The Victorian Homebuyer Fund is a shared equity scheme designed to help more Victorians buy a home.

With just a 5% deposit, eligible buyers can receive up to 25% of the property’s purchase price from the Victorian Government, in return for the same share in the property.

This reduces your loan amount and eliminates the need for Lenders Mortgage Insurance. Similarly, Aboriginal and Torres Strait Islander applicants can contribute a lower 3.5% deposit and access up to a 35% government contribution.

Participants must, however, repay the government’s share, either by refinancing, using savings, or when selling the property. And while the government doesn’t charge interest based on contributions, it does take a cut of any capital gains or losses based on its property share.

So, what are the eligibility requirements for this scheme? What are the price caps? How do you apply? Let’s find out.

How Does The Victorian Homebuyer Fund Work?

The Victorian Government will make a financial contribution for an equity share in the property. You buy back the government’s share over time.

The government will allow eligible participants with a contribution of 25%, and you will need to contribute a minimum of 5% of the purchase price as a deposit. A participating lender will provide the remaining amount.

Note: Aboriginal and Torres Strait Islander participants require only a 3.5% deposit and are eligible for a 35% shared equity contribution.

The government will not charge interest on its contribution but will take its proportional share of any capital gain or loss should you sell your home.

An Example Of How It Works

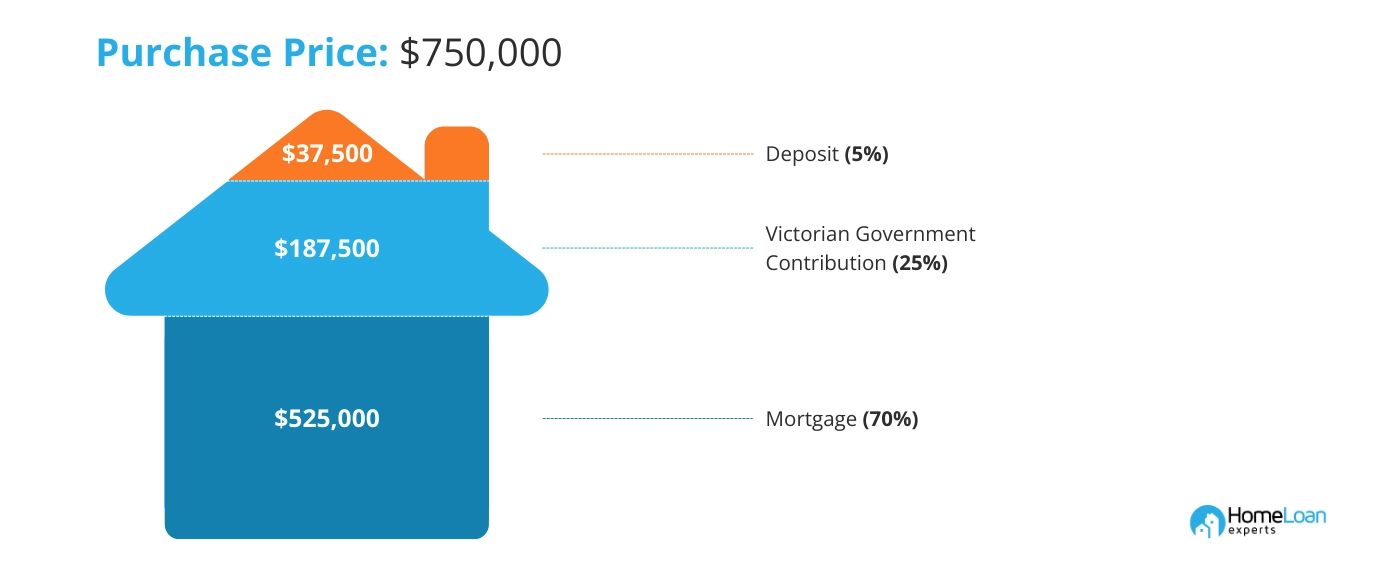

You’re buying a home valued at $750,000 through the Victorian Homebuyer Fund with a home loan from a participating lender. You start with a 5% deposit, which equals $37,500. The Victorian Government contributes $187,500, equivalent to 25% of the property value. The $525,000, or 70% of the property’s value, is secured through a home loan with a participating lender.

The 360° Home Loan Assessor provides a comprehensive breakdown of the savings you can achieve by accessing the fund. By factoring in the government’s contribution, you can understand the reduced deposit amount required, making homeownership more accessible and affordable.

Victorian Homebuyer Fund Eligibility

To be eligible for the Victorian Homebuyer Fund, you must:

- Be an Australian citizen, New Zealand citizen, or permanent resident of Australia.

- Be at least 18 years old at the time of settlement.

- Intend to live in the purchased property as your primary residence.

- Be a natural person (not an organisation, company, trust, or other entity).

- Not be purchasing the property from a related party.

- Not own any interest in land in Australia or overseas at the time of purchase, this includes acting as trustee or beneficiary of a trust.

- Not be a shareholder in a private company that owns land in Australia or overseas.

- Have an approved home loan from a participating lender and enough funds to cover all acquisition costs (e.g. stamp duty, legal fees, etc.).

Saved the required minimum deposit:

- At least 5% of the property price

- Or, 3.5% if you’re an Aboriginal or Torres Strait Islander participant

Have a gross annual income of:

- $135,155 or less for individuals (excluding single parents), or

- $216,245 or less for single parents or joint applicants

What Are the Property Price Caps?

To qualify for victorian homebuyer fund, the property you purchase must meet specific criteria:

- Property Type: Must be a residential property, house, townhouse, unit, or apartment. Vacant land is not eligible.

- Location: Properties can be purchased anywhere in Victoria.

- Price Caps: Up to $950,000 in metropolitan Melbourne and Geelong. Up to $700,000 in regional Victoria.

- Occupancy Certificate: Must be issued before the contract of sale is signed. This excludes off-the-plan purchases.

- Vacancy Requirement: The property must be vacant at purchase or, if tenanted, the lease must expire within 12 months and the tenant must vacate.

- Title Restrictions: Properties with stratum title (e.g. company share ownership), even if only for common property, are not eligible.

Where Can I Buy Under The Victorian Homebuyer Fund?

The property you buy must be in Metropolitan Melbourne, Geelong or an eligible regional location in Victoria. Here are some areas eligible for the scheme.

| Metropolitan Melbourne | Geelong | Regional Victoria |

|---|---|---|

| Southbank, Richmond, Mount Waverley, Croydon, Berwick, Dandenong, Cranbourne, Frankston | Hamlyn Heights, Geelong, Geelong West, North Geelong | Bacchus Marsh, Bendigo, Ballarat, Ocean Grove – Barwon Heads |

How To Apply?

Check Eligibility

Make sure you meet all program criteria.

Get Loan Approval

Apply through a participating lender and ensure you have funds for all purchase costs.

Submit Documents

Provide your lender with:

- ID

- Proof of income

- Details of expenses, liabilities, and assets

Lender Submits Application

The lender lodges your application with the State Revenue Office (SRO).

Provisional Approval

If approved, you’ll have 6 months to sign a contract of sale.

Review Key Documents

Before proceeding, review:

- Participation Agreement

- Scheme Mortgage + Terms

- Letter of Support

Proceed to Purchase

Once ready, notify your lender. Provide a certificate of insurance. Engage a lawyer or conveyancer to assist with settlement.

Settlement

The Homebuyer Fund contribution is transferred via ELNO (or by other arrangement), with your legal representative managing disbursement.

Make Informed Decisions With The 360° Home Loan Assessor

- Determine how much you can contribute as a deposit

- Get clarity on the total costs of buying a home

- Explore interest-rate options based on your situation

What Are The Pros And Cons Of The Victorian Homebuyer Fund?

| Pros | Cons |

|---|---|

| You can buy a home sooner with a smaller deposit. | There are only a handful of participating lenders. |

| You save thousands on LMI fees. | The Victorian Government owns a portion of your property. |

| You might also be eligible for other first-home specific grants and stamp-duty exemptions or concessions. | You have to buy back the government’s share of the property to gain that equity. |

Ready To Apply?

Our mortgage brokers will help you throughout the process. Call us on 1300 889 743 or enquire online for free today!

Frequently Asked Questions

How Many Places Are Available?

The scheme will help a total of 3,000 households over time.

Who Are The Participating Lenders?

Can I Still Apply For The First Home Owner Grant (FHOG)?

I Am An Existing Homeowner In The HomesVic Scheme. Can I Swap Schemes?

When Do I Need To Repay The Government’s Financial Contribution?

Can I Refinance My Home Loan?

Can I Renovate The Property?

What Happens If I Was A Single Applicant But Enter Into A Relationship?

What If My Income Exceeds The Threshold Over Time?

How Soon Can I Sell My Property?

If I Sell The Property, How Are The Proceeds Distributed?

What If I Don’t Qualify For The Victorian Homebuyer Fund?

Still need answers? We're here to help!

Ask an expertOur team of mortgage experts will assist you within 24 hours.