Vendor finance lets buyers pay the seller in instalments, bypassing traditional lenders. It’s common in property and business sales where funding is tight or banks say no. This flexible setup can help deals happen but it also carries risks if not handled carefully.

In this guide, we cover how vendor finance works, its pros and cons, and key legal points to watch out for. Let’s get started.

What Is Vendor Finance?

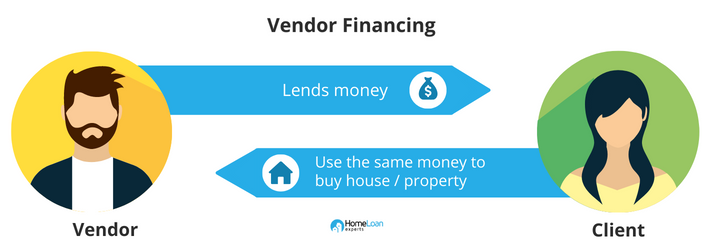

Vendor financing, also known as trade credit, typically involves the seller offering a deferred loan to the buyer.

In some cases, it may include the buyer transferring company shares to the vendor. These loans often come with higher interest rates compared to standard bank financing.

There are actually three different types of vendor finance.

Standard vendor finance / instalment plan

This is also known as a “wrap”. In this scenario, you’ll work with a private investor to help you buy a home. When you find a home that you’d like to buy, the investor will negotiate to try to buy that house for less than the market value. The investor buys the home in their name and then sells it to you at a higher price with an extended settlement.

Instead of paying the investor in one lump sum in six weeks time, you pay the investor in instalments over several years until you’re able to qualify for a loan with a bank and refinance the investor out. This is the most common type of vendor finance purchase in Australia.

Rent to own / rent to buy

This is where you have an agreement with the investor to rent the home from him at a higher than the normal market rent. In return, you have an option to buy the property at a later date for a set price. This is ideal for people who’ll qualify for a bank loan in a few years time and would like to “lock in” their dream home now.

Financed deposit

In this scenario, you’ll borrow 80% of the property value from a bank as this is easier to qualify for than a 95% home loan. The remainder will be lent to you by the vendor (seller). You make payments to the bank and also to the vendor with the aim to refinance the vendor’s loan to a standard bank loan within two to five years.

If you go for this option then you must be committed to making large repayments to repay the vendor’s loan as quickly as possible.

Note: Vendor finance or rent to own finance isn’t for everyone. There are a few risks and higher costs involved so you should probably consider a no deposit home loan before going down this path.

Vendor Finance - Benefits, Risks, and How to Protect Yourself

Vendor Financing offers opportunities for both sellers and the buyers. The sellers can achieve their desired sale price and earn interest, while the buyer can access ownership with limited immediate capital. However, it carries risks, especially for the seller if the buyer defaults.

To reduce these risks, sellers can take several protective steps:

- Negotiate a larger upfront payment to minimise the outstanding loan balance.

- Register a security interest to claim the buyer’s assets if they default.

- Require personal guarantees from company directors or third parties.

- Seek legal advice to ensure interest rate, repayment schedules, and default provisions.

Vendor finance agreements often include detailed clauses around repayment timelines, interest (usually 7–15% p.a.), and security terms.

Sellers should also ensure that security interests are properly registered (e.g., on the PPSR) to gain priority over other creditors in case of insolvency. Vendor finance can be a useful tool but should be entered into with caution and proper legal safeguards in place.

Is vendor finance a good idea?

Most of the risks of vendor finance revolve around your ability to afford the mortgage repayments. Vendor finance is a lot more expensive than a standard home loan and here’s why:

- You’ll pay more to buy a property: You’ll have to pay 10-20% more than what the investor paid for the property.

- Interest rates are higher: In some cases, the rates are at a 1-4% higher margin than the interest rate the investor paid their bank. So if current interest rates are around 5.00%, expect to pay 6.00% to 9.00% per annum.

- The vendor holds the cards in negotiations: The cost of the purchase and your interest rate will depend on how high of a risk you are to the investor and how quickly you can refinance out of the vendor finance scheme.

- The home loan is in the vendor’s name: If the vendor has a mortgage on the property and can’t repay the home loan, the bank is likely to repossess the property. The property title was never in your name, and you’ve lost money paid to the vendor.

- Cannot build equity: The purchase price and repayments for vendor loans are higher, which makes it harder to build equity and qualify for a standard home loan when you refinance.

- You’re at the vendor’s mercy: Vendors can impose harsh penalties if you miss a repayment, like voiding the contract altogether. You will lose all the money paid.

Who is vendor finance for?

If you can qualify with a major lender then it’s better that you apply for a standard mortgage.

We strongly recommend that you consider a no deposit solution like a guarantor loan as a first option because they’re significantly cheaper and a much more straightforward loan process than apply for vendor finance.

| Why use vendor finance? | Other options besides vendor finance |

|---|---|

| You don’t have genuine savings or enough funds to complete | There are banks and lenders who will let you borrow up to 95% of the property value. There are even some lenders that don’t require genuine savings. As an alternative, see if you can qualify for a guarantor which you may be able to obtain with a lower deposit than usually needed |

| You are self-employed and have limited income evidence and financials. | You can still get a home loan if you’re self-employed. We know banks and lenders that accept alternative income evidence. |

| You have a bad credit history | Depending on the size of defaults and the overall nature of your credit history, there may be lenders who will allow you to borrow up to 95% of the purchase price. |

| You have no credit history | You could open a small credit account and make regular repayments on it for over 6 months to build credit. Learn more about what a credit file is and how you can start building a credit history in order to apply for a home loan. |

Besides vendor finance, there are other options available that cater to your situation.

Are you outside of the bank’s lending criteria. We know specialist lenders who can help. Call us on 1300 889 743 or enquire online.

What are the requirements?

Not everyone will qualify for vendor finance. The main qualifying criteria are:

- You must have at least 2% of the purchase price as a deposit,

- You must be able to afford the loan,

- It’s preferred that you’re buying a house or units in a major city or regional area.

Overall, your situation must ‘make sense’. If you clearly can’t afford the repayments or you don’t have a good explanation for your poor credit history, then you’re not yet ready to buy a home.

How much can you afford?

There are two methods that can be used to work out how much you can afford to buy a home for. Firstly, it’s best to work out how much you can afford to repay each month. Then, work backwards to work out the amount you can afford to borrow.

The second method is to use a borrowing power calculator (serviceability calculator). We recommend that you use the same calculators used by the banks to assess someone’s ability to repay a mortgage. These are usually more accurate than generic online calculators.

When can I refinance back to a bank?

There are no hard and fast rules as to when you can refinance to a standard bank loan. However, you must have a clear credit history, stable employment and an excellent history of paying the vendor finance instalments on time and in full.

You must owe less than 80% of the property value to be able to refinance to a conventional lender with a high chance of success. If you owe 80% to 90% of the property value then you may be able to refinance but you’ll need to meet more stringent lending criteria and will require LMI approval.

If you still don’t meet the criteria of conventional lenders, then you can apply for a loan with a non-conforming or specialist lender. Although this is usually cheaper than vendor finance, it’s still more expensive than a mortgage from a bank.

Don’t rely only on your property rising in value to help you get down to owing 80% of the property value. You should commit to making large additional repayments to reduce your debt. Please keep in mind that bank valuers are conservative so it may take a little longer than you predict to reduce your debt enough to refinance.

How much does it cost?

The terms of the vendor finance agreement will be negotiated between you and the investor directly. There are no hard and fast rules.

If you’re able to refinance quickly then the investor may be able to offer you more favourable terms.

Do I need legal advice?

Although vendor finance is a very powerful method that can be used to help you own your own home, it can be a disaster if you don’t understand the terms of the agreement. Please seek independent legal advice prior to entering into an instalment plan, rent to own or financed deposit scheme as they’re legally binding contracts.

We’ve taken great care to ensure that the general information on this page is accurate. However, vendor finance agreements are negotiated between you and a private investor so each agreement will vary.

The terms of your finance are likely to be at least slightly different to what we’ve written above so please take the time to understand your agreement fully before deciding if it’s for you.

You must also be aware that if you miss several payments with a vendor finance instalment plan or rent to buy scheme, you may lose the deposit you’ve paid and the right to purchase the property.

Private investors don’t often have the financial means to hold onto a property if you’re not making your repayments. For this reason, they’ll be less lenient with you than a bank would if you missed payments on a mortgage.

Are you looking for vendor finance?

Vendor finance comes with heavy risks. If you’re not able to save for a home deposit, there are other low deposit and low deposit home loan options available.

Our mortgage brokers are here to discuss these solutions with you. Call us on 1300 889 743 or fill in our free no-obligation assessment form.