Updated: 29 May, 2025

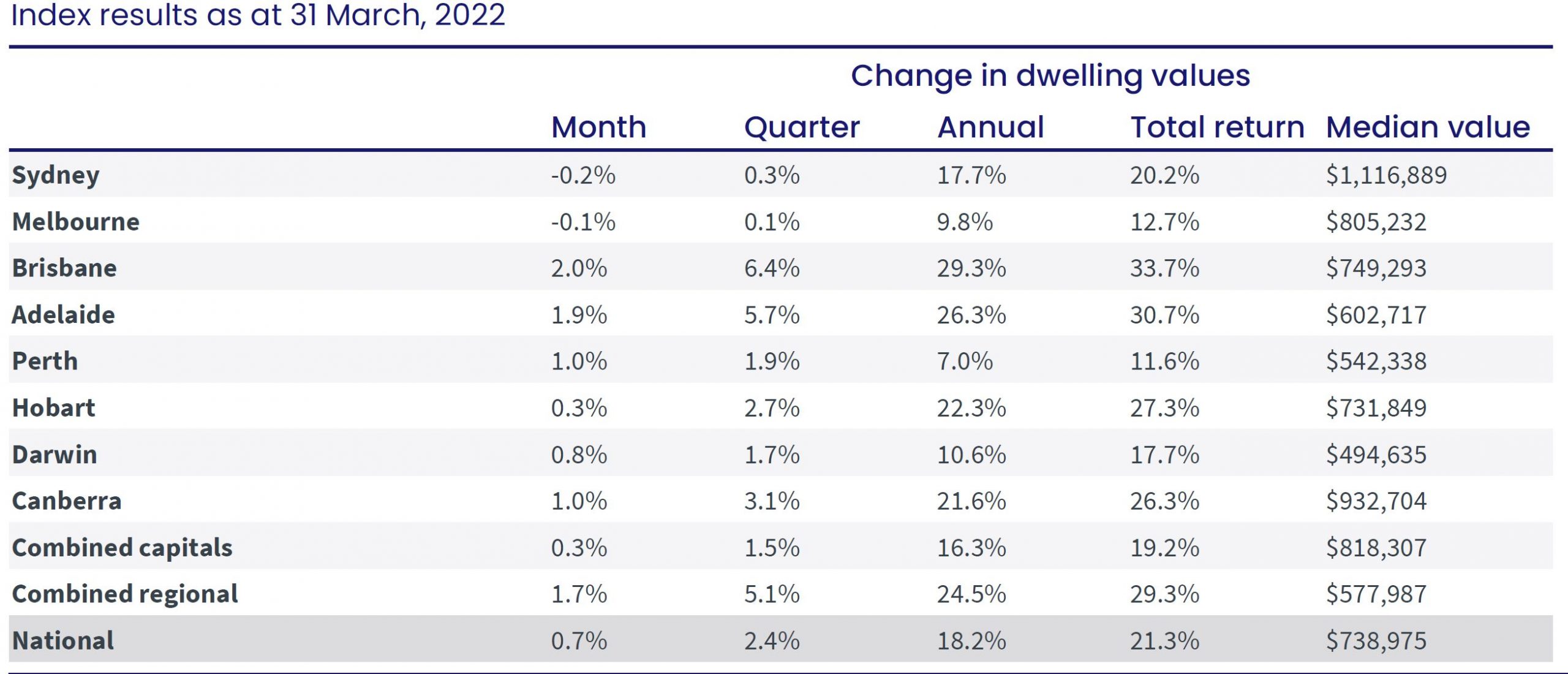

CoreLogic data revealed that the home value index was up 0.7% in March 2022. During the first quarter of this calendar year, dwelling prices in Australia rose 2.4%, adding about $17,000 to the value of a home. Within these national numbers, there was a notable split between the two largest capitals and the rest of the country. Prices in Sydney and Melbourne declined for the month and were flat for the quarter ending in March. In contrast, the smaller capitals, and most regional areas, continued to show strong growth.

CoreLogic research director Tim Lawless said, “Virtually every capital city and major… region moved through a peak in the trend rate of growth some time last year or earlier this year. The sharpest slowdown has been in Sydney, where housing prices are the most unaffordable, advertised supply is trending higher, and sales activity is down over the year.”

Regional Australia Property Market Update

Regional Australia continued to show resilience against the slowdown. Regional dwelling values rose at more than three times the pace of the combined capital cities through the March quarter – 5.1% to 1.5%. And the total advertised housing stock in regional Australia was 43% below the five-year average. Also, The rolling quarterly growth rate in regional dwelling values has consistently held above the 5% mark since February 2021.

Population data from the Australian Bureau of Statistics explains the strong growth in regional Australia. Figures for financial year 2020-21 revealed the number of people living in regional Australia increased by 71,000, while the number living in capitals fell by about 26,000.

Property Market Highlights

Here’s what happened in Australia’s property market in March 2022:

- Sydney and Melbourne experienced flat or falling housing values. However, Brisbane, Adelaide and Perth experienced strong growth.

- The national annual growth rate was 18.2%. It fell below the 20% mark for the first time since August 2021.

- Sydney experienced a significant slowdown in growth. The rate fell from a peak of 9.3% in the three months to May 2021 to 0.3% in the first quarter of 2022.

- Melbourne experienced a slow down in its quarterly growth as well; from a peak of 5.8% in April 2021 to 0.1% in the last three months.

- The preliminary transaction volume estimates for the March quarter tracked 14.3% lower than the same period in 2021. It was still 12.2% above the previous five-year average.

- Advertised inventory tracked 30% below the previous five-year average for the four weeks ending 27 March 2022. However, in Melbourne, the total advertised supply was 8% above the previous five-year average, and in Sydney it was just 2.6% below the five-year average.

- In contrast to the two largest capital cities, advertised stock levels in Brisbane and Adelaide remained more than 40% below the previous five-year average. Low stock levels and persistently high buyer demand created strong selling conditions, which brought prices up.

- Annual rental growth eased from its recent peak of 9.4% in November 2021 to 8.7% over the 12 months ending March 2022. The rate of growth in unit rents reached a cyclical high of 3% in the March quarter, compared with 2.4% growth in house rents.

- Sydney recorded a strong lift in unit rent, up 8.3% over the 12 months to March. In Melbourne, unit rents were 6.9% over the past year.

Consumer confidence fell to its lowest level in about 18 months, due to the slowing property market conditions, rising fixed mortgage rates and affordability constraints.

However, there are some emerging factors that may help boost confidence:

- Migrants are returning, as Australia has opened its international borders. There will be high rental demand, which can incentivise investors.

- Australia’s strengthening economy, low jobless rate and rising income growth should keep distressed listings to a minimum.

- The government announced a large increase in places for its existing home guarantee schemes and its new Regional Home Guarantee.

Our mortgage brokers will help you find the right home loan for your property goals. Whether you’re a first-home buyer or looking for your next investment opportunity, call us on 1300 889 743 or enquire online today.