Updated: 29 May, 2025

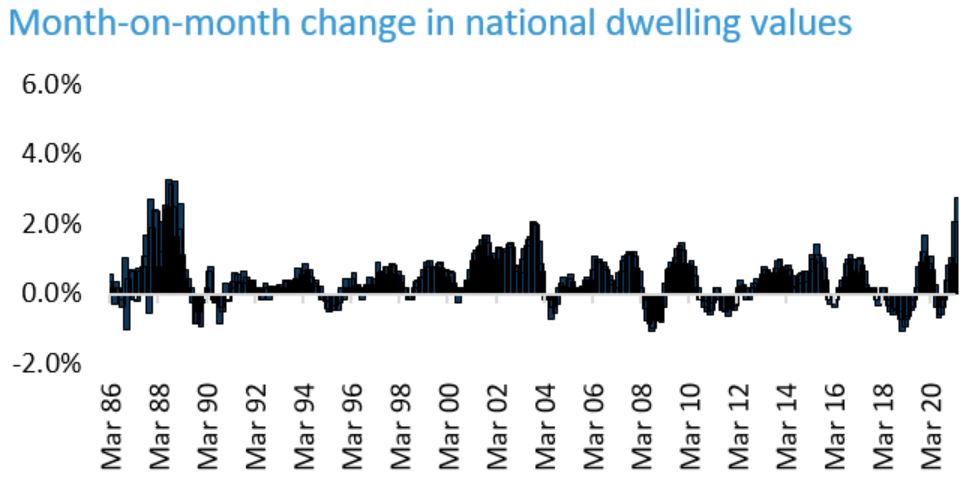

CoreLogic’s home value index recorded a 2.8% rise in March 2021 which is the fastest rate of growth experienced by the housing market since October 1988.

Sydney and Melbourne’s recovery has finally outperformed many of the smaller cities that were leading the charge in growth.

Sydney’s housing values were 2.6% higher than their peak in July 2019, while Melbourne’s housing values recovered from a 5.6% drop in values caused by the pandemic and set a record high in March.

Capital cities finally outpace regional markets

The combined capital cities index recorded a 2.8% lift compared to a 2.5% lift for the combined regional index.

“Housing values in regional areas are 11.4% higher over the past year, demonstrating the earlier stronger growth trend; capital city values are now 4.8% higher on an annual basis with the acceleration in growth evident in March,” said Tim Lawless, CoreLogic’s research director.

What is causing the housing boom?

There’s an imbalance in supply and demand.

- In the four weeks ending 28 March, the advertised stock levels were 25.5% below the five year average.

- National new listings were 8.1% higher than a year ago and 3% higher than the five year average, yet buyer demand is consistently outweighing new advertised supply.

- The ratio of sales to new listings is tracking at around 1.1, which means for each new listing added, 1.1 homes are sold!

According to Mr Lawless, “Such a rapid rate of absorption is keeping overall inventory levels low and adding a sense of FOMO amongst buyers.“

Sales activity is rising

- Auction clearance rates have consistently held above 80% in March. Auctions are experiencing rapid selling times and vendors are lowering their discounts for private treaty sales.

- The number of home sales over the March quarter was 21.9% higher than a year ago.

- The six month trend in house sales was tracking 16.5% above the decade average, while unit sales were 0.3% lower than average.

There’s a lift in premium housing

- The upper quartile of the market recorded a 3.7% lift in values compared to 1.6% for the lower quartile.

- The trend is most evident in Sydney, Melbourne and Brisbane.

| Capital City | Upper quartile | Lower quartile |

|---|---|---|

| Sydney | 4.8% | 2.2% |

| Melbourne | 2.8% | 1.6% |

| Brisbane | 3.1% | 1.1% |

“Previously, it was premium value properties that were leading the downturn in these markets. However, more recently this trend has reversed as buyers take advantage of improving economic conditions and record low interest rates,” explains Mr Lawless.

How affordable is housing?

Research published by the National Housing Finance and Investment Corporation (NHFIC) compared how affordable housing is to renters and first home buyers based on income groups.

The research compiles data as of 30 June 2020, so it was before property prices started rising.

- Sydney and Hobart are expensive for first home buyers. The bottom 60% of income earners can only afford 10% to 20% of properties in these markets.

- The most affordable city for first home buyers is Brisbane. The bottom 40% of income earners can afford to pay off a mortgage for around 60% to 70% of properties in the market.

- Renters on low income will find properties expensive in Sydney and Hobart. Only 0% to 10% of homes are considered affordable in these cities to the bottom 40% of the income earners in these markets.

- On the contrary, Perth and Adelaide are more affordable to renters. The bottom 40% of income earners can afford between 90% and 100% of rental properties.

- Perth is the most affordable city for renters. Renters in the bottom 40% of income earners can afford to pay for around 90% to 100% of rental properties in Perth.

Buyer activity surged due to government stimulus and schemes put in place due to the pandemic.

How long will the housing growth continue?

- The housing market is reacting to record low interest rates.

- Australians are optimistic and confident in the housing market.

- Supply levels cannot keep up with heightened demand, creating a sense of urgency in buyers and upwards pressure on housing prices.

With prices soaring, housing affordability is out of grasp for many Australians.

As a result, speculation is mounting as to when regulators will step in to quell the growth, as affordability issues often drive regulator activity.

While expectations are that house prices will rise throughout 2021, the pace of growth will slow.

What will trigger the fall in the property market or slow its growth depends on whether:

- Interest rates will rise.

- The government will continue its incentives for first home buyers.

- Restrictions are placed to tighten credit policies to limit lending.

Get a home loan today!

With prices soaring and speculation of tighter credit policies, it could be harder to qualify for a home loan in the future.

If you’re thinking of buying your first home or diversifying your property portfolio, talk to our mortgage brokers.

We can help you in your property buying journey and find you a home loan that matches your goals.

Call us on 1300 889 743 or enquire online.