Updated: 22 Jul, 2024

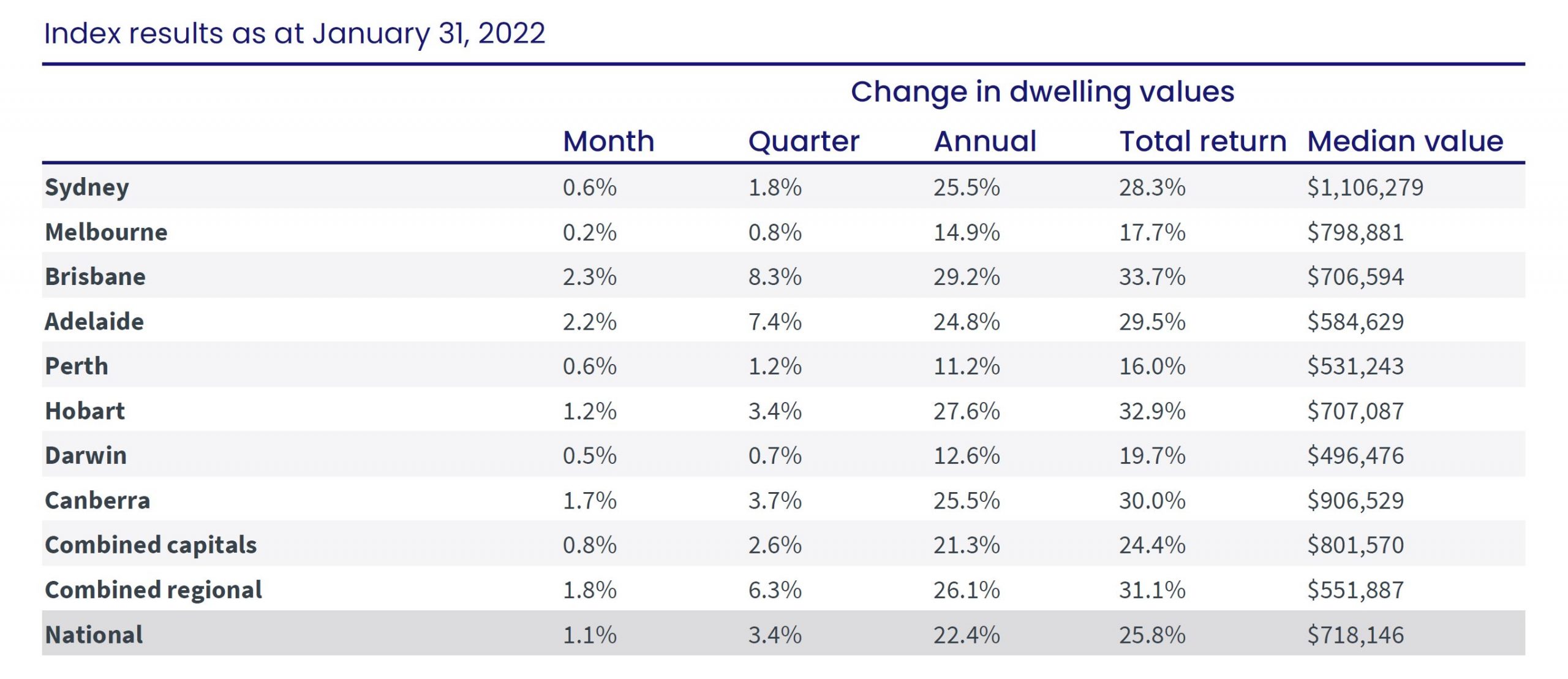

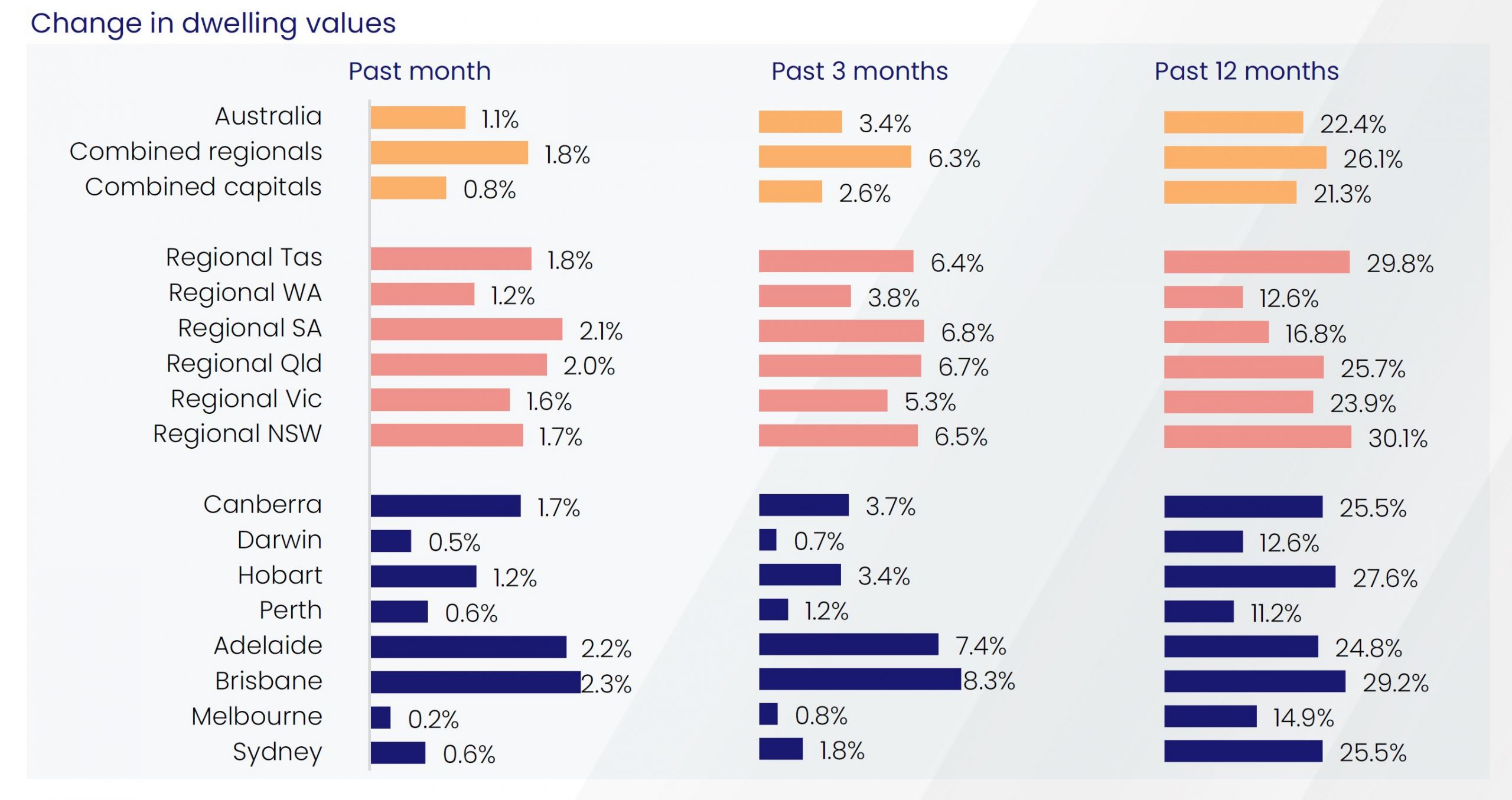

CoreLogic data revealed that housing values rose 1.1% in January 2022. Property prices jumped by 22.4% over the last 12 months, which was the biggest annual increase since the year to June 1989. A typical Australian home now costs $131,326 more than a year ago.

What Happened To The Property Market In January 2022?

- Median house values topped $1 million in three of eight capital cities: Sydney, Melbourne and Canberra. Sydney’s median value climbed to just under $1.39 million.

- Brisbane and Adelaide led the pace of gains in overall dwelling prices, at 2.3% and 2.2%, respectively. Affordable property prices and demographic trends supported demand in the two cities. Meanwhile, growth in Melbourne (0.2%), Darwin (0.5%), Sydney and Perth (both 0.6%) softened.

- The difference between the national median house and unit values reached a record 28.3%. This may lead to buyers looking at the more affordable medium-to-high density portion of the market.

- Houses recorded a higher rate of growth than units. Nationally, houses were up 1.3%, compared with a 0.3% rise in unit values.

- Sales activity was 15.1% higher than last January and 39.4% above the previous five-year average.

- Real-estate agent activity was 22.1% higher than a year ago.

- Over the four weeks to 30 January 2022, fresh listings were 5.7% higher than a year ago but 7.1% below the previous five-year average. Nationally, advertised supply levels were 20% lower than a year ago and 36.9% below the previous five-year average.

- The quarterly pace of growth in rent has eased since the peak of 3.2% in the March quarter of 2021. Over the three months ending January 2022, quarterly growth was 2%. Annually, national rents were up 9%, still below the recent peak of 9.4% in November 2021.

- The gross rental yield fell to a record low of 3.21%.

CoreLogic research director Tim Lawless explained, “The trends in advertised supply levels go a long way towards explaining the performance of housing values. Melbourne and Sydney have seen inventory levels normalise over recent months, taking some urgency out of the market as supply and demand become more evenly balanced. The situation in Adelaide and Brisbane is very different; supply remains tight, and buyer competition is a key factor supporting the upwards pressure on prices.”

Buyers Opting For Regional Areas

The performance gap between regional Australia and the capital cities widened in January 2022. Over the past three months, the combined regionals index recorded 6.3% growth, compared with a 2.6% rise for combined capitals.

- Home sales activity was 57.9% above the five-year average in regional areas, compared with 26.6% above for capital cities.

- The combined regional index was up 1.8% in January 2022. Australia’s regional market experienced a greater increase in housing values than capital cities. The combined capital cities index was up 0.8% for January 2022 and 2.6% for the quarter.

- Regional Queensland (2%) and regional South Australia (2.1%) led the pace of regional growth in January 2022. The other regional areas recorded a gain of at least 1.2%, which indicates a strong demand for regional housing.

Over the past 12 months, the strongest regional markets were commutable areas with lifestyle characteristics, like Southern Highlands and Shoalhaven, Sunshine Coast and the Hunter Valley. In the most recent three months, rural regional markets, like the Central West and Capital Region of NSW, climbed the ranks.

Our Brokers Are Here To Help

With regional Australia in hot demand, prices could surge too high and price out home buyers. Do not hesitate to buy or invest in property if you’re ready.

Don’t quite know if you’re buying in a good location? Use our postcode calculator to find out if lenders are available in areas where you’re looking.

Home Loan Experts’ mortgage brokers are here for you. We’ll help you get pre-approved for a mortgage so you can buy the right property. Call us on 1300 889 743 or enquire online today.