancing process can take time.

Your existing lender can take time to discharge your loan and transfer it to your new lender.

Refinancing during COVID-19

Banks and lenders have updated their policies on refinancing for COVID-affected customers. To be eligible for refinance, you must:

- Provide 6 months clear repayment history.

- Resume mortgage repayments.

- Show evidence that you’re not affected by the COVID situation by providing recent payslips, bank statements and sometimes a letter from your employer.

Should I refinance now?

Ask the following questions before you decide to refinance:

- Did you talk to your current lender before refinancing?

- Why are you refinancing your current loan?

- Do you know the costs involved in refinancing?

- Is the loan to value ratio lower than 80%, i.e. is the equity more than 20%?

- Do you have a good credit score?

- Did you check the comparison rate?

- Are you fine with the loan term?

- Will you own the property for a long time?

- Do you have the updated documents required?

- Will you benefit from the refinance?

- Is your fixed term ending soon?

- Will you use all the extra loan features that you get with refinancing?

- Are you getting the best deal out of the refinance?

If you’ve answered mostly yes to these questions, then you could move ahead with refinancing your mortgage.

Our mortgage brokers are here to help you refinance your home loan. Call us on 1300 889 743 or fill in our free assessment form.